Just look at all that green. S&P 500…….up. NASDAQ…….up. Russell…..up. Errr, but maybe don’t look so much at gold, which as of this moment is down nearly $50 per ounce. It has been a total dog for a full seven months now. Total garbage.

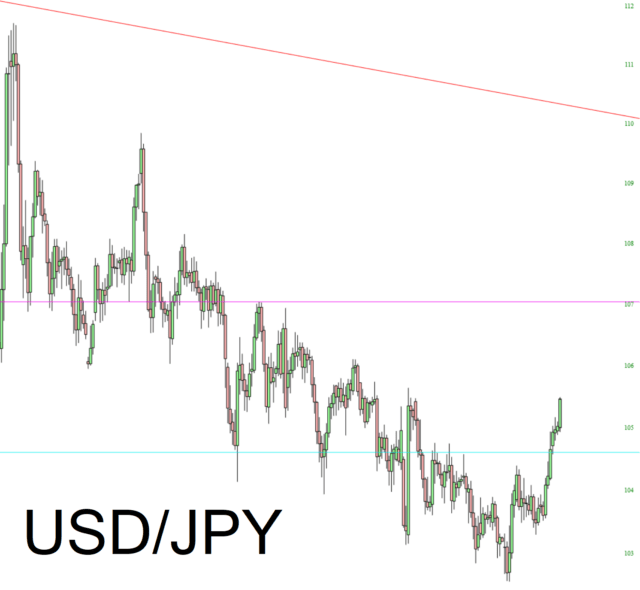

A big part of today’s outsized plunge is that US dollar continues to strengthen. After all, the cotton paper used to print dollar bills is of the highest caliber, with carefully-chosen green inks and the most rapid printing presses imaginable. Naturally our dollar beats their yen.

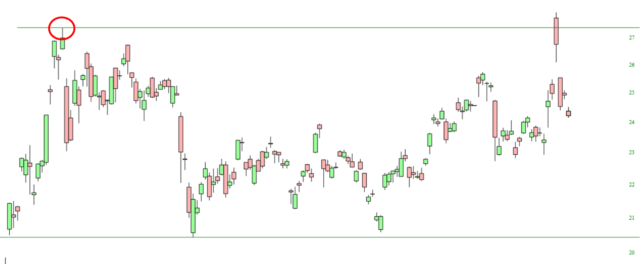

Silver hasn’t been as awful as gold. Its peak on August 6th (circled, just as I’ve done with gold above) was, unlike gold, beaten just a few days ago. Remember the whole “we did it with GME, now we’ll do it with SLV” surge? Well, that’s what all this was about. Plus silver hasn’t been in the steady meltdown mode that gold has been. All the same, its spike above the August 6th was a one-minute-wonder.

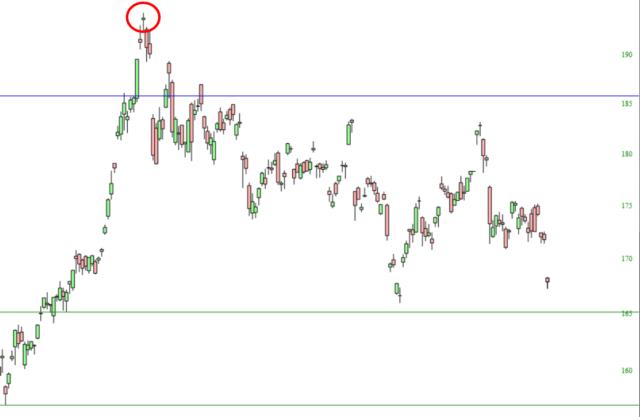

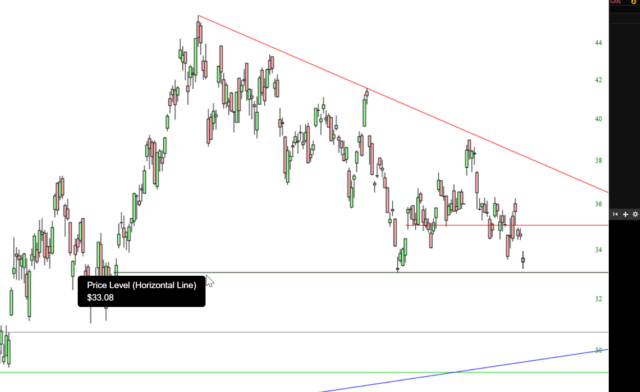

Miners, naturally, have been getting smacked down since August 6th as well. Take note of the horizontal line highlighted. Break that, and miners will go from Awful to Really Awful.

Speaking of reddit………..their particular target in the world of silver was AG, which went ripping over its resistance. It has lost almost every penny of those gains, although I will note here that the line now represents support instead of resistance, so this might not be a terrible buy point (certainly better than four days ago!)

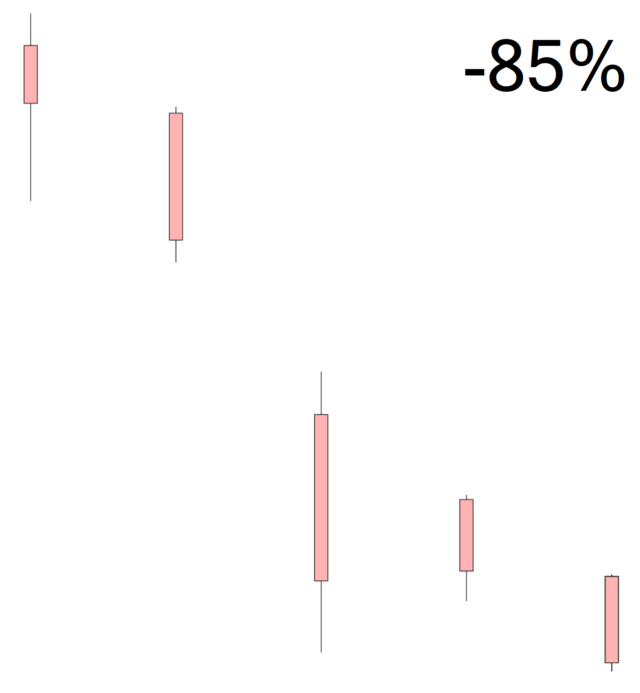

Oh, and if you’re basing this on WSB-power, forget about it. When I rolled my eyes at the whole WSB “revolution”, I got lots of surprised gawks, but it’s true – – the whole thing was an absurd exercise, and there’s no telling how many naïve teenagers and twenty-somethings lost, collectively, billions, in this entire farcical misadventure. I present to you, again, GameStop: