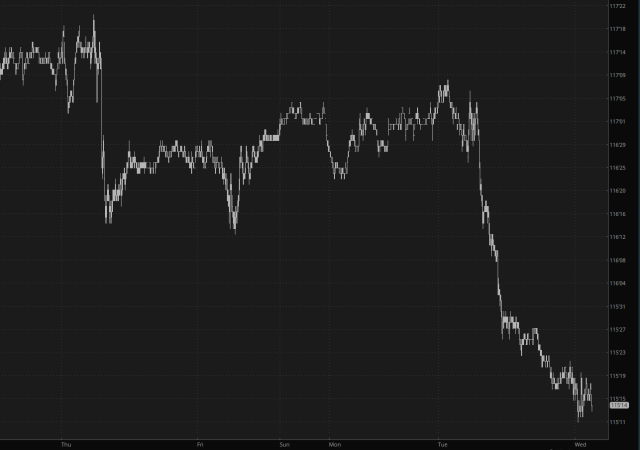

All assets are joined at the hip. It didn’t used to be that way. These days, however, with the government fully in charge of thrusting liquidity into the markets, it doesn’t matter if you’re talking about gold, stocks, or kitty litter, everything moves up or down together. This is why I’d like to highlight the fact that Bitcoin ($BTC) seems to be squandering its opportunity to burst forth from its green basing pattern, shown below. Instead, it has spent a week just lamely roaming around doing nothing. It is entirely possible the price is going to slip well into that green zone, spoiling the setup and souring the entire crypto space.

I sure hope so!