I had a very busy, productive weekend, but in the midst of it, I commiserated with a number of fellow bloggers about the state of the market. Specifically, about how the hopeful days that started January 29th terminated far too swiftly on February 9th, and how we were grinding around at VIX-will-be-single-digits-again-land.

Their response, to a man, was pretty much “this is how bear markets start, with a shot across the bow, and then a big recovery rally to apply the smirk to bulls’ faces more firmly than ever and to break any remaining bearish hearts.” We’ll see if that holds true. For the moment, at least, it’s nice to wake up to some red. Here we see the NASDAQ has taken its entire end-of-week mega-rally and unwound it for really no reason in particular except for simmering trade wars.

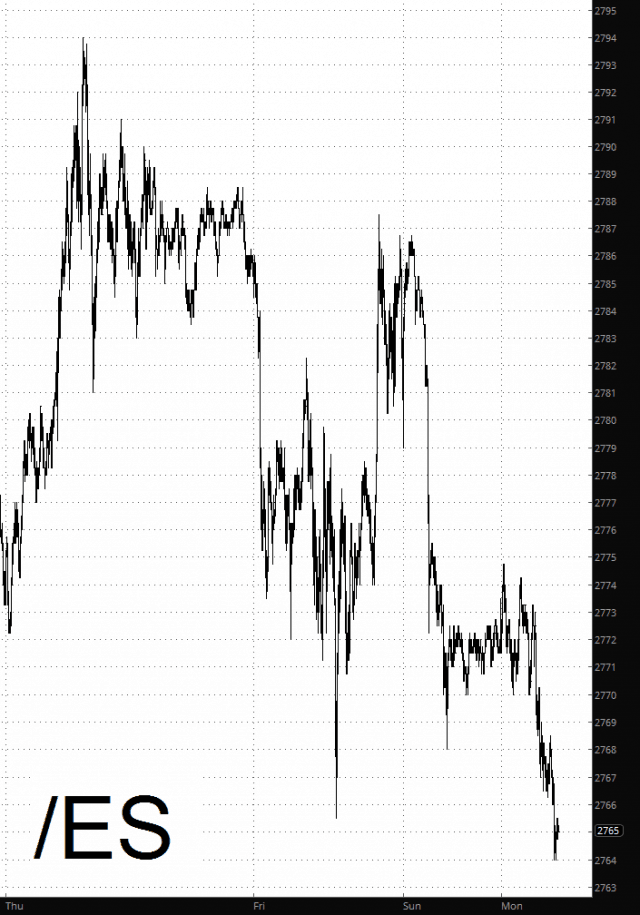

Somewhat more severe is the ES, which didn’t just unwind its action from late last week but instead has actually bested it.

For myself, I am coming into the week short but not crazy-short, with 151% committed and 50 different positions (all roughly the same size with no ETFs at all). This is a week packed with speeches from central bankers, and of course the only-twice-a-year OPEC meeting is coming up on Friday, which has the chance to roil oil markets.