Cross-posted from NYUGrad’s substack site……….

Before you read futher, I would like to thank you all as we just surpassed 100 subscribers. I am on a mission to grow this community and treat each engagement with 100+ as I would 10k+. I have plans to add services including a podcast, webcast reviews of charts, community chats, and premium content. But everything will be free for now, so that we can grow the community. Happy Holidays!

I feel like an idiot stuck under a rock. Maybe it is because I have not revisited the Wizard of Oz since I saw it as a kid.

Let me know in the comments if you knew that the Wizard of Oz was an allegory with hidden meanings central to the Depression of 1893, the struggle of farmers and blue collar workers and the Gold standard.

Excerpts from Michael A. Genovese

The allegory begins with the title. Oz is the abbreviation for ounce, the standard measure used for gold. Dorothy represents Everyman; the Tin Woodman is the industrial worker, the Scarecrow is the farmer, the Cowardly Lion is William Jennigs Bryan, the Wizard is the President, the munchkins are the “little people” and the Yellow Brick Road is the gold standard. Toto probably represents a dog.

In the movie, Dorothy begins her journey through the Land of Oz wearing ruby slippers, but in the original story Dorothy’s magical slippers are silver. Along the way on the yellow brick (gold) road, she meets a Tin Woodman who is “rusted solid” (a reference to the industrial factories shut down during the depression of 1893). The Tin Woodman’s real problem, however, is that he doesn’t have a heart (the result of the dehumanizing work in the factory that turned men into machines).

Farther down the road Dorothy meets the Scarecrow, who is without a brain (the farmer, Baum suggests, doesn’t have enough brains to recognize what his political interests are). Next Dorothy meets the Cowardly Lion, an animal in need of courage (Bryan, with a loud roar but little else). Together they go off to Emerald City (Washington) in search of what the wonderful Wizard of Oz (the President) might give them.

When they finally get to Emerald City and meet the Wizard, he, like all good politicians, appears to be whatever people wish to see in him. He also plays on their fears. To Dorothy, he is a disembodied head; to the Cowardly Lion he is a predatory beast; to the Woodman, a glowing ball of fire. But soon the Wizard is revealed to be a fraud–only a little old man “with a wrinkled face” who admits that he’s been “making believe.” “I am just a common man,” he says. But he is a common man who can rule only by deceiving the people into thinking that he is more than he really is.

Fast forward to today. The main exhibits I would like to share are in the context of The Wizard of today, The Federal Reserve, and its impact on everything from asset prices, jobs, and real estate. Never in my 40+ year lifetime can I remember a time when the financial markets and real economy suffered from Singularity, where the outcomes of many things are at the mercy of ONE collective of men.

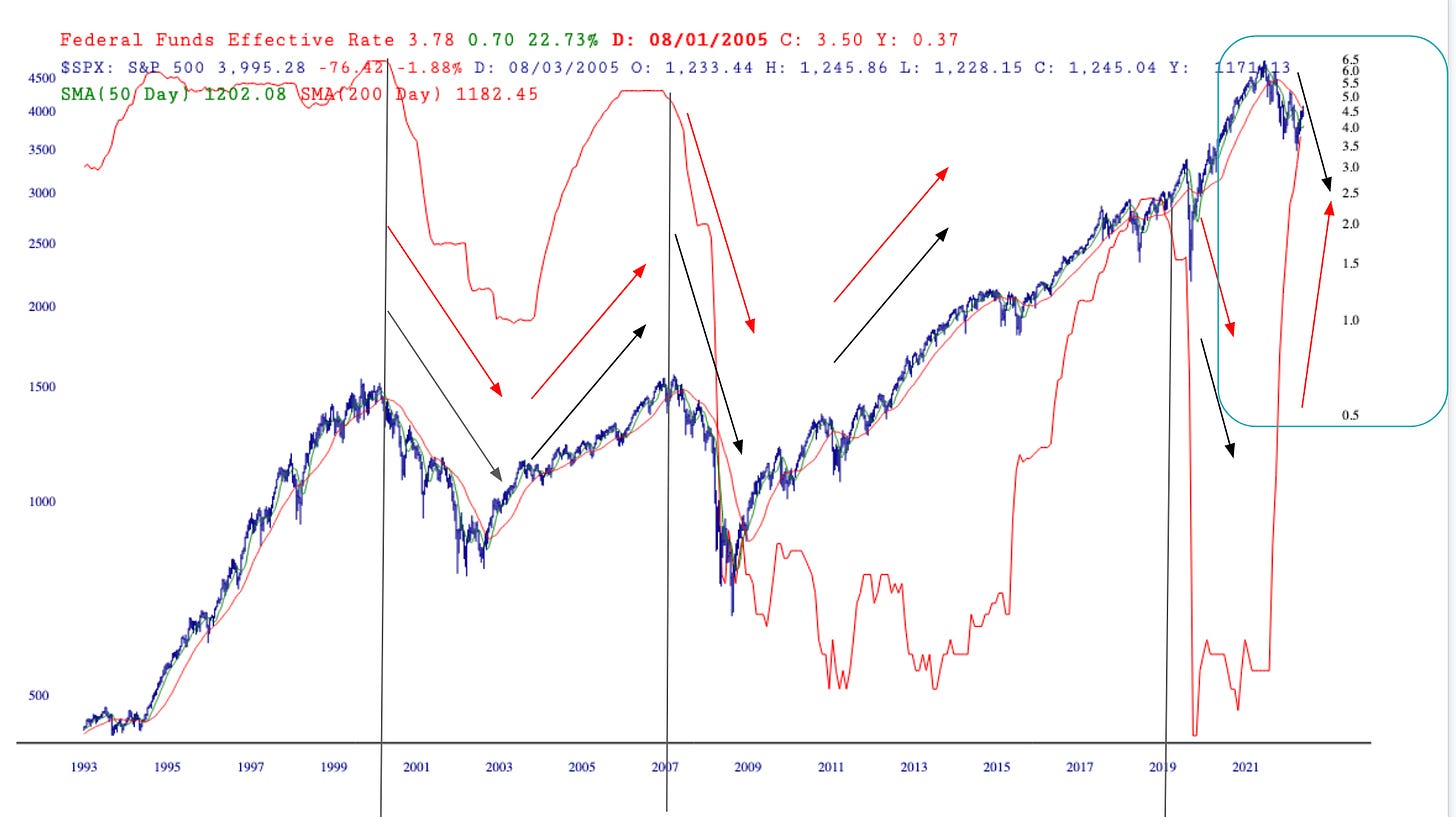

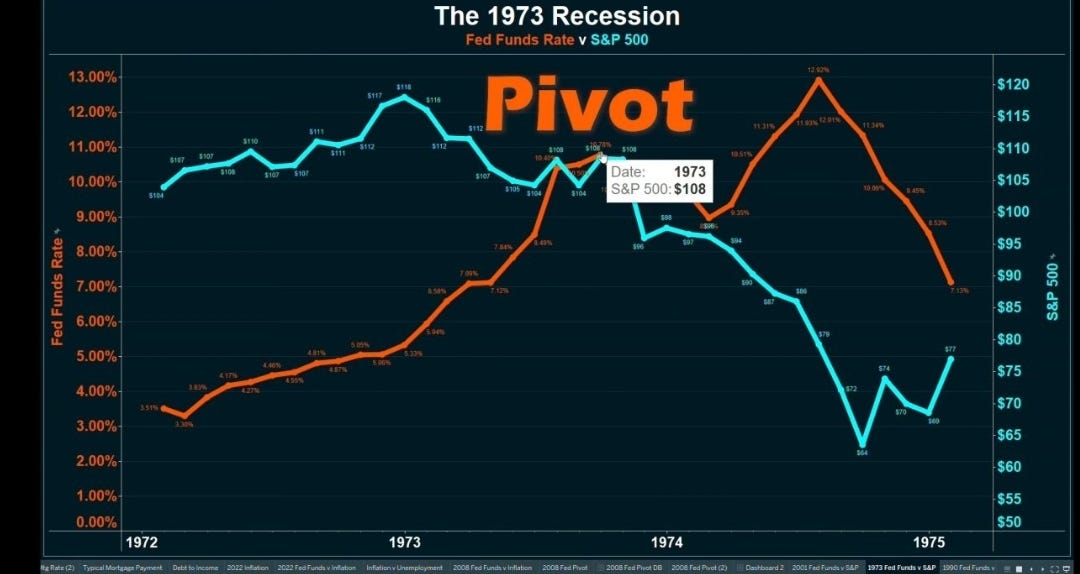

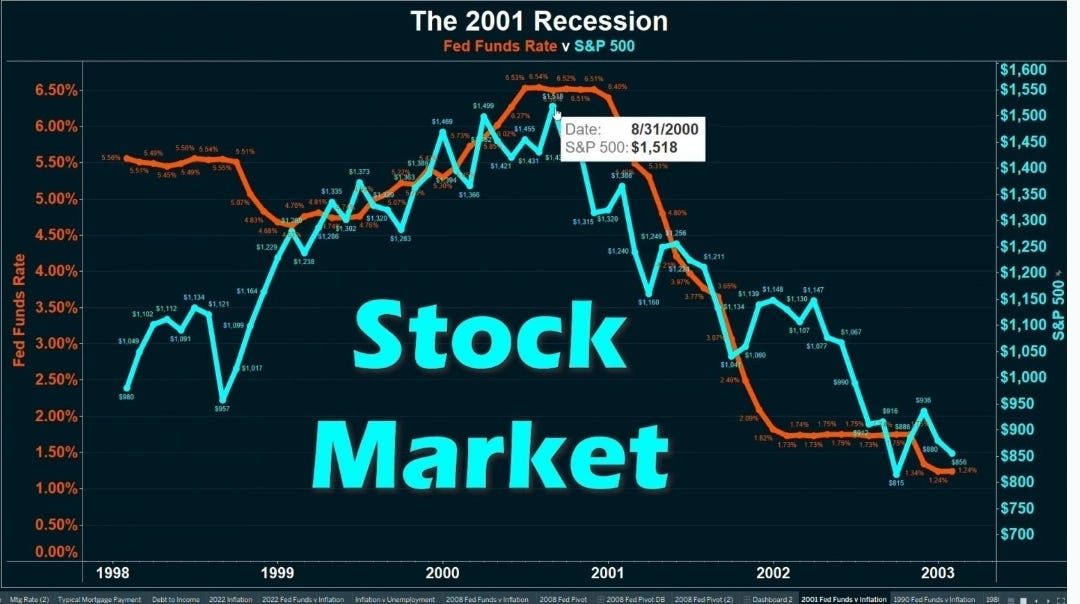

Take a look above chart overlaying $SPX with the Fed Funds Rate. It is counter intuitive and synchronous. The Fed raises and stocks rise. The Fed Pivots and stocks fall with rates. Except the time when Fed Funds were pinned to near zero and stocks soared, we are now in another divergence. In hopes to be like his hero Paul Volcker, Jerome and his gang are trying to undo the very Inflation they caused by raising rates faster than ever before. And in this time stocks are slowly making lower lows and highs. No one knows how this divergence will resolve but history can be a guide.

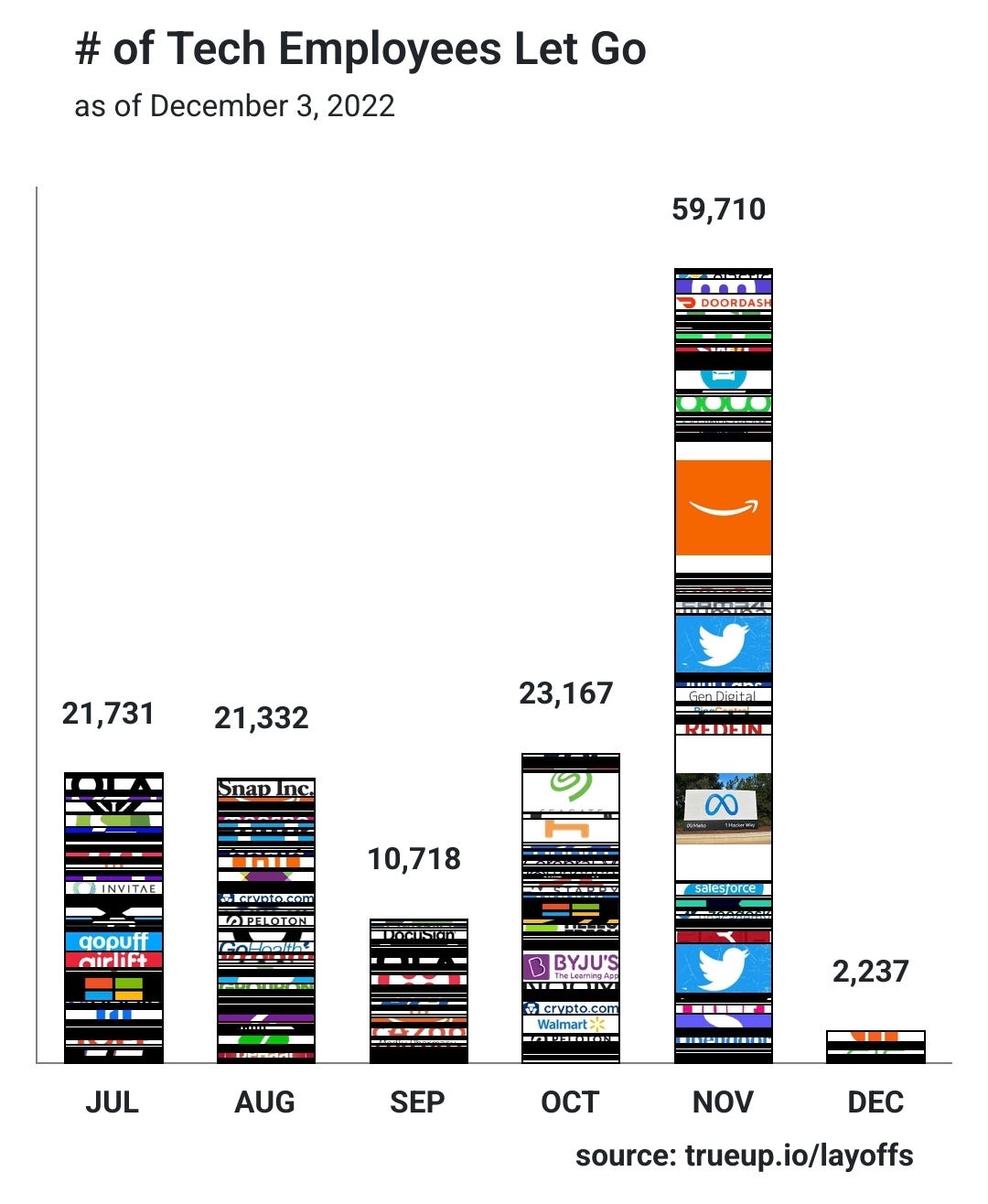

The impacts are also being seen across tech, now that many tech stocks are down so much. Cheap money is how tech grows, through share buybacks, issuance of corporate bonds at low rates, or VC Funds.

So far in 2022, there have been 1,340 layoffs at tech companies with 213,658 people impacted.

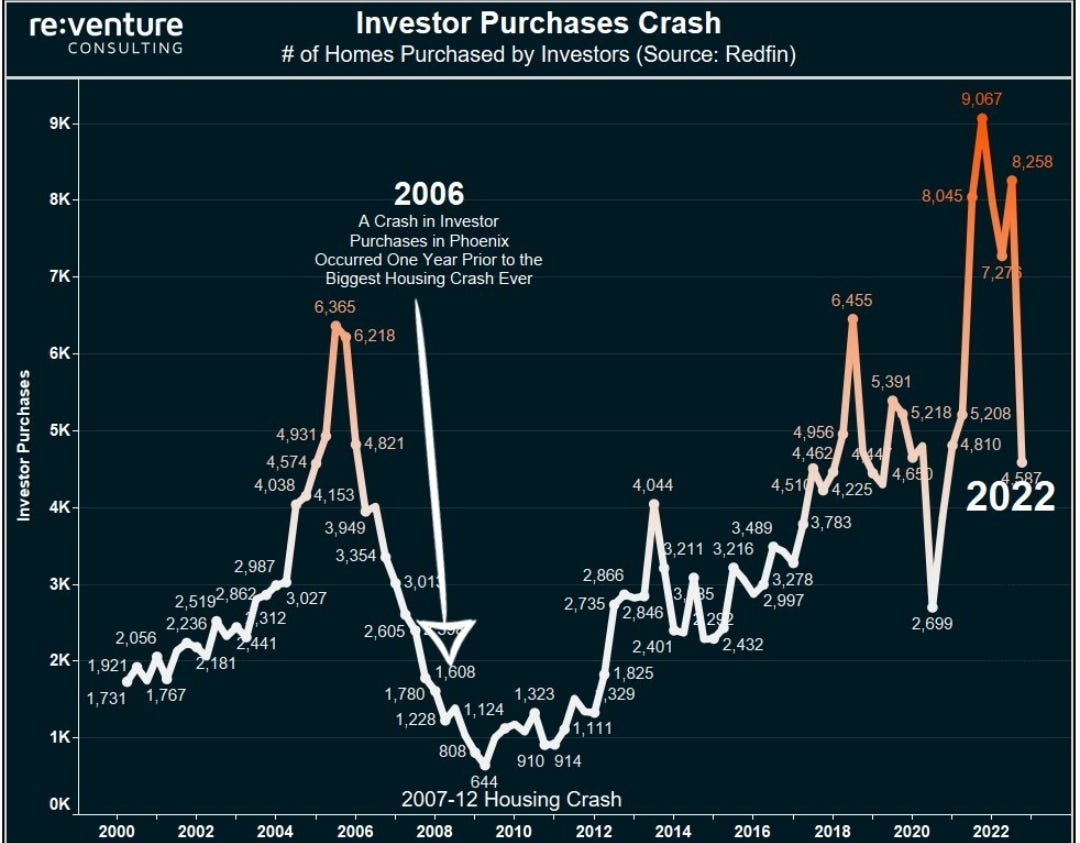

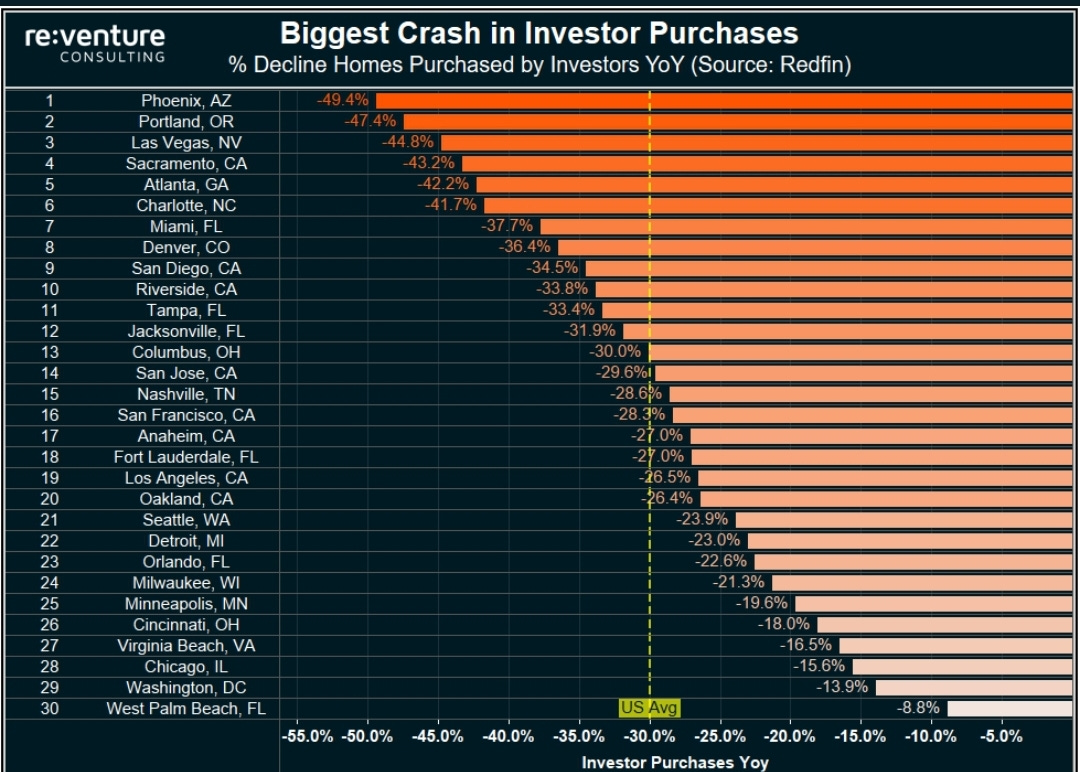

Housing is now showing obvious signs of trouble. In America, the share of homes owned by Investors is higher than it was in 2007! Albeit this time that investor is Wall St and not mom and pop with multiple N.I.N.J.A loans.

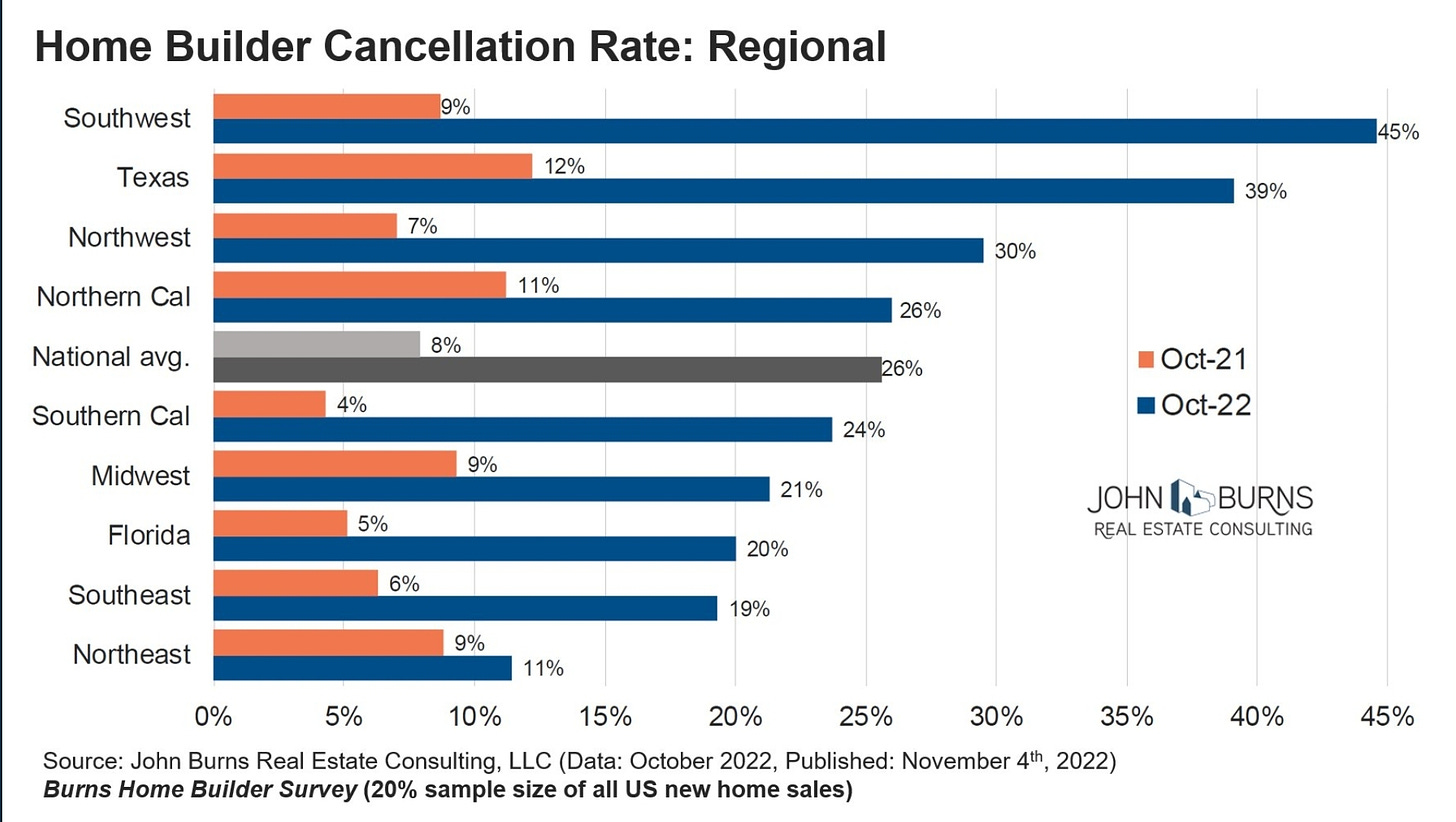

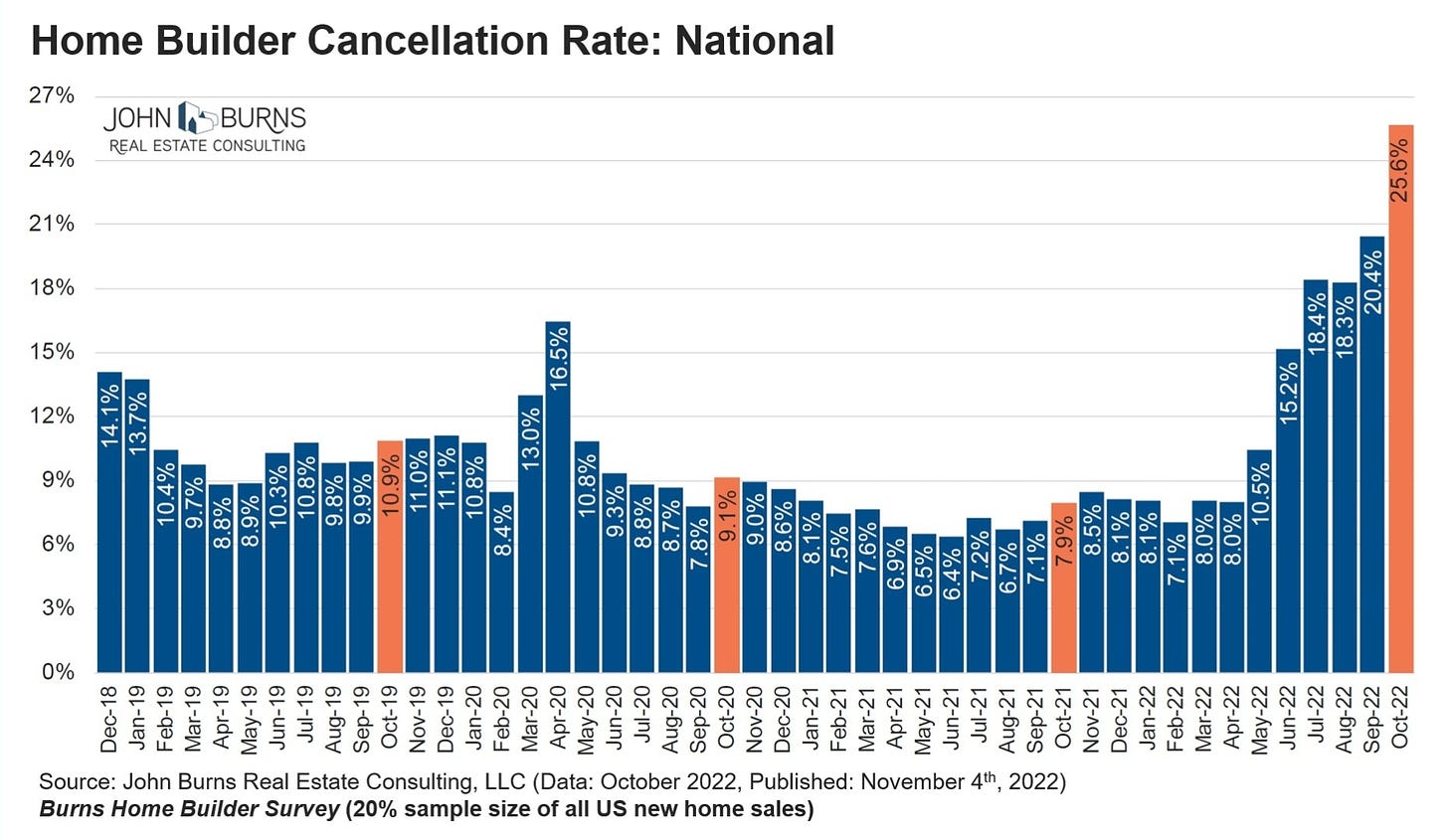

New Home builders are also seeing spikes of contract cancellations by consumers who are waiting or being priced out and unqualifying today for the mortgage they did qualify for 9 months prior.

We are about to see if there is no place like home and we meet Dorothy in a happy ending.

PS if you enjoy the writing please recommend to others. As I grow the community of readers I would love to have like minded individuals like yourself!