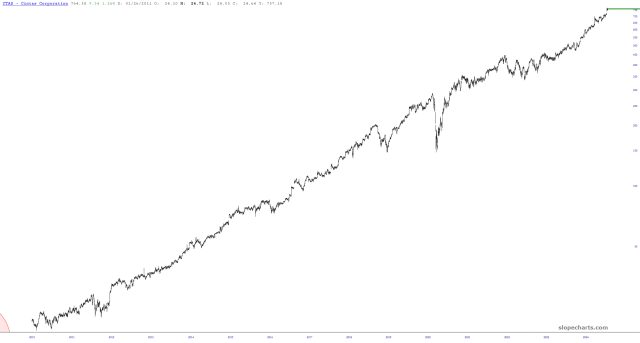

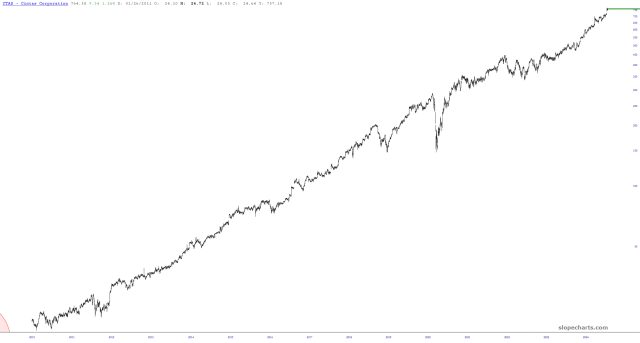

My hand to God, if you looked at this chart, you would have to assume the company has a patent on turning pig dung into gold bars. But, no………..they make uniforms. You know, like for nurses and police officers. Uniforms. Go figure.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

My hand to God, if you looked at this chart, you would have to assume the company has a patent on turning pig dung into gold bars. But, no………..they make uniforms. You know, like for nurses and police officers. Uniforms. Go figure.

As I’ve said, precious metals are the only asset whose ascent I am cheering. Or was cheering, more accurately, since it’s been getting dragged down with all other assets. Silver, for instance, has lost about 15% of its value.

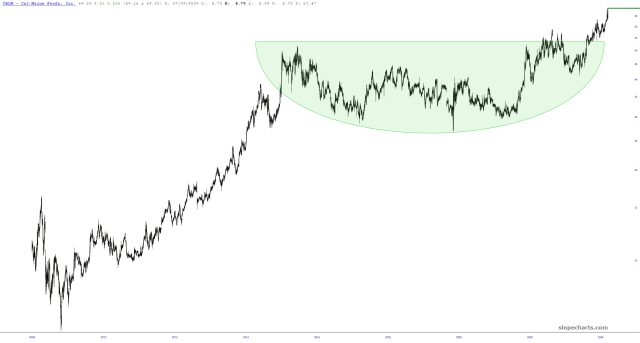

One of the longest-lived bullish positions I’ve ever offered on Slope was the world’s most boring company – Cal Maine (CALM) which sells freakin’ eggs. But a pattern is a pattern, and this thing continues to rock the free world.

I hate to say it, but one of the few charts I see as plausibly and strongly bullish is simultaneously one of the most evil entities in the world: Blackstone (symbol BX) whose utterly heartless chairman, Larry FINK, may well wind up being Treasury Secretary, just to wrap up the utter regulatory capture by the financial industry.