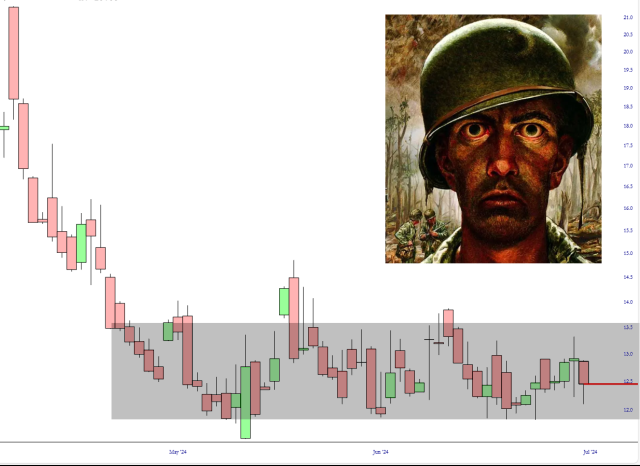

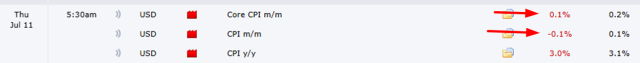

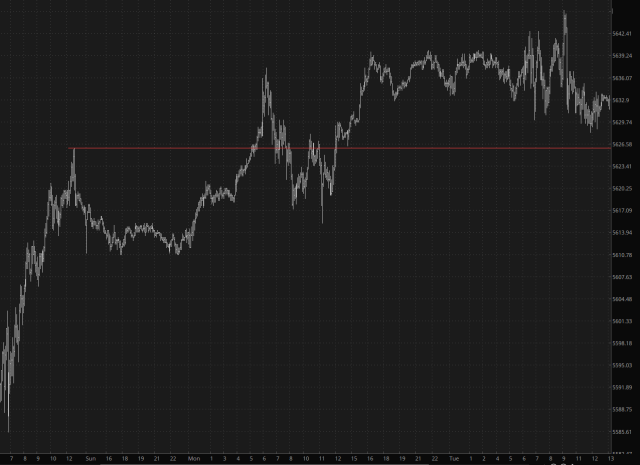

As if being a bear in a totally fake market wasn’t hard enough, yesterday some reprehensible douche nozzle named Bradley Sills from Bank of America announced that the stock Shopify (SHOP) was just a peachy-keen “buy” and, gosh darn it, you should exchange cash for shares. The stock ripped higher, causing me to just about puke, since I had some very profitable puts on it. I dumped them at a small profit and then, of course, this morning, the ENTIRE lift has been destroyed, because, let’s face it, Shopify is probably only worth $zero per share.