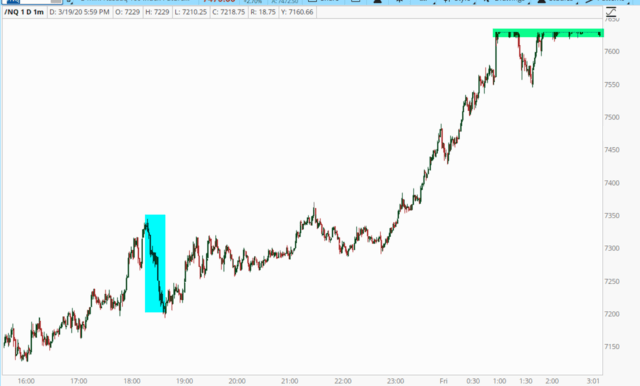

It appears that my The Bottom Is In post managed to nail the bottom after all. One key moment happened after hours yesterday, after California Governor Newsom announced that the entire state would be in a state of lockdown. The ES and NQ sold off some at first (blue tint below), but within a few minutes, they regained their footing. They’ve spent all night climbing, with the NQ itself limit-up for a while (green tint).

I have not been shy about my own pronouncements about what a big turning point this is (particularly with my Percent R post last night to premium members). At the same time, I’ll say once more that the kinds of words I would use to express the state of this recovery are: fragile, paranoid, and still hazardous. One doesn’t simply watch $25 trillion of wealth get destroyed in the span of 30 days and then just stroll in, whistling a merry tune, and safely pluck up stocks at bargain prices.

This goes a long way to explaining my utter non-participation at this point. On the one hand, I’m doing posts about how oversold the market is, and the kinds of buying opportunities that ravaged sectors like energy possess. On the other hand, here I am sitting with not a single position to be named. When it comes to trading, I am not a timid soul, but I continue to be in wait-and-see mode.

As I’ve suggested, the only investment I’d like to make is to buy Put options on Slope of Hope traffic. I’ve done this long enough to know that my “foul weather friends” – – the looky-loos who wander into Slope only when the world is falling apart, just to see what’s happening here in bear-land – – will be wandering back to Yahoo Finance in short order. That’s OK. I realize this site has a well-earned reputation. It’s just kind of amusing to me how predictable all of this can be.

Good luck out there! Or, if me, you choose not to be “out there”, you can hang out with me here in the bleachers and we can thumb through the morning paper.