You are probably acquainted with the old saw, “you always fight your last battle”. In the case of politics, the last “battle” saw every poll prediction turned on its head, and a night of nothing but jaw-dropping shocks. Thus, people assumed 2018 would be like 2016, and they laughed at the polls.

Well, as the results clearly show, the polls were 100% right. In fact, you might as well have predicted the outcome in JULY, since it’s exactly, precisely, and spot-on what the pollsters and oddsmakers predicted: a Democratic House, a Republican Senate, and nothing particularly earth-shaking on the national scene.

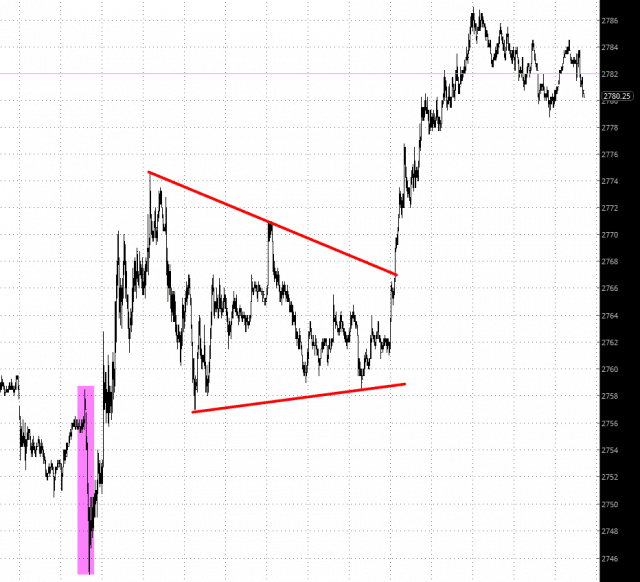

I was watching the markets with rapt attention last night, since I love charts (obviously) and politics. The only dose of excitement came when it seemed, briefly, that Kentucky-6 would go to the Dems (see magenta tint below), but that was quickly dismissed, as the “blue wave” was not materializing. As I’m typing this, the markets are solidly, but not shockingly, higher – – although they are starting to fade a bit. In short, it’s totally green on my screen: ES, NQ, gold, bonds, crude oil – and volatility is sinking as the uncertainty and tension of the election fade away.

The bounce that began on October 29th might have some life left in it. Markets hate uncertainty, and now that these elections are behind us, they can obsess over other silly things, like the prospect of some grand bargain with China (ha!) with respect to the trade wars. My main fear was that I’d regret being so “light” in my portfolio, but as I stand here now, I have no regrets.