Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Growing Interest

For a while there, I figured bonds had hammered out the foundation for a sustained rally. That may still be true, but the thesis is looking pretty shaky.

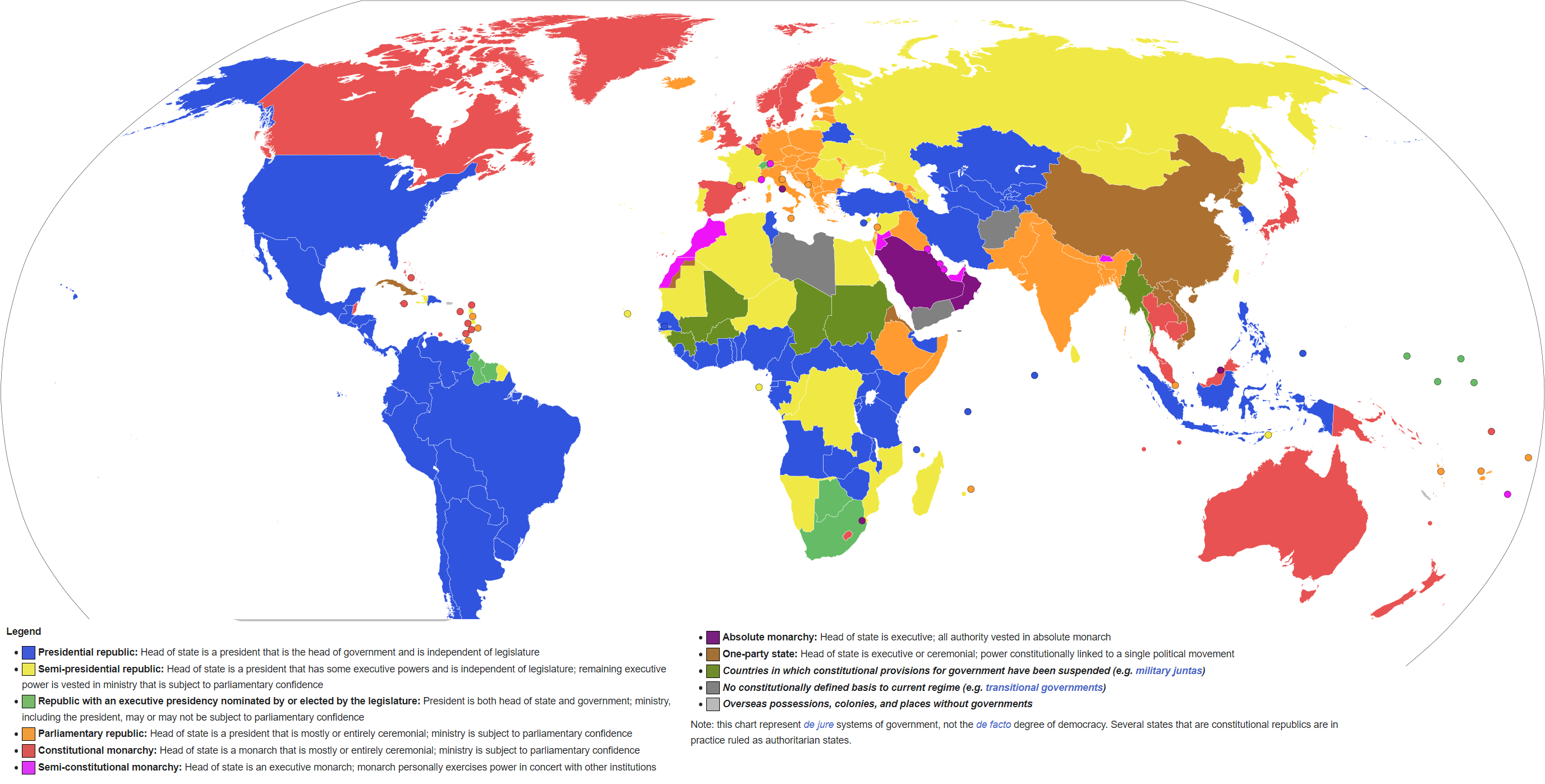

Worldwide Social Studies

Here’s a color-coded map of the different kinds of governments in the world. China and North Korea, which are both one-party dictatorships, are aptly in brown.

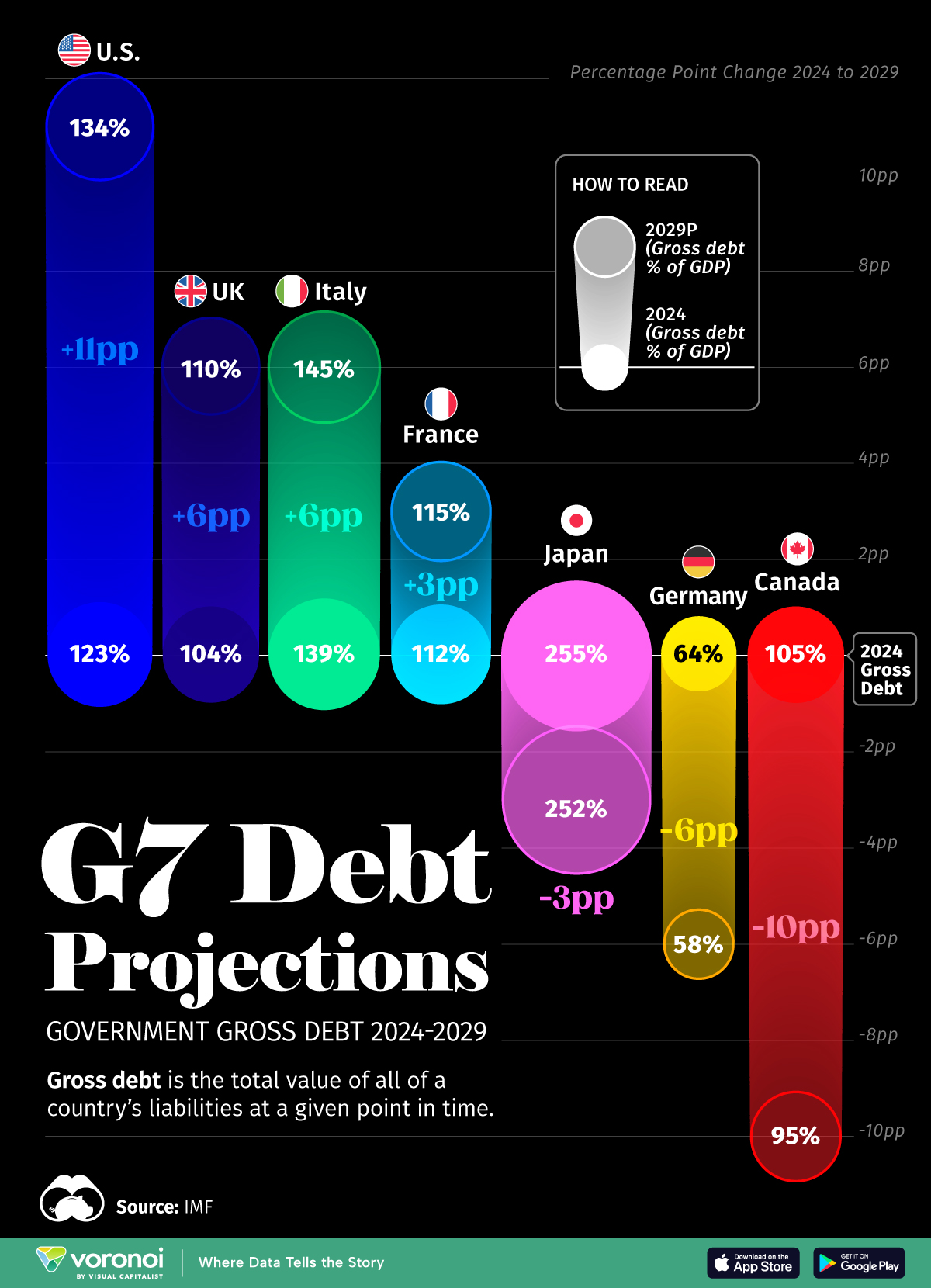

Borrowing Toward Ruination