Electric Vehicles are starting to pile up as sales slow down.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Electric Vehicles are starting to pile up as sales slow down.

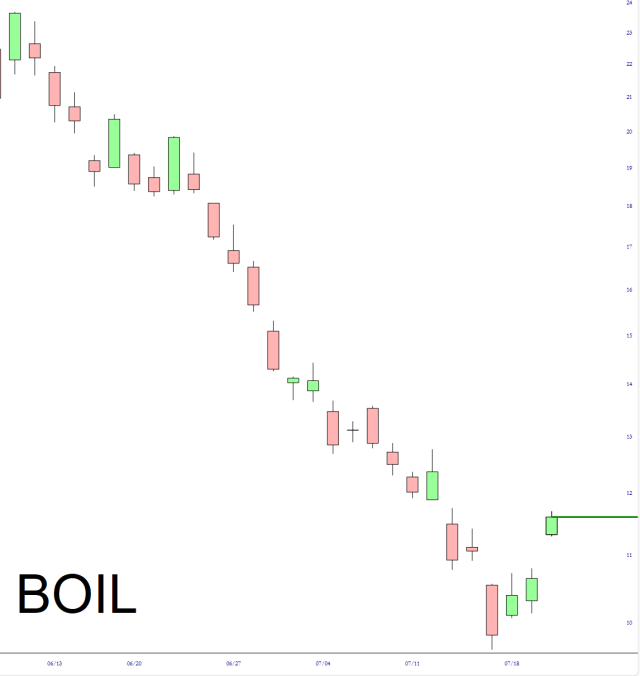

Just a quick follow-up to my Out in the Cold post, which suggested natural gas was about to rally: so far, so good! Here the leveraged bullish instrument is rallying mightily this morning.

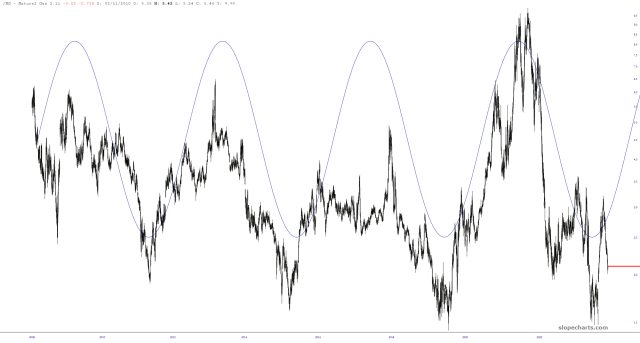

Natural gas has done horribly for weeks, and it seems extremely stretched to the downside relative to its multi-decade cycle.

I’d say that Sunpower is cooked. It’s incredible how much scamming and fraud took place on the backs of the Build Back Better canard.