Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

They Cared After All

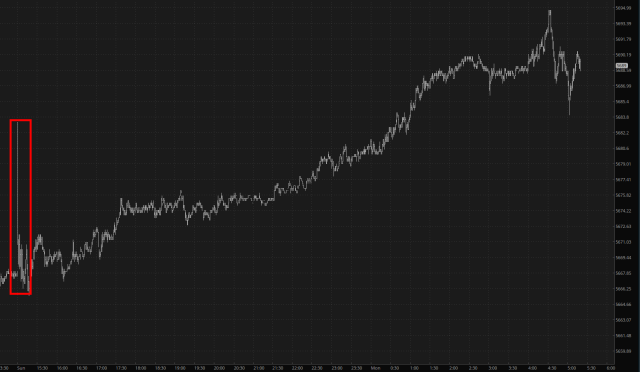

On Sunday, when the futures markets opened up, the equity futures had a briefly popped and then settled down into virtually unchanged. (Briefly, the /NQ was even a little negative). Over the course of the night, however, the markets absorbed what I assumed are the political ramifications of this weekend and pushed steadily higher. I’ve highlighted in red the brief and peculiar period in which markets completely shrugged everything off. Here’s the /ES:

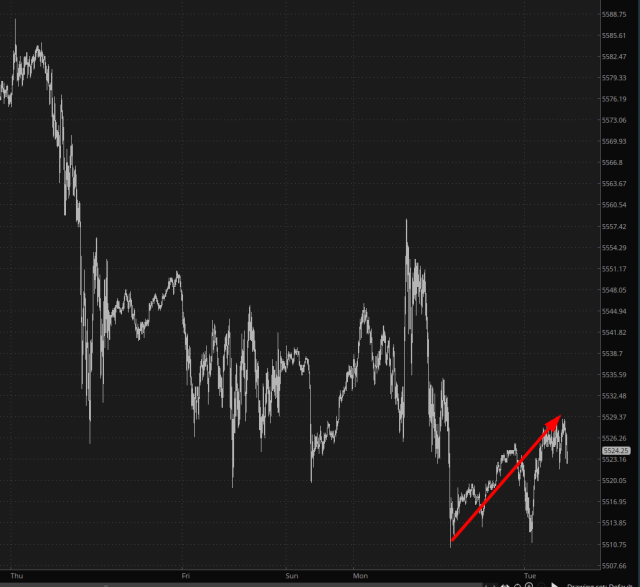

Brief Bounce

After a couple of days of modest weakness, it’s no shocker to see a little green this morning. With decades of conditioning, humans are going to be “buying on the dip” at any opportunity, never know when it’s already too late. The world is going to be completely obsessed with NVDA for the foreseeable future, although I am confident the same thing is going to happen to them as happened to Cisco – – in a couple of years, no one will care about them. Not even a little.

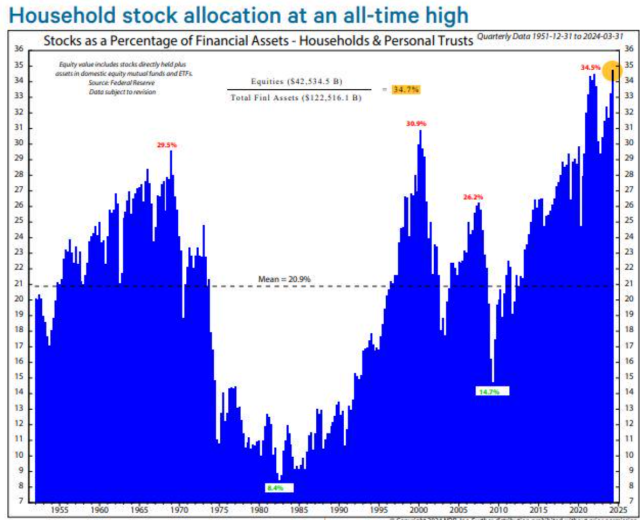

Record High Allocation

This is what generational tops smell like.

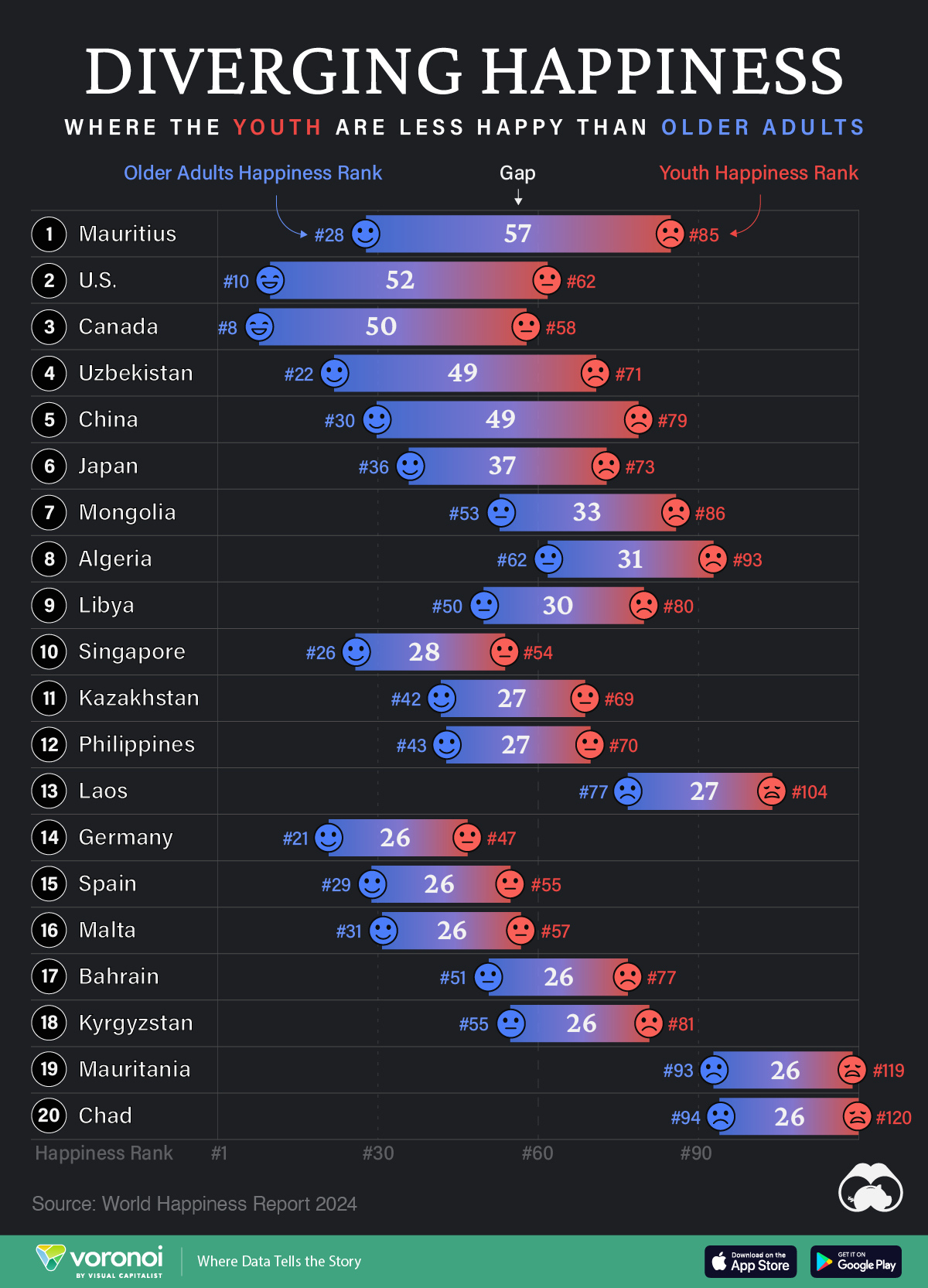

The Giddy Youth of Canada