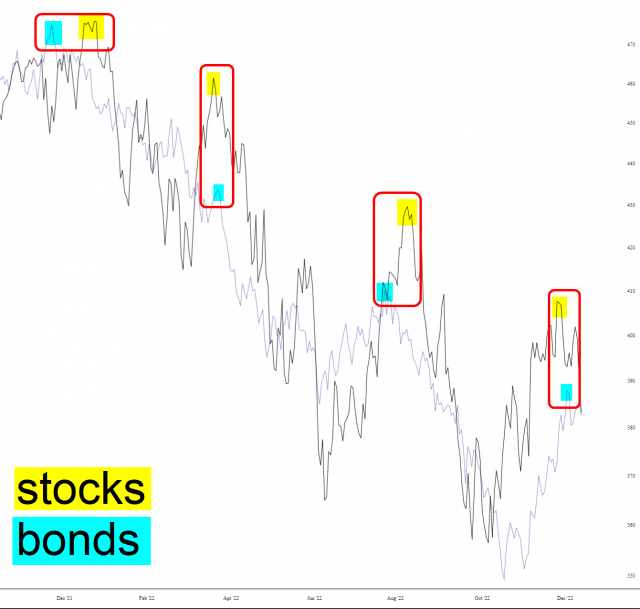

During this bear market, bonds and stocks have topped out at roughly the same time. The first time, bonds topped out weeks before stocks. The second time, they were identical. The third time, bonds again preceded stocks by a couple of weeks. This time, it seems to be in synch.

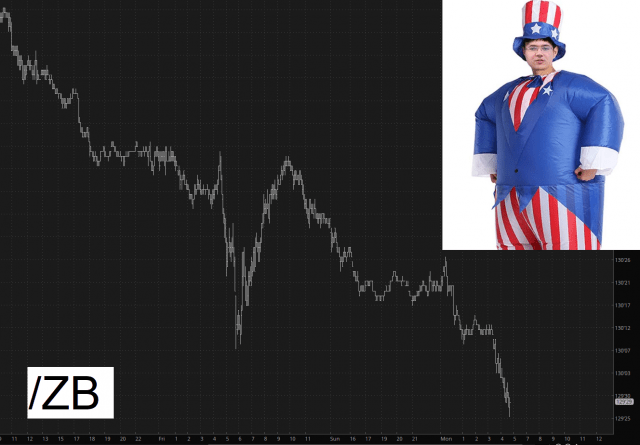

This is especially germane this morning, before the opening bell, as bonds are once again getting zapped (down over 1%) while equities are flat. I started acquiring TLT puts early last Friday.

Of course, over in ZH land, it’s perma-bull time as always, this time with “China Hopes” being the reason that stocks are a great bargain and you should buy them immediately. They emphasize it by stating how China’s leaders (who are always honest and accurate) will focus on boosting the economy, which is in sharp contrast to their declaration that they intend to crush the economy mercilessly. Oh, wait, they never said that. China’s leaders are just saying what they’ve said every day for the past fifty years.

For myself:

- I am loaded to the teeth with put positions

- I have only 3% cash left

- My view is that, for this bear market, 2022 was the appetizer and 2023 is going to be the main course