Today is the last day of the quarter. For me, who manages a small hedge fund, that is terribly exciting, because I don’t have to wring my hands with worry about guarding my Q1 results. I’ve got an amazing quarter under my belt, and, frankly, I don’t have to worry about messing it up. I feel far, far more enthusiastic about getting aggressive by day’s end than I did even yesterday.

And what a quarter it has been. Surely in the long history of United States financial markets, if this isn’t the most amazing quarter in that entire span, surely it ranks in the top four. What I’ve had the privilege of enjoying just this month includes:

- Some of the best trading of my life;

- Far and away the biggest surge of subscribers ever, in the midst of celebrating Slope’s 15th birthday;

- Some amazing product/feature breakthroughs on the site.

And we’re only one-forth of the way into the year!

Last night, we got a good, clean rejection of last week’s rally. Yesterday’s baseless and absurd ascent in prices did not more than double-top this dying beast on the ES.

Longer-term, you can see the wipeout this quarter, in spite of the criminal and treasonous Jerome Powell and Stephen Mnuchin throwing trillions and trillions of dollars in a desperate bid to save their worthless asses. In a sane world, they would both be executed. Sadly, for us, we have to tolerate these vermin.

In a similar fashion, and equally as important, the NQ has been rejected. As indicated by the green tint in the chart above, the level of 2700 (give or take a few points) is my line-in-the-sand, but we’ll see if we get there or not. As it is now, I am relying on the price rejections of the ES and NQ as the breeze filling the sails of the U.S.S. Ursine.

I’ve made no secret of my bearishness with respect to precious metals miners, and I know some of you are doing well with this. The GDX continues to do God’s work.

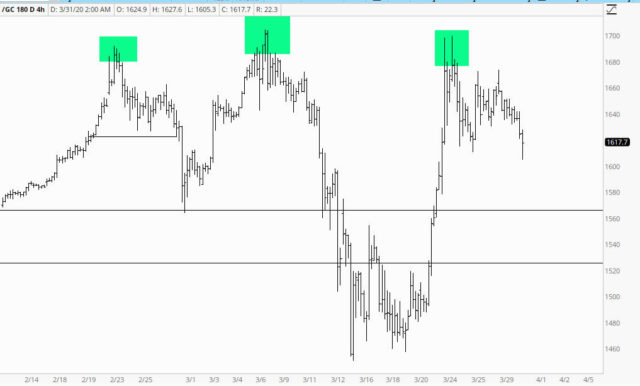

As I’ve said before, if there was any time in human history that you’d expect gold to be ripping limit-up every single day, it is now, and yet the best it could muster was a feeble approximation of its prices back in February. This is all about context, folks. If this is the best gold can do, I wouldn’t fall dead with shock if the fairy from the future told me it would be heading toward $1,000/ounce.

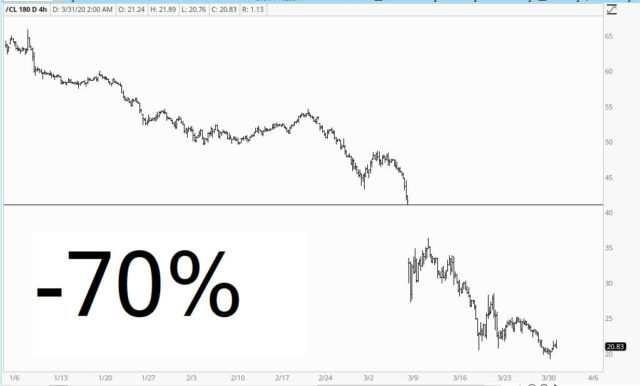

Oh, and remember early in January, when we did that missile attack on that General, and everyone and his brother who worked on Wall Street declared most assuredly that we were heading back into triple-digit oil prices? Remember? Well I do. This was one of the great contrarian moments of all time. Oil has been an absolutely shrieking disaster, and a very honest predictor of our future economic malaise than the horribly-manipulated equity markets.

In closing, I must once again share my zealous gratitude for those here. Your numbers have become legion, and the emails tumbling in my inbox every day, filled with kind words of brotherhood and gratitude, mean a tremendous amount of your host and long-suffering narrator.

Q2, here we come.