Slope had a lot of great short ideas in May. I was up 25% for the month. When trading began for June (that is, on Monday), I made the shift from bearish to bullish. Some people apparently thought this was a sign the market was going to collapse.

Why would that be? Am I a contrarian indicator now? If so, I’m not sure why. Slope has been knocking it out of the park – – even with cryptos, whose top I called last week, and I don’t even trade the stuff. So I’m a little puzzled why my pointing out great “long” charts would be seen as a sign of the end-times. Every single one was profitable, and handsomely so.

In any case, I don’t dabble in bullish actions much, and I am once again a pure bear. Let me stress, however, that I’m not an aggressive one. I have 0 longs now, and 35 shorts (as opposed to the 75 just a couple of days ago). I have no ETFs and no big positions. I got up to 252% margin a couple of days ago, but I’m not even using margin buying power right now. I am, in a nutshell, a pint-sized bear. I have 48 other charts waiting in the wings.

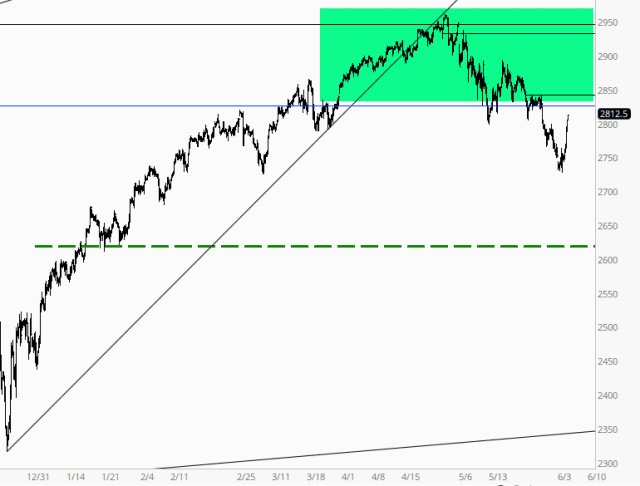

I’m not sure what part of my brain fell out that caused me to yammer on about 2800, but the figure – – which I’ve cited endlessly here earlier – – was 2826. They’re close, but sheesh, what’s wrong with me? Anyway, that’s the level that matters to me. My trading buddy Atilla says 2850, but I’m sticking with my best guess.

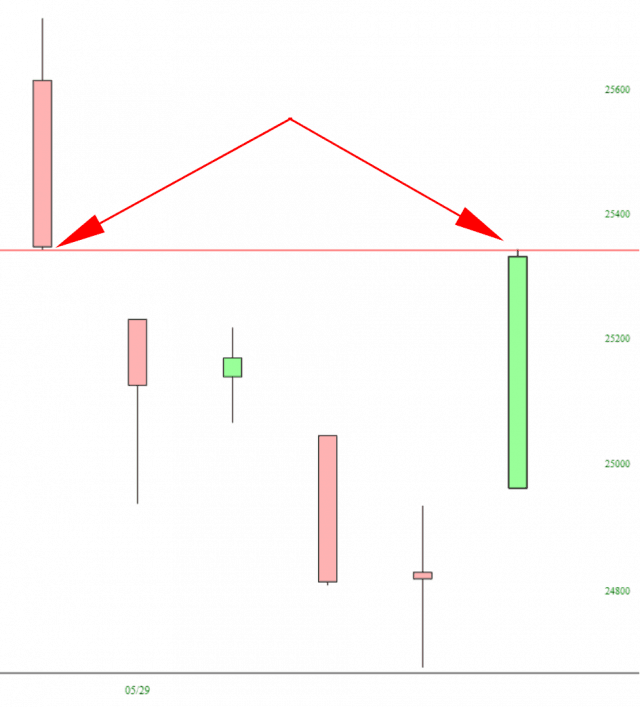

Importantly, we accomplished in a single trading day what I feared might take weeks, which is undid all the damage from the four prior trading days. This is the Dow 30, and I find it jaw-droppingly amazing how perfectly it closed the gap.

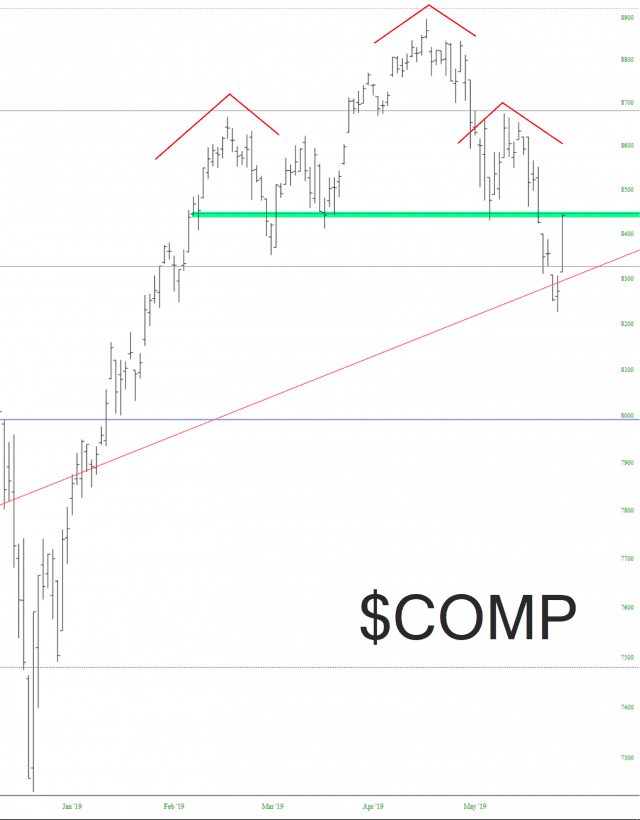

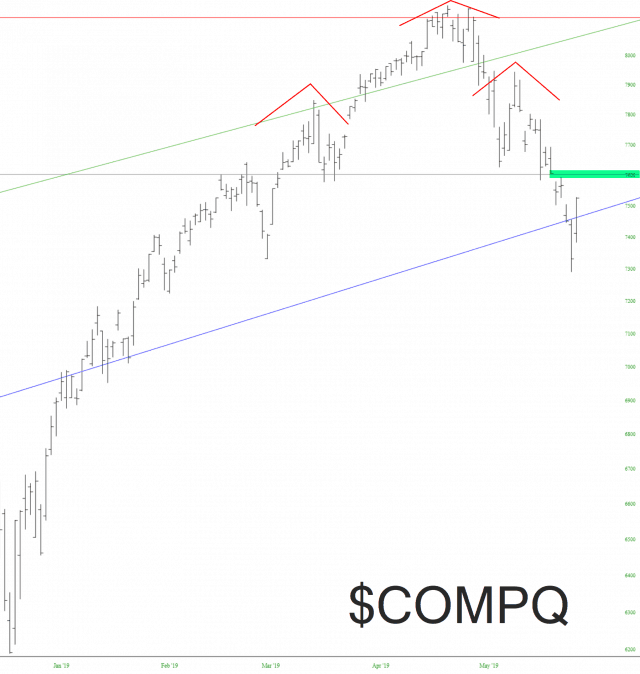

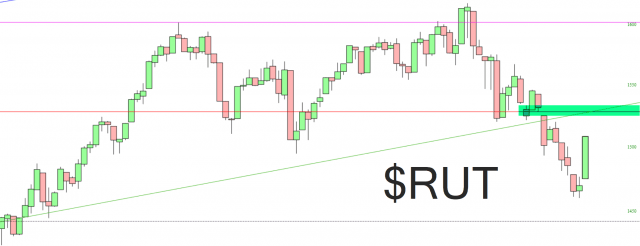

Below are four other important cash indexes. I’ll let my lines speak for themselves.

Impatience is a terrible character flaw of mine, and I’m trying to quell it, but I must confess I’m eager for this red-eyed bear market to return. It’s so much more fun than those grinds higher. May was dynamite, and I think June has the potential to be even more exciting.