My last post ended with a few continuing short ideas despite the grind higher. When relative weakness is still abound while the market grinds higher then it tells me that when the broad market takes a breather (or even, God forbid, maintain a decent downtrend for more than a few hours), then these should continue their weakness. Perhaps they won’t drop in any dramatic fashion, but should all experience decent profitable pull backs.

BA Monthly chart. This finally seems to have been hitting some major resistance at around $220. Monthly candlesticks like this feel like a decent reversal back to $180 at the very least, possibly to $165 if real weakness grabs hold of this market once again. I wouldn’t put a stop as high as $220 as that is just too far, but I think you could catch the downswing. Look for shorter term short setups and ride the wave down.

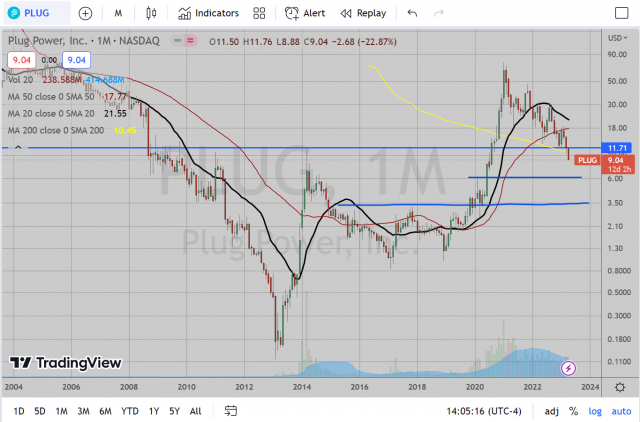

PLUG Monthly. The hydrogen energy space had its day in the sun and has slowly drifted back down since the peaks of 2021. Important support level at about $12 area attempted to bounce up to $17 in January and is now at just above $9. Next support levels look like $6 and $3.50, with that resistance level at $12 required to hold. Just as with BA, look for shorter term short setups while the overall weakness persists. This has provided great intraday shorting opportunities in the past few weeks where it would tick up ever so slightly with market popping higher, only to form large red daily candles.

GL Daily. The monthly chart on this stock is actually incredibly strong. This is a Life Insurance company so I suppose the nature of this business is that they can adjust premiums as necessary to avoid large impacts from inflation. Regardless, it is still very weak relative to broad market in recent weeks. The recent pattern indicates it is consolidating underneath the 20 Day MA. A cross/close above $109 would be a MATLBO and could actually potentially be a good long idea. But if this doesn’t cross that average, then I think the short side maintains the advantage. I’m not saying this will drop into oblivion, but it has a good chance at pulling back to some decent support levels. The risk:reward is what is so attractive to me on this one. Even if this only manages to get to $100 then the risk is only about $2 for profit potential of $7.

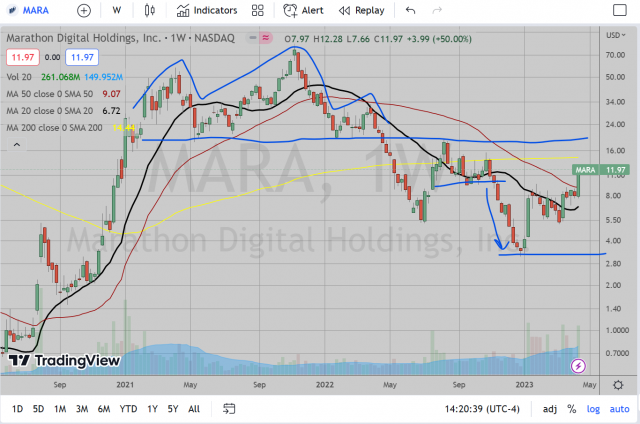

TSLA Weekly. Ok. I know this message has been beaten to death, but it really still looks so good to the short side. This pattern is just so powerful and while it had a fantastic bounce since January, it doesn’t mean it can’t take out those lows. And just to show you how powerful this pattern is, here is MARA with a bounce from $5.50 to $18 between June-August 2022 only to take out those lows and only find support back at $3.11 in December. Same pattern which I believe will yield similar results: