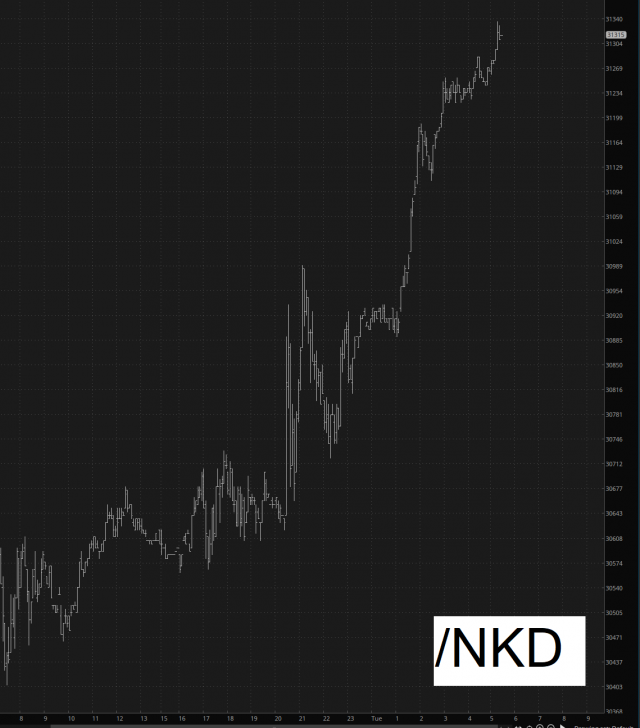

Last night, the Japanese Central Bank did its thing, which as the chart plainly shows means pounding the country’s currency into 1-ply toilet paper. Japan was a thriving, prosperous, growing economy until the late 1980s, after which time it has been an increasingly desperate simulacrum of the real thing.

But this is central bank paper games, not reality, so the Nikkei is gobbling it up, blasting higher in a matter of hours.

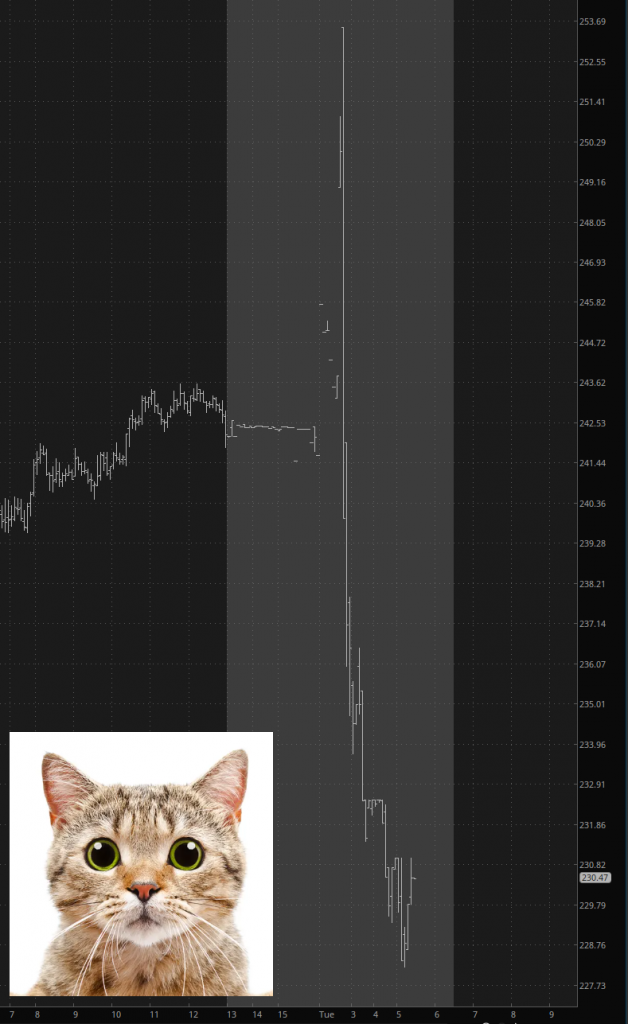

Here in our own shaky republic, earnings continue to tumble out, with a highlight this morning being Caterpillar (CAT) which did the increasingly common “pop on press release/drop on conference call” schtick. Looks like the intermediate-term trendline is going to get snapped.

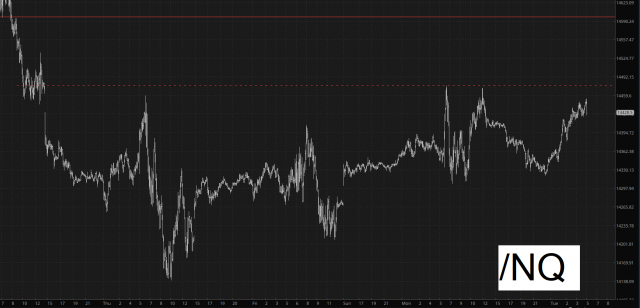

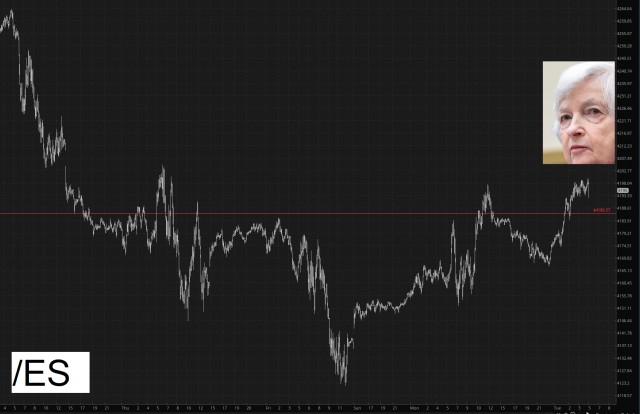

I am increasingly uneasy about the bullish base which has formed in recent days. Between the Wednesday FOMC, Thursday afternoon’s Apple report, and Friday morning’s jobs report, there is a lot of dry tinder waiting to be list. The /ES is presently on the bullish side of its Fibonacci, which is one reason I have built up my cash position to 30% to play things a bit safer.

The /NQ is well below its own Fibonacci (the higher of the two lines below), but it, too, is trying to complete a bullish base below that dashed line that you see. It may well take until Friday’s normal session until the smoke clears on all this!