Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Wh-UPS

From our “Try Not to Overthink Things” department, I offer you the following.

Yesterday, based upon the enormous and well-formed topping pattern in UPS, I decided to buy October $150 puts. I then noticed yesterday that UPS reported earnings this morning (if you need some help with the relationship between yesterday and today, I direct you to Ms. Harris), and that made me a little nervous, so I trimmed back my position a bit out of nothing but cowardice.

Trading A Wild Week In EV Stocks

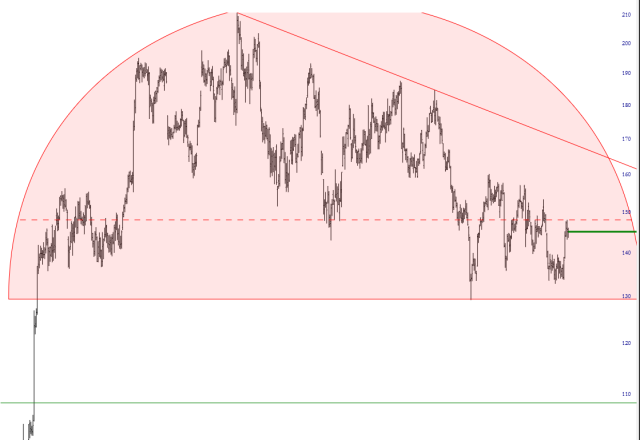

Getting Tactical About Tesla

SHOP ’til It Drops

I am also the happy owner of September $70 puts, presently up 20% from purchase. Remember, I am acquiring these puts dirt-cheap at these laughably inflated market prices.