I thought some of you would have a passing interest in where I spend most of my time for your sake.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

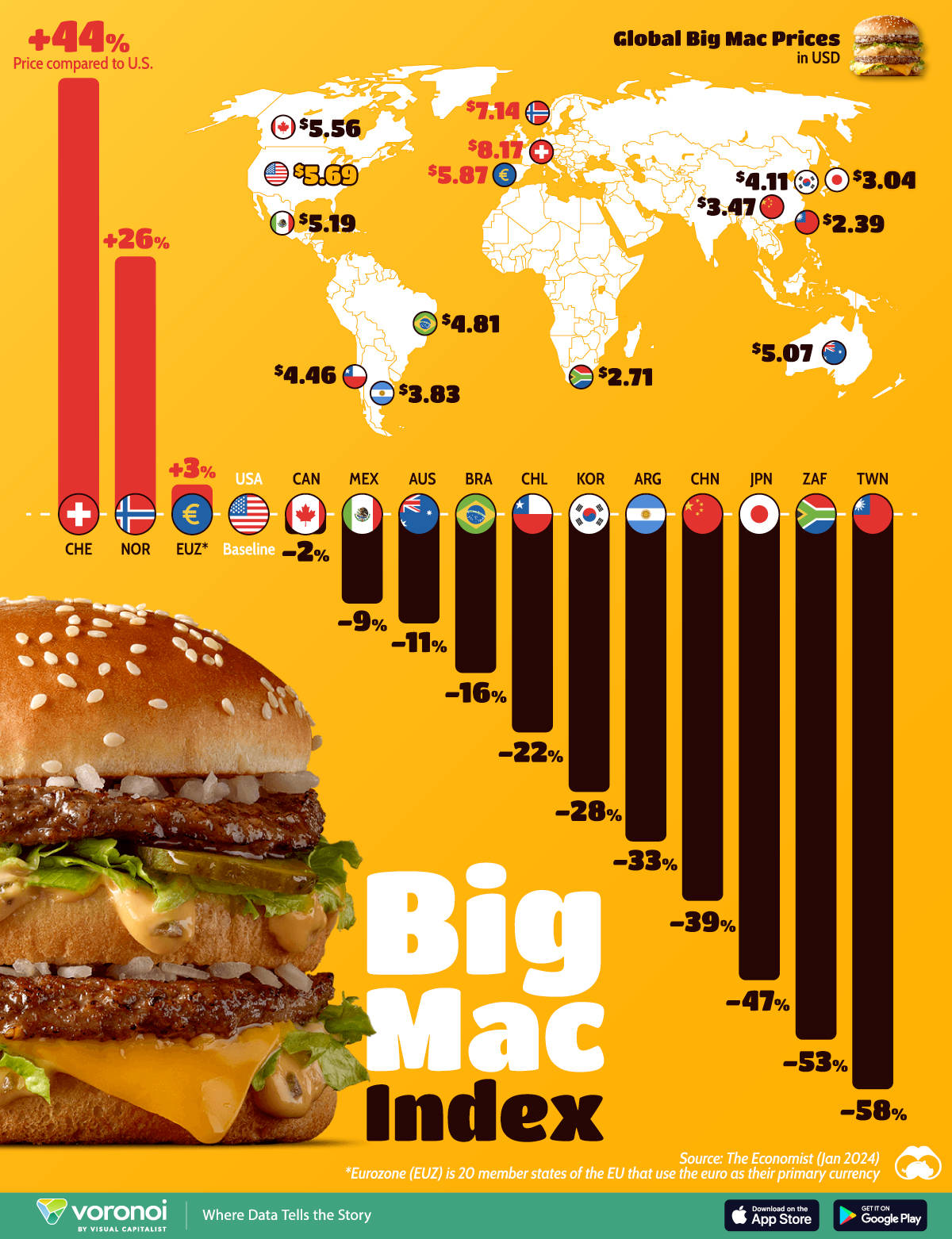

Normalizing Currencies

You Are Not Alone

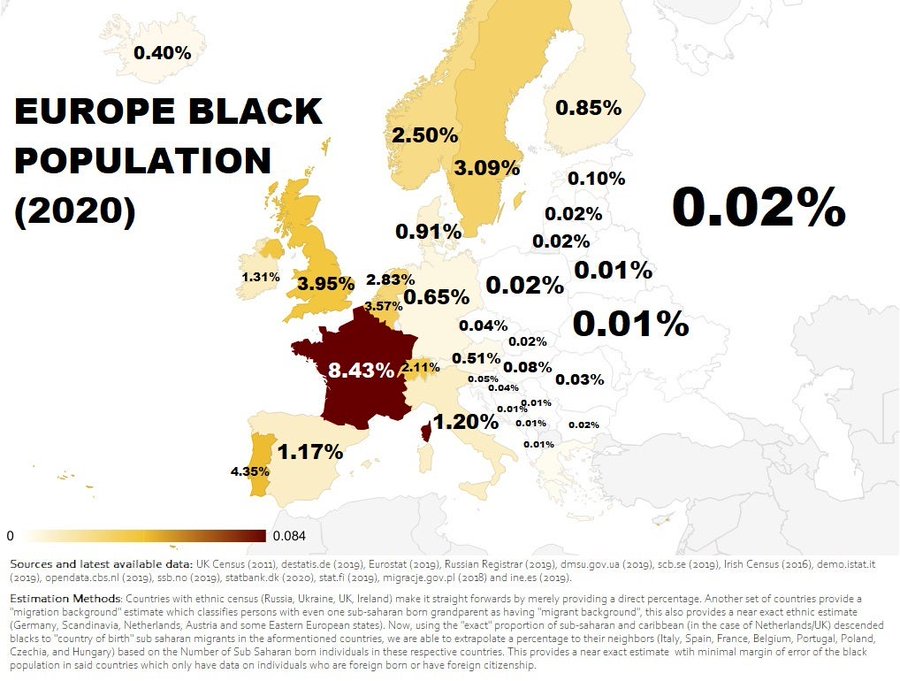

Lily White Continent

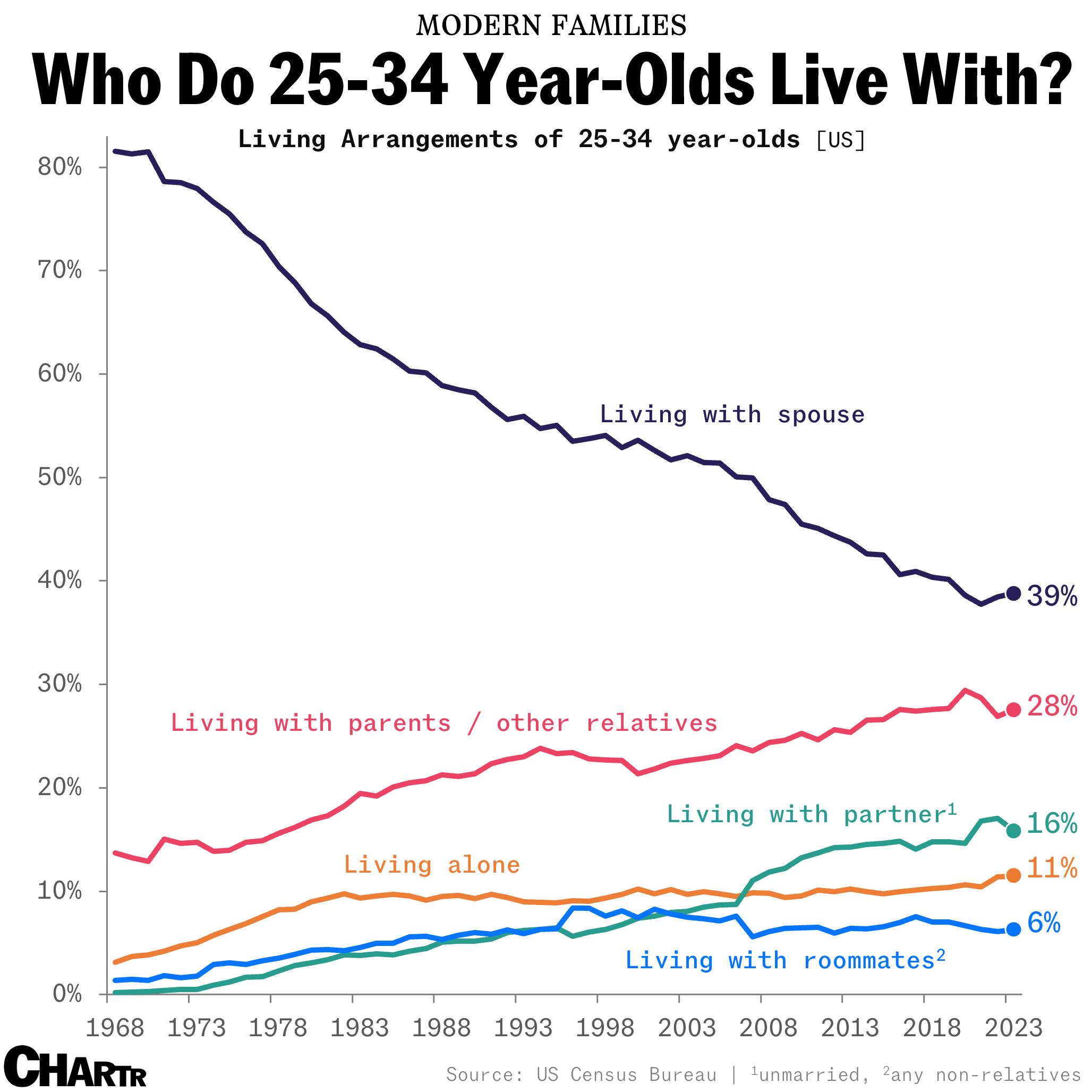

Marginalizing Normies

I’m old fashioned. I realize that. By the time I was 24 years old, I had (a) a wife (b) my own home (c) a career (d) and, of course, a dog.

To observe that there are an ever-growing group of 34-year-olds still living with mommy and daddy is just eye-rollingly pathetic to me. For real. It seems that making a life of your own has become freakish.