Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

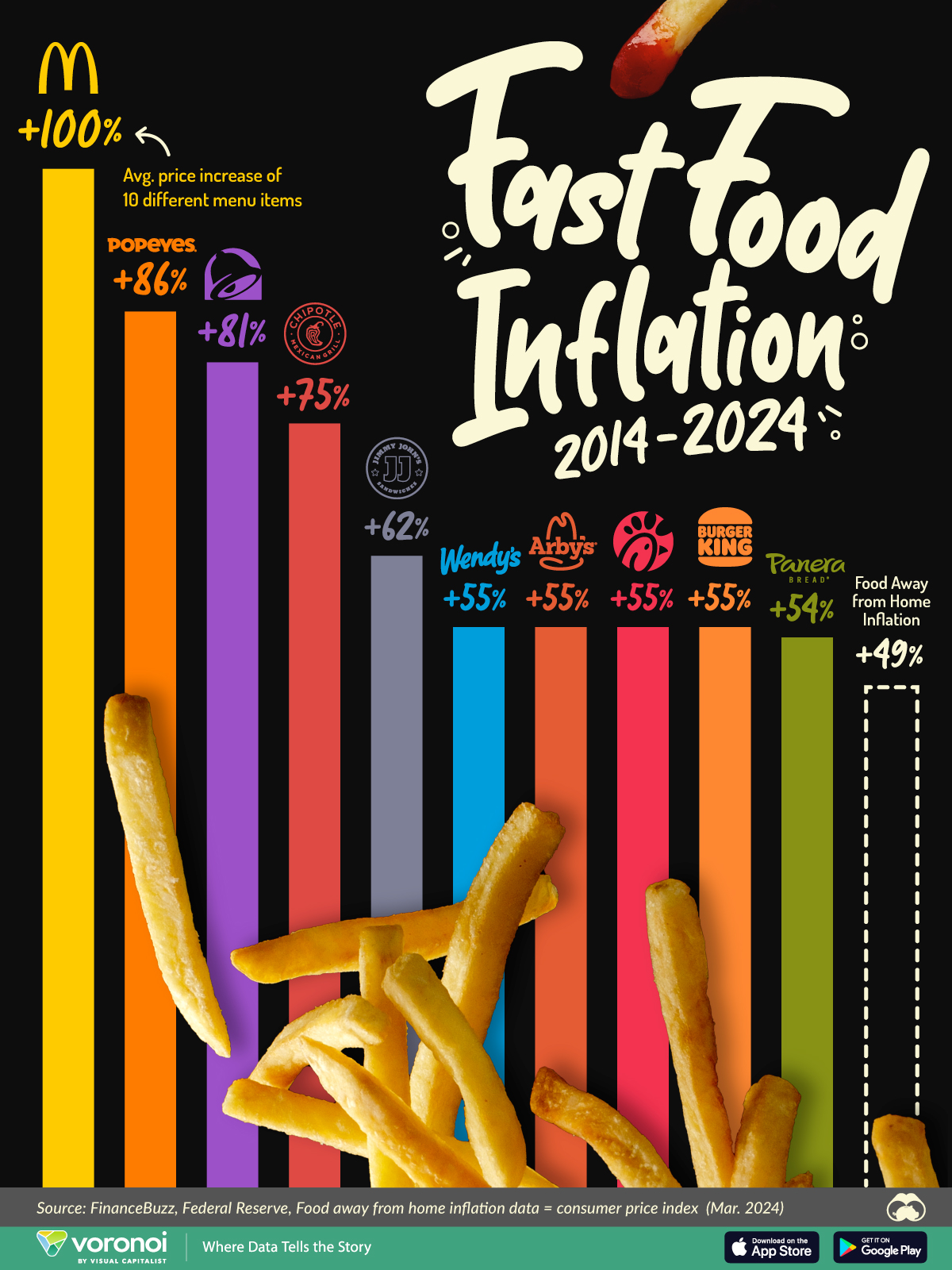

Hockey Sticks

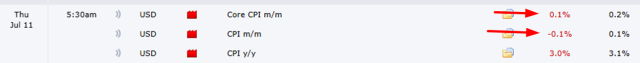

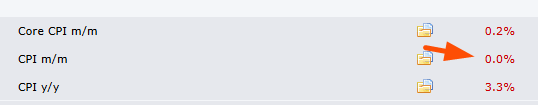

The CPI numbers are out and, in spite of everything your eyes tell you, prices are FALLING. This gives the all-clear for the Fed to make the rate cut we’ve been hearing about since the beginning of time, since these government-created numbers came in ice-cold.

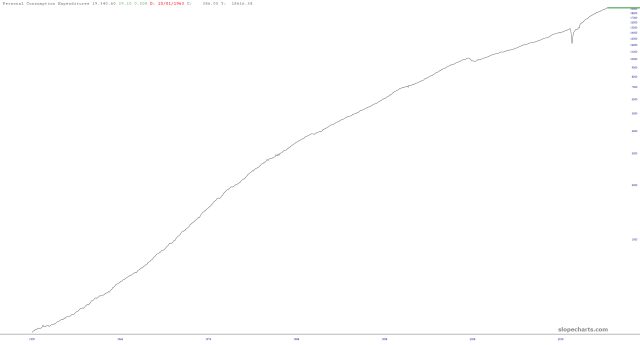

PCE for Thee and Me

The big economic report this week is the PCE, but it’s a joke. Let me tell you why, and I’ll do so with the chart below, which shows the cumulative effect of the PCE (inflation) over decades.

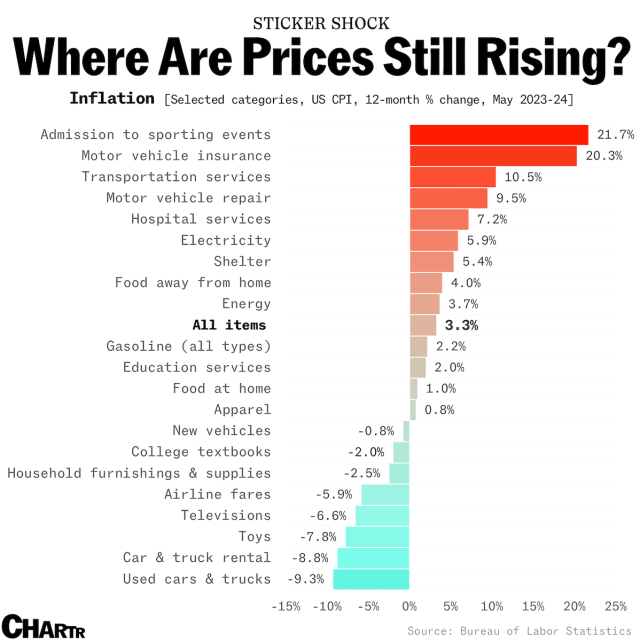

Where Inflation is Hiding

Inflation? What inflation? The government just told us prices are DROPPING! Anyway……..

The Power of 0% Inflation

The CPI numbers just came out, and they tell you what you already know from all your grocery shopping, your gas-tank-filling, and your bills-paying. We have 0% inflation. Absolutely.

Look, this is simple: the members of the FOMC are human beings and, as such, as innately political. They want to be left ALONE, and if the current administration loses in five months, the Fed is going to very-much-not-be-left-alone. It’s already been made clear by the opposition that they want much greater oversight and control over the Fed.

(more…)