Back in 2010 and 2011, the market was all about the Euro. It was all anybody talked about. We hung on to every pip. Since then, it had sort of faded from the scene, and I stopped bothering looking at EUR/USD altogether.

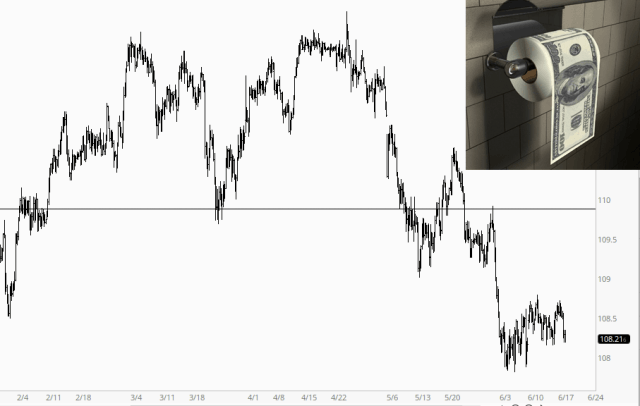

That all changed this morning, now that Mario Draghi has once again thrown open the Stimulation Spigot, since it’s quite apparent that the debt-addicted world is incapable of absolutely any organic growth, so they’re just going to just keep…………stimulating. You can see how the currency war has been affected our own U.S. dollar, portrayed here versus the Japanese Yen.

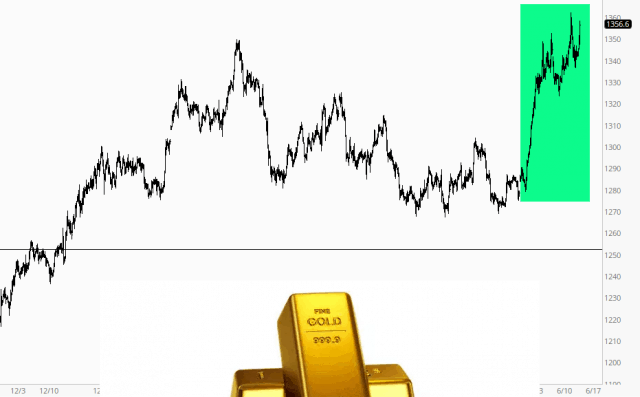

Since fiat currencies are continuing their race to the bottom, it is giving true hope to the world of precious metals. The effect of Mario’s capitulation is plainly evident this morning with gold.

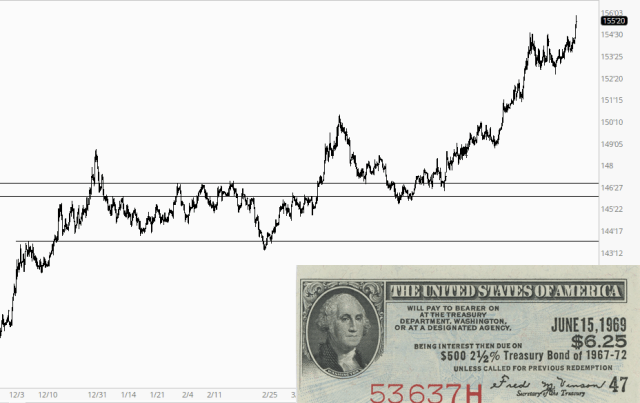

The most electrifying chart to me is bonds, which continue to be an absolute monster. Just look at the consistency of their uptrend. Rates continue to collapse around the world, and I just read that the German Bund has reached a new historic low of negative three-tenths of a percent.

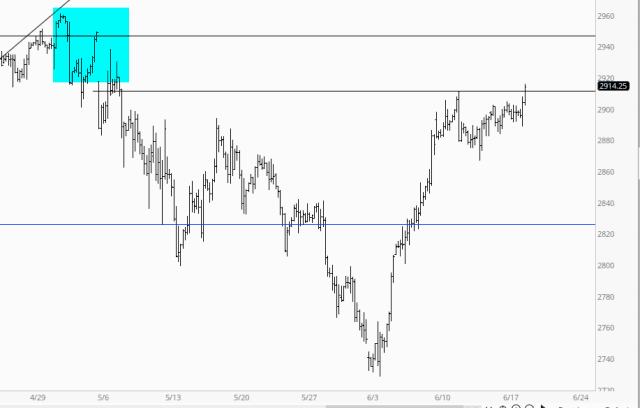

Of course, there’s nothing equity bulls like more than some of that sweet, sweet stimulation, so our own equity quotes are in the green. As of this moment, the ES is up about two-thirds of a percent and the NQ is up more than a full percentage point. The barrier between present price levels and lifetime highs is that skinny teal zone I’ve tinted.

As if it was’t enough to have two monster events – – tomorrow’s Fed party and next week’s G20 – – now we have THIS insanity!