Preface from Tim: Yesterday, I posted an image of the insane move higher at the reverse repo market had made, and Lee Adler was kind enough to write me an email, which I am sharing below with his permission. If you like this kind of information, you might want to look at Lee’s site to see his offerings.

Your post on RRP is in my wheelhouse. So I wanted to share these thoughts with you.

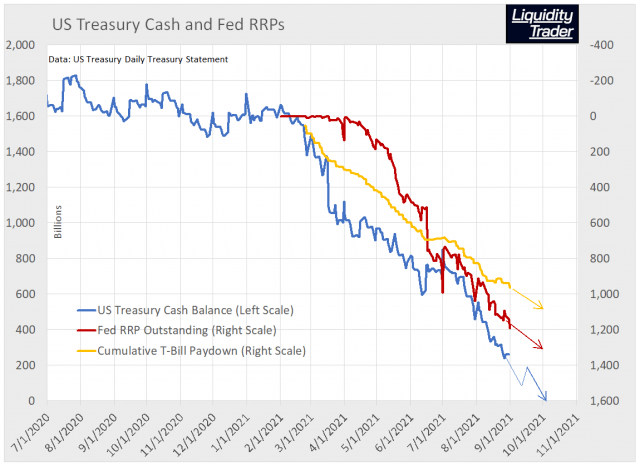

Here’s my updated chart of the Fed’s RRP slush fund, which I cover regularly at Liquidity Trader. I’ve attached the latest update (from this post). The next scheduled T-bill paydown is for $30 billion on September 7. That will bring the net paydowns of T-bills since February 23 to $993 billion and total gross bill paydowns to $1.03 trillion.

With this cash, the US Treasury and the Fed, acting in cahoots as always, have created the RRP “slush fund.” The Treasury takes short term paper out of the market and returns cash to the holders of the paper, mostly MMFs, but also others. They then have nowhere to go, so voila, they send the cash off to the Fed as overnight money, in the Fed’s RRP account. This fund will allow the Fed to begin to cut QE purchases, with the illusion that there are no ill effects.

The arrows show a simple projection toward DD-Day, or the Drop Dead Date, when the Treasury runs out of cash and Congress will be forced to raise the debt limit. That’s when the countdown starts for the depletion of the RRP slush fund. As it approaches zero, I think of it like a black hole, with the singularity, the point of infinite gravity, at the center. No one knows what will happen there. But I don’t think it will be nice.

There’s a lot of misinformation out there, including the Sperandeo piece. The Fed is not draining. It is not tightening. The buildup of RRPs is the natural direct result of the T-bill paydowns.

It’s not difficult to connect the dots if you take the time, and use the simple rules of accounting as the basis of the analysis.

That’s easy for me, since this stuff has been the locus of my research for the past 20 years and I’ve had a bit of educational background in accounting, so I’ve always seen monetary analysis in terms of double entry bookkeeping, debits and credits, assets and liabilities. All of the data necessary to connect the dots is published weekly by the Fed, and daily by the US Treasury.

But apparently, it’s not so easy for everyone else. That’s because they focus on traditional monetary finance theory, which is garbage, and economic theory, which is both garbage, and irrelevant. GIGO.