I’ve noticed the most bizarre phenomenon here on Slope. I’ll say “the ideal thing to happen would be such-and-so“, and immediately someone declares that such-and-so could never possibly happen.

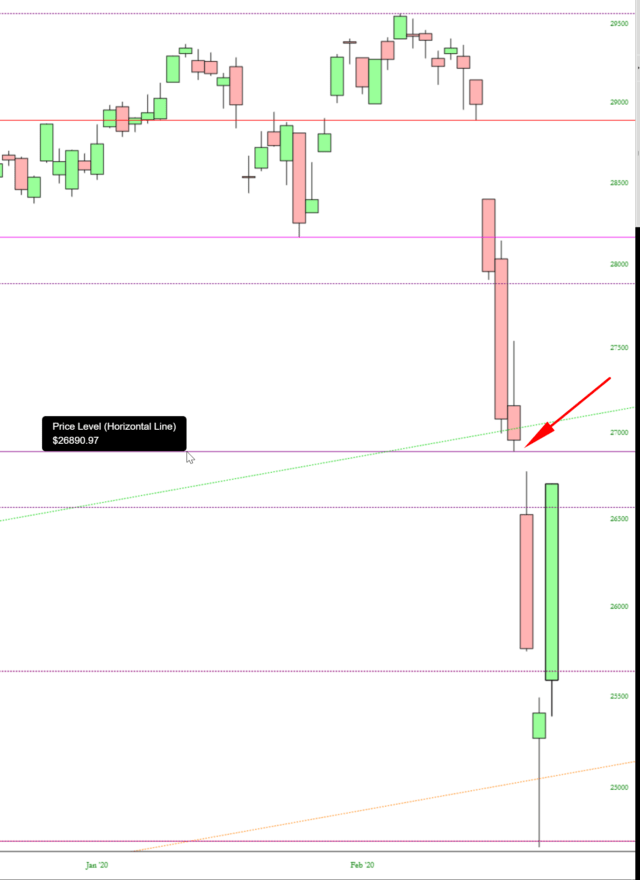

This happened again in just the past few days. I mentioned that the ideal situation for the bears would be for a hearty rally, prompted by government intervention, that would push us back to the price gap that existed from last Wednesday. Someone then specifically declared in the comments section something along the lines of,. “All the bears are saying the same thing, that we will fill the price gap and then fall again. Get over it. It isn’t going to happen.“

Well, I can’t say whether that entire prediction will transpire of not, but we seem to be just about done with Part One already, and we’ve only had one day of trading. Up about 1200 points on the Dow.

I mean, is that not incredible? It seems that quadruple-digit days are becoming commonplace on the Dow Industrials, and between Friday’s hammer and today’s bullish engulfing pattern, we’ve traversed about two thousand points. Incredible! Just amazing!

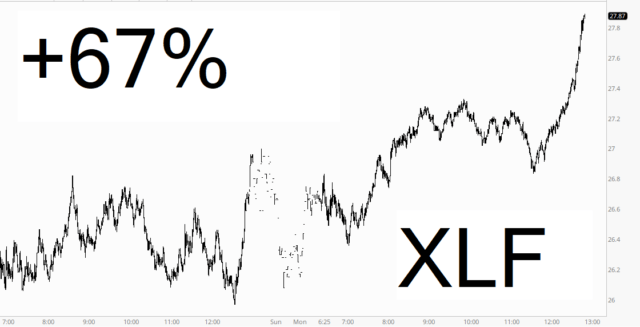

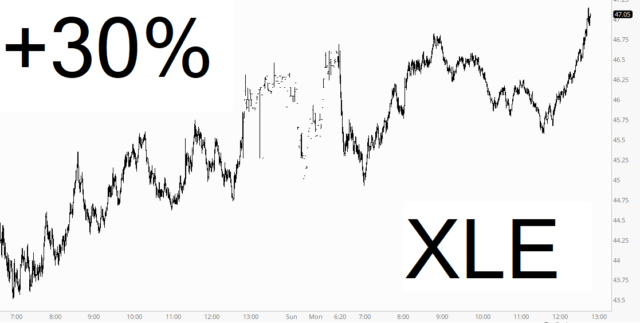

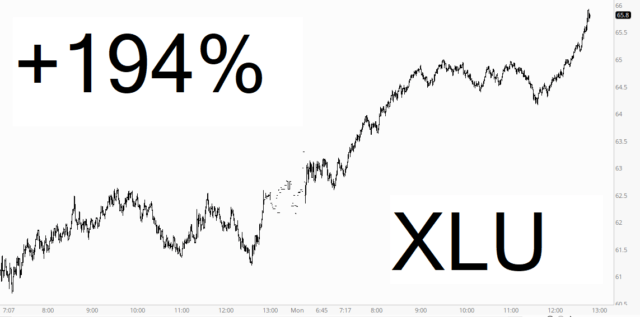

You may remember that I specifically bought call options on XLE, XLU, and XLF late last week. Today was a banner day for these suckers; here are the intraday charts, and I’ve put the price price change on the call options (they were all March expirations) on each one. I am out of all of these positions.

Who says this bear can’t call upside action too?

So now what?

Well, I’m in a curious position. I am totally flat. Not a single position (OK, that’s not entirely true, I do have one position, but that’s between me and Slope’s Gold/Diamond subscribers). So I bear no risk, nor am I open to any opportunity. I am market neutral, which is totally freakish.

I guess, starting tomorrow, I would feel comfortable poking around my watch list of 115 possible shorts and seeing if anything is ready. Or maybe today’s burst higher is just part of the entire counter-trend rally. My point, though, is that my desire for an explosion of prices have already transpired, perhaps almost in its entirety, and all the doomsaying this weekend, including the collapse when the Globex opened, turned out to be a total head-fake.