Good morning, everyone, and welcome to the end of the trading year. With a complete lack of economic data and earnings data, I think the next five trading days – – today, Wednesday, Thursday, Friday, and next Tuesday, are going to be buffeted about like a ship lost in fog. There are a number of factors at work here that are going to make the trading activity messy and, in the end, meaningless;

- Low volume: let’s face it, except for Slopers, humans are bums. They eased off work in mid-December and won’t deign to put in a few hours a day again until well into January. It’s going to be a very quiet trading environment. (I’ll also grumble, as I always do, that once we get out of this insanely long holiday season, we have yet ANOTHER forced holiday by way of MLK, only two weeks later! Doesn’t anyone like to WORK anymore? And don’t get me started on Juneteenth).

- Economic blank sheet: we don’t get an even semi-interesting economic data report until next Wednesday. Zero. Zilch. Nada.

- End-of-Year Weirdness: This has been a year of losses for almost everyone. Will they be dumping in order to harvest tax losses? Will they be loading up in advance of the new year to get stocks “cheap” (ha!) There’s a lot of weird psychology and second-guessing going on.

- Start-of-Year Weirdness: Once all the cruft from 2022 is done, then people will jump the gun and gobble up stocks when the new year begins, thinking that the bear market is over and it’s time to get stocks immediately so they can enjoy fat gains in the new year. This same psychology drove the market to its lifetime high on the 2nd day of 2022. Literally within ten trading hours of the new year, the market peaked.

We already witnessed the weirdness in real-time when futures opened on Monday afternoon and immediately exploded higher across all asset classes. People assume that the sins of the past thirteen years have been paid for in full, and that 2022 has wrung all the excesses out of the system. I don’t think so. I’ve said it before, and I’m sure I’ll say it many times to come: 2022 was the appetizer. 2023 will be the main course.

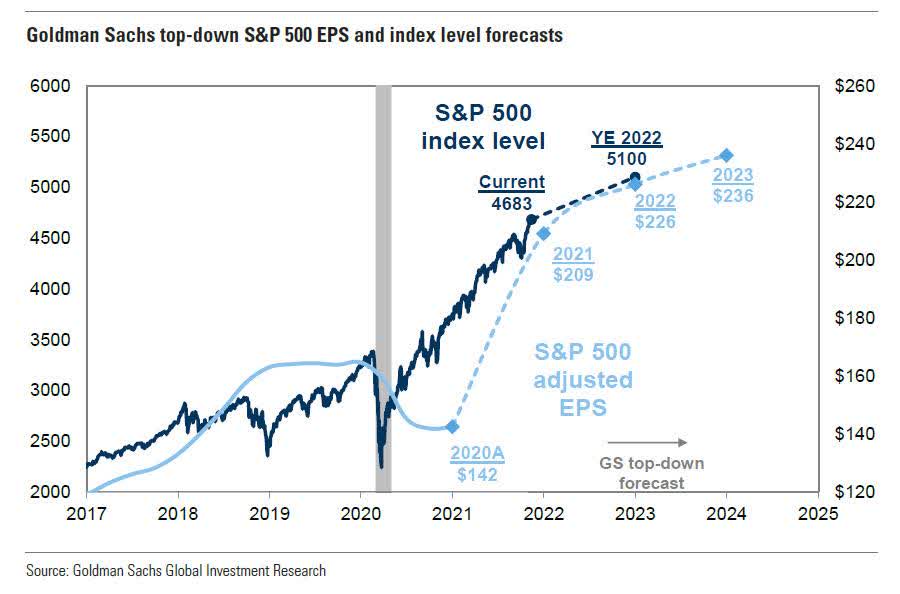

Or, alternately, you could latch on to the advice of the highly-paid experts like Goldman Sachs, who offered their target of 5100 for the S&P for, well, right about now.