It’s been a rough few months to be a bear. And this week, as if to put a cherry on top, was a fantastic f-you if you had been short the broad market.

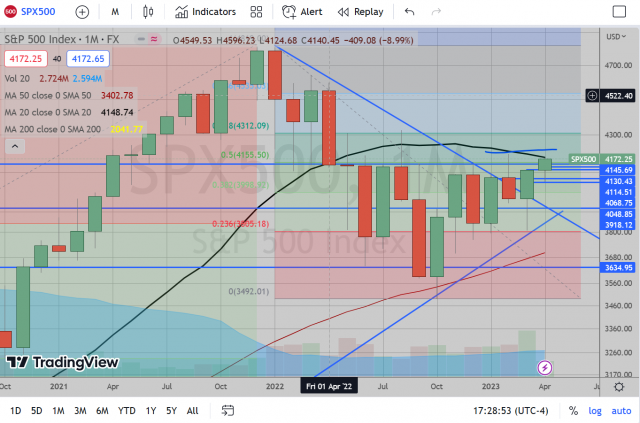

SPX monthly chart. Today officially closes the April candlestick. Without the moving averages it is quite the bullish candle now, looking like it is set up for a pop in May. This is what was scaring me the most the past month. When by Wednesday it looked like we were about to be set up for the next big leg down, in only 2 days we rallied and pretty much completely engulfed the previous range.

From a technical perspective, the only thing I can see to grasp onto would be the 20 Month Moving Average. Closing at the highs like this, however, makes it feel like we could slice through that like butter as we have tested it quite a few times now and failed to reject. As such, I threw my hands up and said “why bother”.

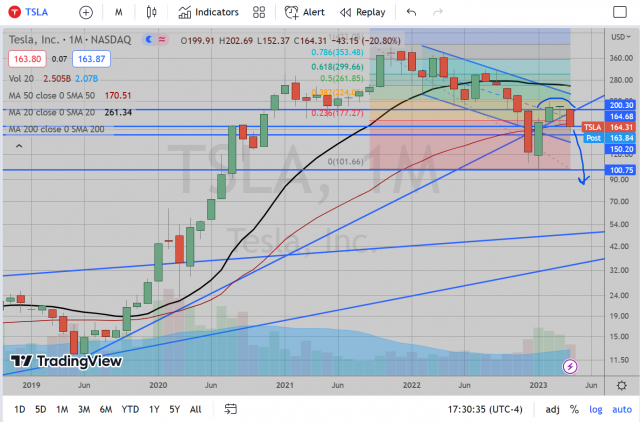

TSLA monthly chart. This sucker, in the face of a market ready to breakout, has suffered quite a bearish top last year, tried to rally back 100% in 3 months, only to turn in an April red candle to engulf the March candle. The relative weakness to the broad market is undeniable. And this is what I like to look for in individual stocks. We did manage to close juuuuust above March’s lows, we still couldn’t exactly take off and squeeze.

On the daily chart, we can see how important that 165 level is. Even if we do breakout, I’d expect this to close the gap at the most. I’ve got stops set up just above 165 in case that resistance can’t hold, but I’ll jump right back in up near 180.

The technical pattern has been playing out nicely. The market is trading as if this really is overvalued. The fundamentals helped (the earnings growth story isn’t so hot) and they cut prices 3 times to “gain market share”. Look, you cut prices once to gain market share. You cut 3 times to unload inventory.

From what I am reading, all that plus the “Inflation Reduction Act” aren’t steering people to buy Electric Vehicles. Add to that Musk’s obsession with Twitter (or “X” now???), SpaceX, and whatever else he has going on, he is mostly an absentee executive for TSLA. And all those investors (the smart ones anyway) I guarantee are unloading on every pop now, hoping the TSLA cult keeps buying for a squeeze. With a PE Ratio of 50 right now, this is a falling star.

So all that being said, I’ve stopped trying to short the broad market (and getting shit on) and hitched my wagon to jumping on the only short that consistently treats me nice and am back all-in short on TSLA. My timing sucks a little, but my target on this remains $50-$80, so I’ll be watching for resistance levels on this going forward, even if I need to adjust as it goes along.

P.S. I don’t doubt in the long run, TSLA could still turn around and become a behemoth once more, but perhaps it will take a trip down to double digit territory before shooting back into the stratosphere, not unlike Netflix after the 2011 peak to 2012 bottom (check out the chart for yourselves). I’ll probably be getting long anywhere in the zone I mention above for long term.