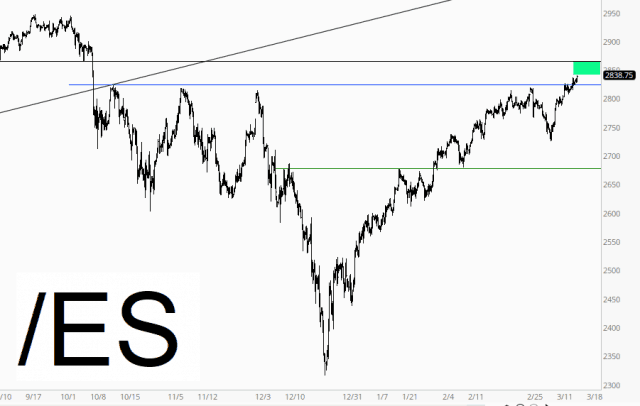

Is the S&P 500 (SPX) on the verge of a sustained upside breakout as it pushes through multiple prior failed rally peaks just above 2800? This week should provide some answers.

Actually, a sustained climb above 2832 (on a closing basis) also will answer the question we have been asking in these weekly articles for the past four weeks: Will the powerful advance from the Dec 26 low at 2346.58 be stymied in the 2775 to 2832 resistance zone?

This zone is the area that measures 76.4% of the entire prior Sep-Dec correction — what we’re calling the “Fibonacci Recovery Price Resistance Zone” — and in the last 20 trading days the SPX has probed but failed to hurdle the upper boundary (2832) of this zone no less than five times!

(more…)