It feels like last Thursday morning all over again.

In spite of the general consensus among readers that this morning’s Producer Price Index wouldn’t be a big deal (although Honduki got the nuance correct…………)

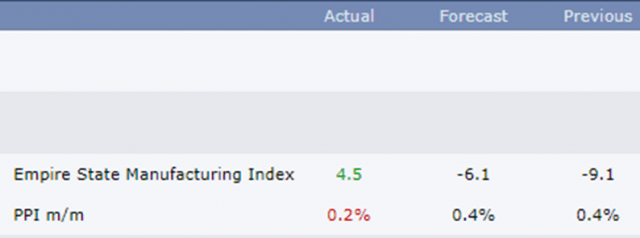

It turns out it was quite influential. For both data points coming out, it seems the “Actual” was a very bullish surprise compared to the “Forecast”:

Which sent assets exploding higher. Yesterday afternoon, for whatever reason, stocks bled out into the close (red zone) but they spent the entire night and early morning unwinding those losses. The millisecond the PPI hit, everything ripped to new multi-month highs, extending the merciless counter-trend rally that began about five weeks ago on October 13th.

And Zerohedge, every bull’s favorite site now, is celebrating all the green with its usual gusto.

In recent days, I have sort of thrown my arms up at the rest of 2022, which is why I’ve pushed all my options expirations out so far (out of 25 positions, merely 1 of them expires in January, with the rest all the way out into June). The big picture isn’t changed, but by God, the bulls are endlessly kicking the bears in the balls day in and day out for over 30 days now.