As a young man, I bought my house for the same reasons most people do: I was married and wanted to raise a family there. I wanted a nice big yard so I could have dogs. I wanted room to expand. I wanted to live in a safe, quiet neighborhood. So, in 1991, I was able to do all those things. It was a stretch, but we bought a small, run-down home on a large lot in a nice neighborhood in Palo Alto.

I didn’t buy it to make money. I didn’t buy it as a speculative investment. I just wanted a place to live. And yet……….

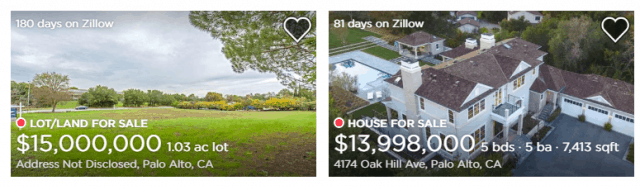

Now, if this had been a stock, I probably would have sold it at the first sign of profit. Hell, knowing me, I probably would have shorted it. But, mercifully, I didn’t do any of those things, because……….it’s just a house. And these days, by Palo Alto standards, it isn’t particularly special either:

(And take note the thing on the left is a lot – – no house – – just a lot; and it’s 1.03 acres, not 103, in case you misread it).

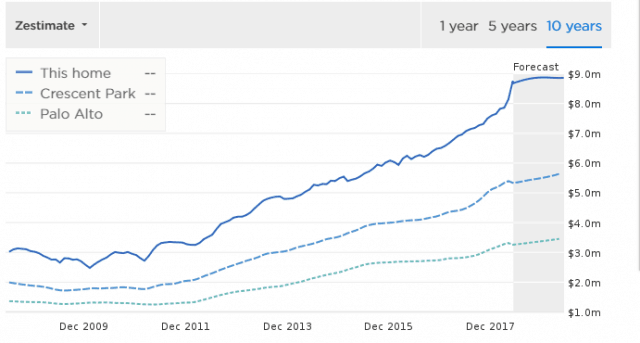

As pleased as I am with this good fortune, I still think it’s absolutely insane. I could never afford to live here now. Can you imagine a $100,000 tax bill every year for life? And Zillow doesn’t see any change in store:

In SlopeCharts, the ticker symbol for my neighborhood is $PALO. But maybe it should be $WTF instead. Why do I say that. I offer you the following from this morning’s Palo Alto Daily Post front page:

Now, personally, I suspect these 46% are full of crap, because no one ever leaves here. But still – – if the feeling is that Bay Area life, what with its politics, its insane traffic, its taxes, and its out-of-this-world real estate prices should be abandoned in the next few years by almost half the people that live here……..what the devil are they doing paying these kinds of prices for real estate?

As for me: as long as the price slump is limited to 90%, I’ll be fine. I’m not going anywhere. All my dogs are here.