Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Brazil Opens Up

The Brazilian fund has completed an inverted cup-with-handle pattern, and it is behaving beautifully. I have tightened up my stop 28.89 based on this morning’s price gap.

Brazil Nuts

Below is the chart of EWZ, the ETF for Brazil equities. I have acquired a large number of September 30 $30 puts on this sucker. It has sealed its price gap today, and I love all that overhead supply. Let me put it this way – -I’d much rather own a ton of puts on EWZ that, let’s say, DIA!

Allahu Akbar Not So Much

Remember ISIS? This is what they imagined they would rule by 2020. I think, so far, it’s probably more like half a city block.

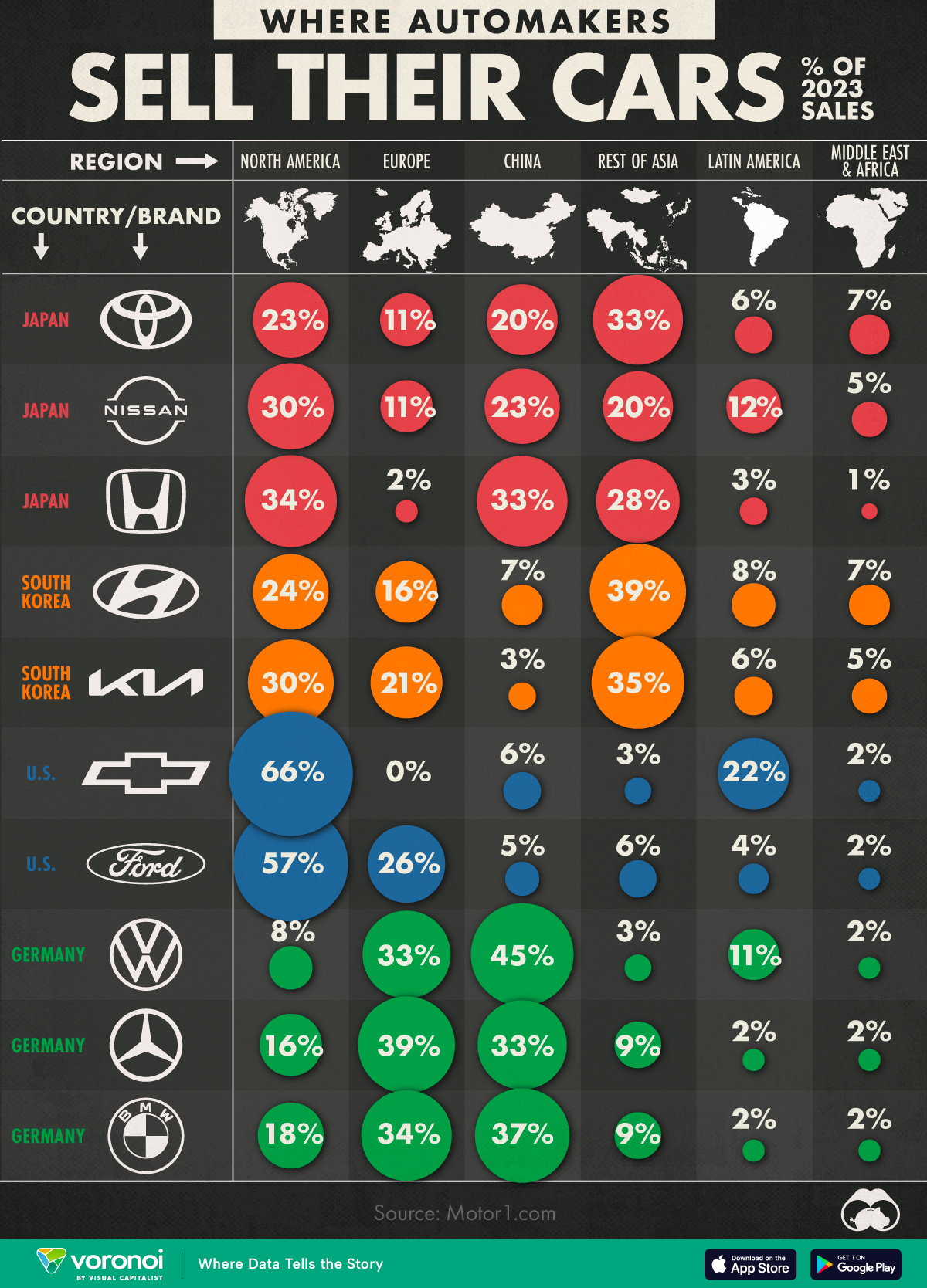

Cars and Countries