Well, suffice it to say, the grind up continues and we are in bear hell. What has been clear to me is that this is a day trader’s market (for the most part). For swing traders and others, trying to stay in position in either direction won’t work (unless you are playing the really long game). It hadn’t really worked since October.

Daily Chart SPX. Remember those days? Looks how much fun we had. The market on an intraday basis may have been a minefield, but the longer term trades made big moves in both directions. Those countertrend rallies provided for nice rides up for those who lean bullish (orange arrows), and provided better prices for those who lean bearish to short (purple arrows).

I’ll even say that despite the massive August 2022 rally feeling so painful to bears, it did still provide great setups to short and ride all the way to the October lows. Then…

Daily Chart SPX, but only since October 2022. Look at this mess. Same theme park, but instead of the rollercoaster, we are on the tilt-a-whirl, which only tilts and rises/drops a few feet and goes nowhere (which is actually kind of fun at a theme park, but not for stock markets). The trade completely changed in October. Look at all the short stubby orange and purple arrows all over the place. We’d rally, set up a range/top, break down from top range, and even provided failed breakouts as well, but then that breakdown itself was a fakeout? Even on a short term basis, the day to day chop is maniacal (gray boxes). Chop/fake consolidation setups fake breakdowns, gapups, and vice versa.

So all this is to say, what’s a trader to do? We have essentially been in a sideways drift upwards overall on longer term charts, so holding more than a day seems dangerous. Well, as I said, this is a day trader’s market. The intraday setups are there and provide for big intraday moves, but holding overnight seems like a big crapshoot.

However, when faced with market indecisiveness (while the direction has been up, I think we can agree it has not been going up in a way that can be described as “decisive”), I look for relative weakness or strength in individual stocks. The last few stocks I think can still provide profits to the short side are:

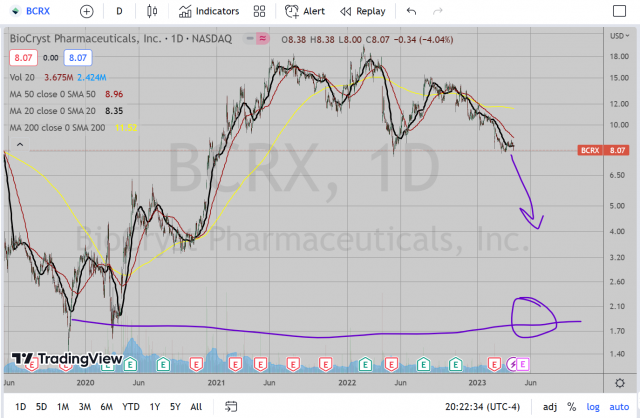

BCRX. I have posted on the monthly chart in the past, noting the big swings up and down that this stock has taken since the 90’s (I’m not posting the monthly chart again, so take a look for yourselves). It has been a reliable wave between $2 and $13. Right now, it is in the middle at just above $8, but the direction is down on the daily chart and I think it may be worth trying to catch the ride down. I’d put a stop at just above $9 in case this does decide to try and bounce here. But otherwise looks like it is headed back for $2. I’ll be loading up longs anywhere beneath $2 (though note that it has gotten as low as $1 before as well, so I’ll need to see a bottom form).

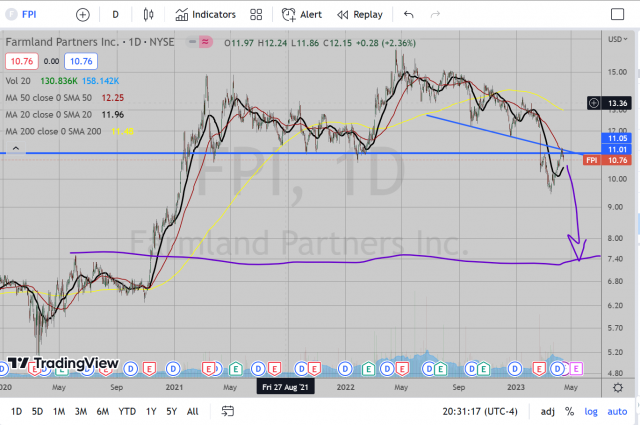

FPI. Farmland Partners is a REIT which owns farmland, invested in crops, etc. The underlying sector is not as interesting to me as is the chart setup itself on this one. It broke beneath clear previous support and is treating it as resistance now. I think this is headed back for $7.50-$8 area.

GS. While this is one of the stronger of the big banks, it is not invincible. The risk:reward from $340 is just really good on this. I don’t think banks are out of the woods yet after the most recent bank collapses. I don’t think GS is going to collapse by any means, but its stock won’t be left unscathed.

I’ll leave it at 3 stocks for now. We’ll see how the next few weeks shape up before really sticking to shorting anything because while I STILL believe we are not in a bull market, that doesn’t mean there won’t be another painful rally. And while these rallies are led lately by the few tech stocks, they still tend to drag other stocks as well. If anything, the rallies may drag these stocks up to more attractive resistance spots to short.