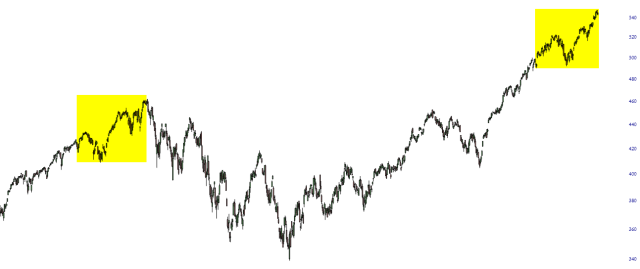

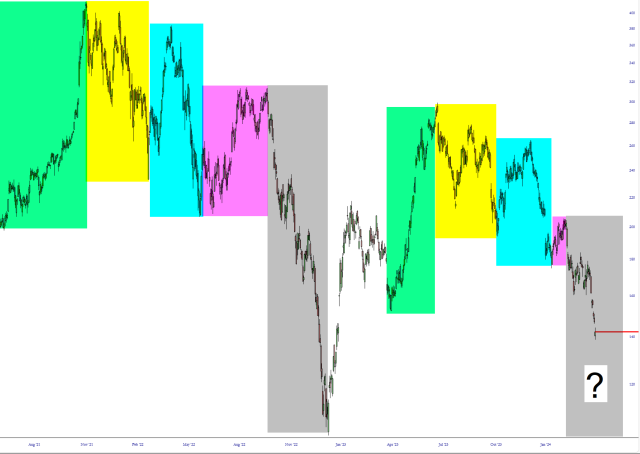

Most analogs offered these days borrow price data from many years, or even decades, ago. I’d like to offer something more recent. I was wondering to myself what the last major dip in the market looked like just before it commenced. I noticed a sizable “stutter” to the market’s ascent in 2021, and I couldn’t help but notice we had exactly the same thing happen in April of this year.