It’s just 3:30 in the morning, Tim-time, but the sun started rising over the East River half an hour ago, so I’m up and about. It’s interesting to see how the narrative of the market is falling to pieces. The thesis of this entire ridiculous 2024 rally has been that (a) multiple interest rate cuts from a Biden-loving Fed and (b) low inflation would both contribute to a stock market that did nothing but make new highs every day.

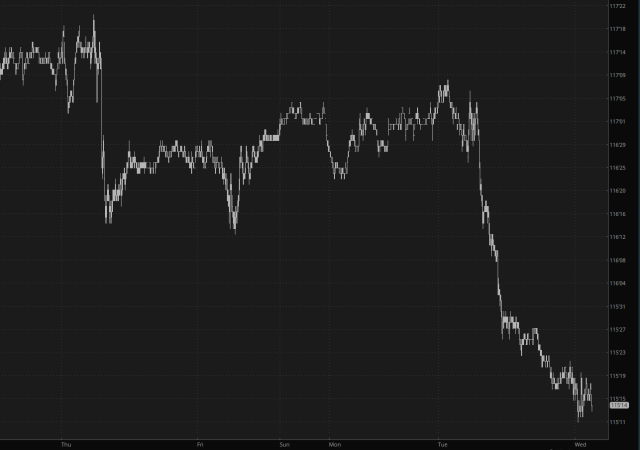

Yet what do we have? Well, we have a plunging bond market, thanks to the fact that Powell has cut rates precisely ZERO times almost halfway through the year (in contract to the 5 cuts predicted before)……..

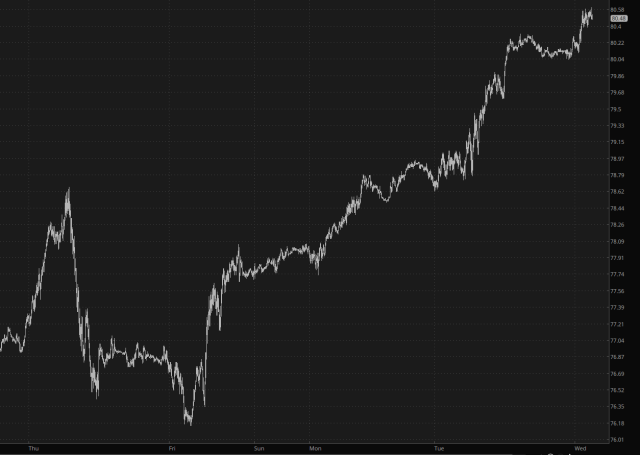

………and oil prices that are absolutely exploding. Oh, I forgot, the government doesn’t count ENERGY or FOOD when it comes up with its totally fake inflation numbers, so I guess this isn’t an issue.

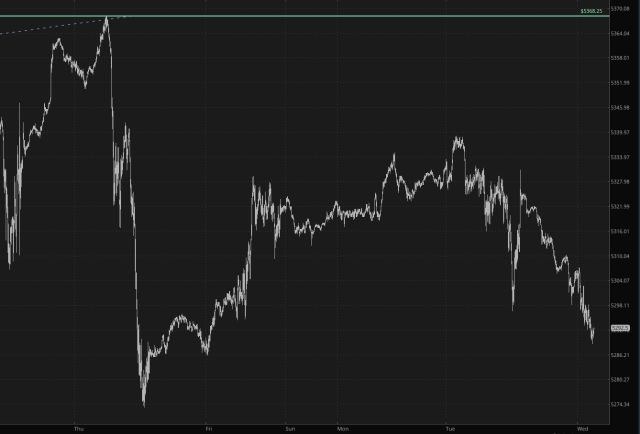

Even so, the /RTY, /NQ, and /ES (shown here) are all weakening.

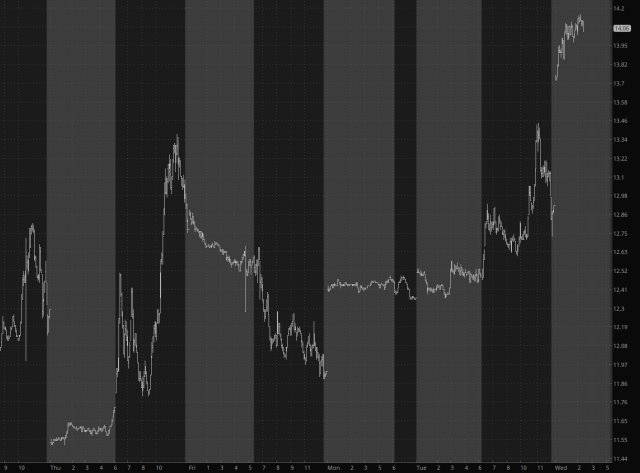

In turn, volatility has ripped from an utterly comic 11-handle to a still funny but not quite as hysterical 14-handle.

As the ONLY bear left on the planet, it’s a breath of fresh air. You think there are other bears? Nope. ZeroHedge used to be the most ravenous bear of them all (during the rise of the S&P from 666 to over 5,000, after which they turned permabullish). My tweet sums it up neatly: