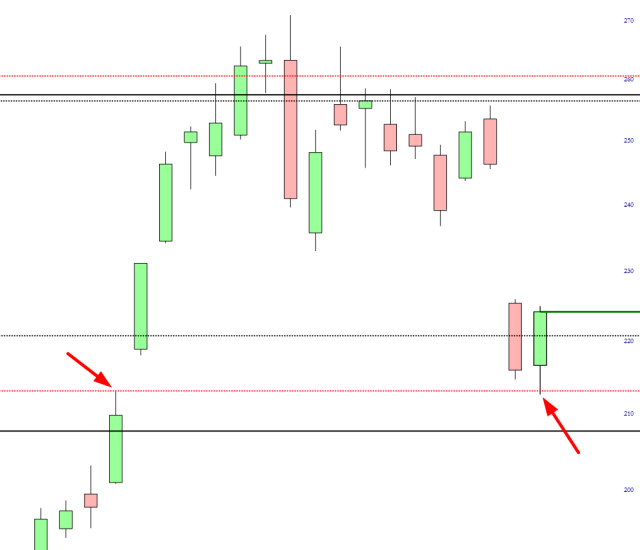

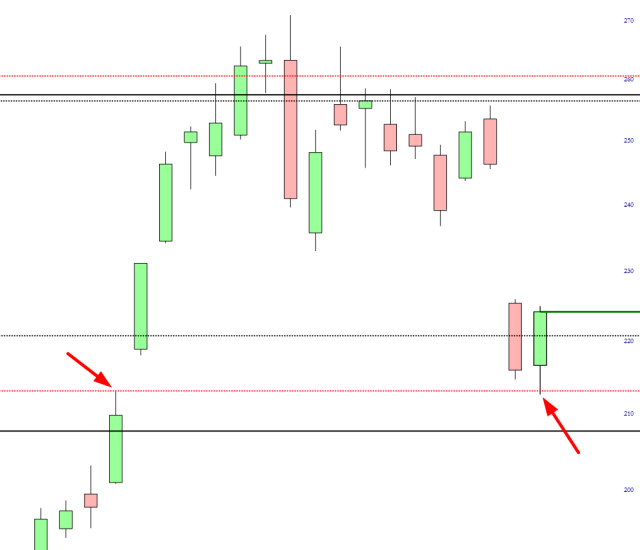

Whoops, I did it again! My target for a bottom for TSLA was the gap at $213, and bang-diddy-bang, we nailed it! Any recovery is going to be suppressed by the overhead supply now. I think we’ve seen the highs for 2024 already.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Whoops, I did it again! My target for a bottom for TSLA was the gap at $213, and bang-diddy-bang, we nailed it! Any recovery is going to be suppressed by the overhead supply now. I think we’ve seen the highs for 2024 already.

Let’s keep an eye on those price gaps on the tech stocks. I have highlighted the below with a dashed horizontal line here on the NASDAQ Composite:

Below is the chart of EWZ, the ETF for Brazil equities. I have acquired a large number of September 30 $30 puts on this sucker. It has sealed its price gap today, and I love all that overhead supply. Let me put it this way – -I’d much rather own a ton of puts on EWZ that, let’s say, DIA!

OK, it wasn’t entirely closed, but it came within 0.75%, so I’m going to say that’s enough.

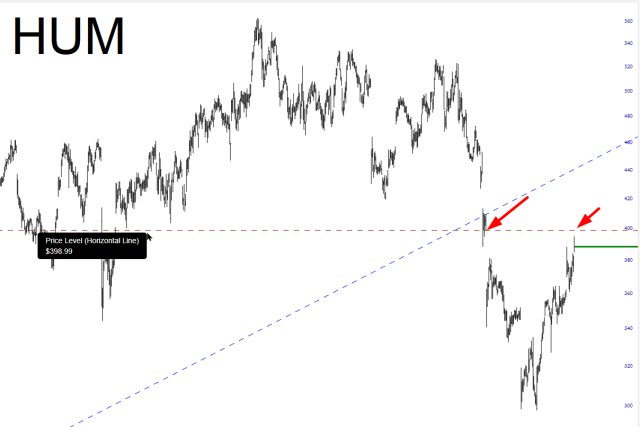

A prospectively good place to short DELL, with a stop-loss just above the price gap I’ve highlighted.