As a resident of the fair city of Palo Alto, California, I have watched with a combination of bemusement and dismay as real estate prices have, over the past three years, reversed course. Mostly, however, I feel a sense of relief that we still have proof that trees do not, as the saying goes, grow to the sky. Although in the case of stocks, such as AAPL below, this has yet to be demonstrated.

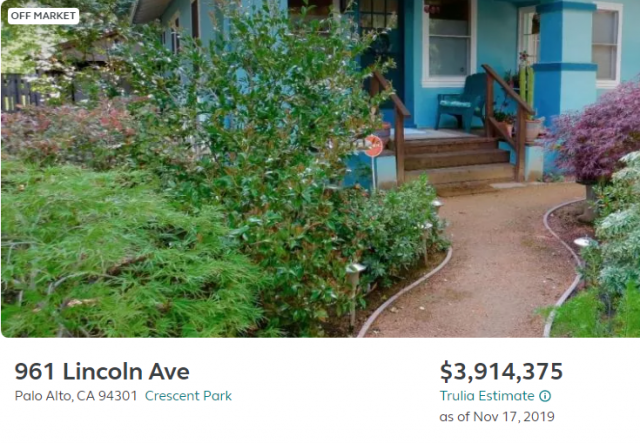

Let’s dial back the clock three years. There is a small house (about 900 square feet) just around the corner from where I live that garnered attention, because it was being put on the market for $10 million. Let me be clear, the 900 square foot house was not made of gold bullion. It was just a little cottage. But here we have it:

To be fair, the cottage is on, for this neighborhood, a lot of half an acre, which is gargantuan for here. Most lots are like 6400 square feet or so. All the same, a Chinese buyer snapped up the place for $10 million, and it has sat there, unoccupied, for three years. I know this for a fact, because I walk my dogs in front of it every morning, and although a gardener is evidently paid to keep the yard tidy, not a soul has crossed the threshold in all these years.

Having said that, present estimates for this property are a bit south of $10 million. I’m sure the rich Chinese national who plunked $10 million into this place was doing so as a “safe haven”, but I’m not so sure how one can celebrate a $6 million plunge in value.

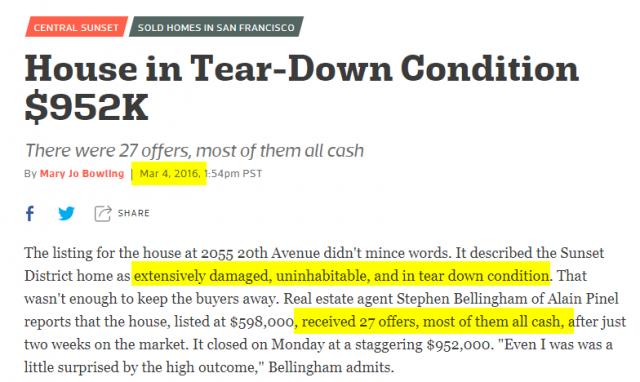

From what I can tell, 2016 was definitely some kind of peak frenzy, when multiple all-cash offers, people camping out in front of sites where a listing was going to be posted the next morning, and a scarcity of inventory ruled the day. Just north of here, in San Francisco, there was this tale:

It was typical of the time: 27 offers (most pure cash) and a sale price nearly double the offer. And all this for an “uninhabitable” place. Glancing at Street View, I’m inclined to agree.

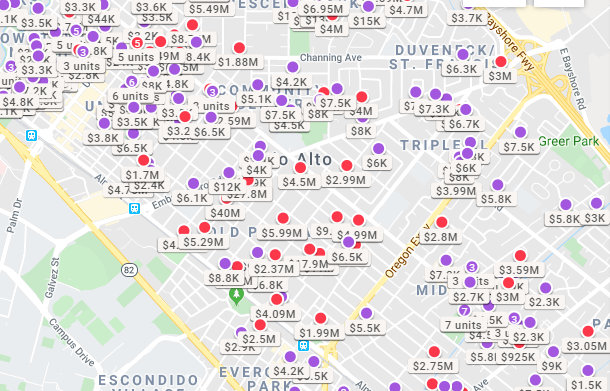

Times have changed. There aren’t multiple offers anymore. The Chinese seeking a safe haven have fled. And the new tax code has splashed cold water on California real estate. As for scarcity of inventory – – back in 2016, I think at one point there were a total of 11 properties listed for sale – – that has changed too:

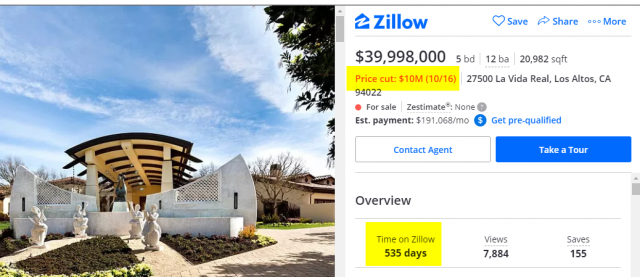

The most poorly-situated sellers are those with ultra-luxury properties. It took me all of three seconds to get an example for you. Below we have a $39,998,000 property (far more appealing than if it was priced at $40,000,000). You may have noticed that little mention of a $10 million price cut as of last month.

Added to which, this sucker has been on the market for 535 days already. It was not that long ago that the “days on market” was invariably a single digit, often a number rhyming with “fun”. Helpfully, Zillow lets you know the monthly mortgage payment at this reduced price would be a thrifty $191,068 twelve times a year.

At this price, it’s obviously a lovely place. They’ve even decided to dedicate a portion of this expensive property to a statue:

As a history buff, I couldn’t help but instantly think of the statue of the children in Stalingrad after the Nazi bombing of the city. It’s eerily similar and, once all the shifts take place in asset prices over the next decade, probably extraordinarily prescient.