Well here are eight words I never thought I’d type: I’m sick of stock prices falling every day. I mean, yeah, it’s been a great quarter (just eight trading days left……) but I’d like us to turn the corner of this thing. You already know the reasons why, so I won’t belabor them. But even with – – what is it, $6 trillion in central bank and legislative commitments already, with $1.5 trillion last night from the ECB? — this poor, diseased market can’t seem to get up off the mat.

Just to recap my own positioning:

- Vast, vast, vast majority of portfolio is in U.S. dollars (which evidently are growing in value vis a vis world currencies by the second);

- Short bonds via TLT;

- Short precious metals miners via GDX (long DUST in personal account);

- Long oil producers via large XOP position;

“Bailout” play via long BA

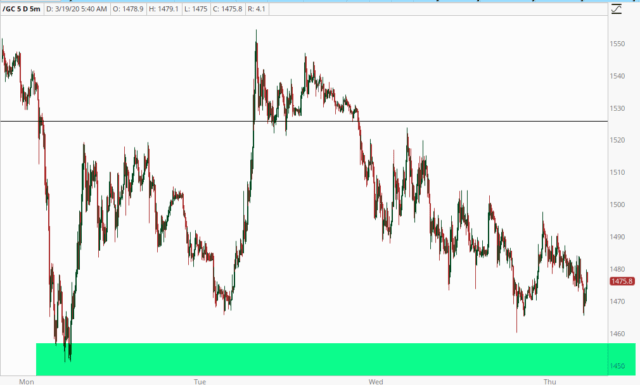

I’m hoping gold can break its shelf of support and help drag the miners down with it. The boys at Elliott Wave – – whom I tease mercilessly during bull markets, but are actually pretty exceptional during bear markets – – are looking for gold to head toward the $1,000 mark.

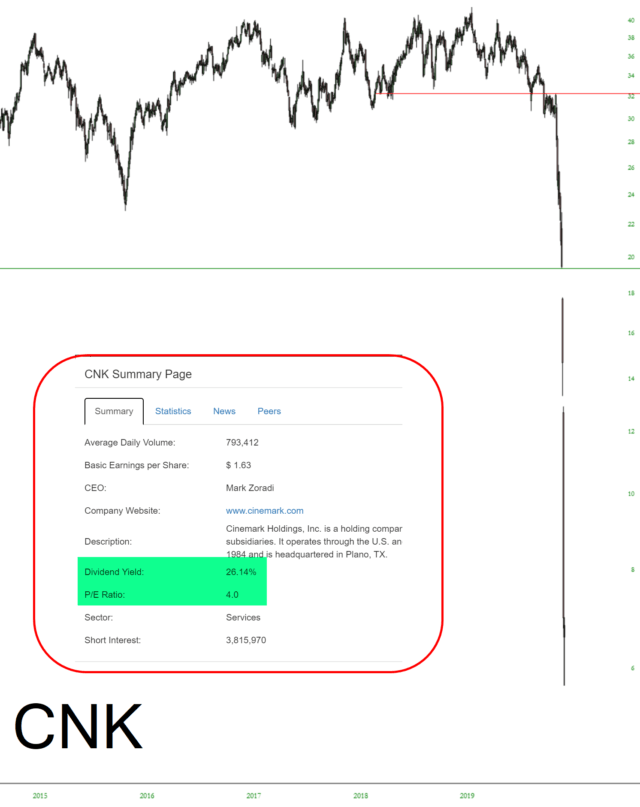

The merciless, mauling mayhem of the past month has created countless curious figures. Observe Cinemark, the huge movie theater operator. Their stock price is so puny now that they are sporting a price/earnings ratio of 4 and a dividend of about 27%. Of course, these are historical data points, but still, it’s quite remarkable.