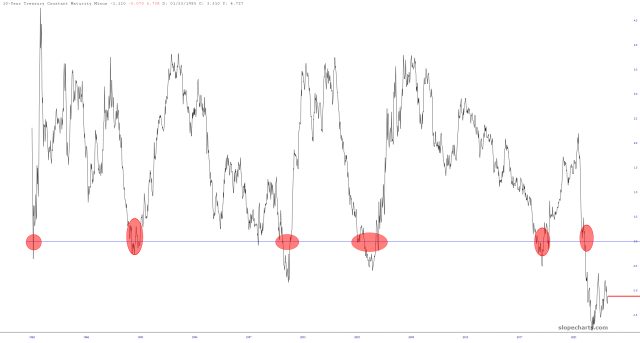

Let’s keep an eye on bonds (and, by way of extension, interest rates). The rally in bonds seems to be petering out.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Let’s keep an eye on bonds (and, by way of extension, interest rates). The rally in bonds seems to be petering out.

So remember, boys ‘n’ girls, an inverted yield curve has 100% prediction success with respect to recessions, but you’re supposed to believe that this time, which is the most severe one ever, is going to magically be different.

The bonds, by way of TLT (shown below) keep slipping as the symmetric triangle suggested.

The market is, once again, a ceaseless sea of green this morning. The S&P 500, the NASDAQ, the small caps, crude oil, and bonds are all up. At the moment, we at least remain in a series of lower highs.