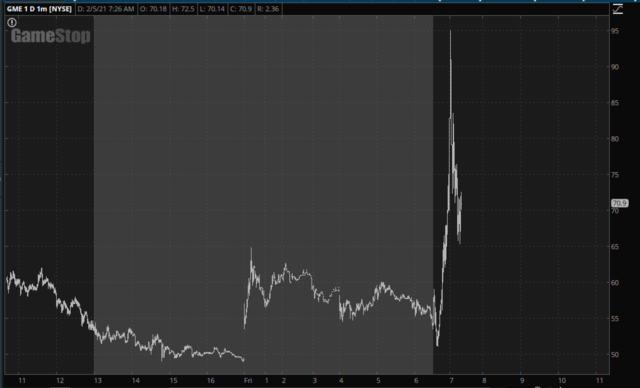

It’s quite evident that the GME crowd hasn’t learned a thing. However, it’s still fascinating to watch at a safe distance. The mere fact that they were allowed to buy the thing was enough to almost the price within minutes. That nuttiness is already unwinding.

But let’s look at the much bigger picture, which is the small caps, by way of IWM. Observe how extreme things have become: the price is sky-high relative to its long-term Bollinger Bands.

Even more interesting is the True Strength Index. Notice how this indicator has been carving out a series of “lower lows”, just like it did a year ago, even in the midst of nominally higher prices.

Let us strip this down to its essence: remove the drawn objects. Even remove the prices. Here we see the trio of exponential moving averages over a period of years. There can be no doubt that things are more “stretched” now than they have even been before. Sooner or later, we are going to witness, at the least, a reversion to the mean.

I wanted to mention – – and I’ll mention it again later – – that Saturday morning the site might be in for some rough seas. We have agreed to deploy the new site at that time. On one extreme, it’ll deploy, and hardly anyone will notice anything even happened. On the other extreme, things will go very badly, and we’ll ultimately decide to retreat and fall back to the original site.

Suffice it to say that we picked Saturday morning as a relatively quiet time when, should we actually go offline, it won’t matter much. I wanted you to know in advance.