A few days ago, I did a premium post about five precious metals miners that I liked as long positions. They’re all up since then, and I think their prospects are greater than ever. Go, gold, go!

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

A few days ago, I did a premium post about five precious metals miners that I liked as long positions. They’re all up since then, and I think their prospects are greater than ever. Go, gold, go!

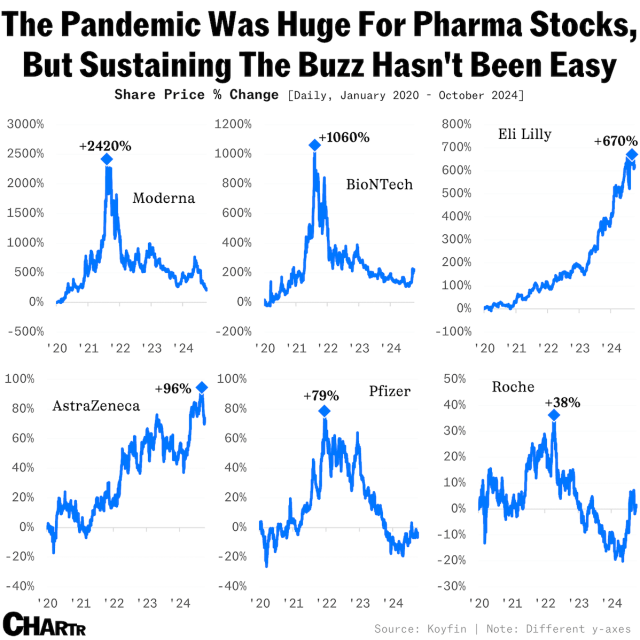

What I referred to in 2020 as Accidental Beneficiaries of Covid………….

Micron’s earnings report sent the stock exploding higher. As I wrote last night, however, take note of the substantial overhead supply holding things from going any higher.

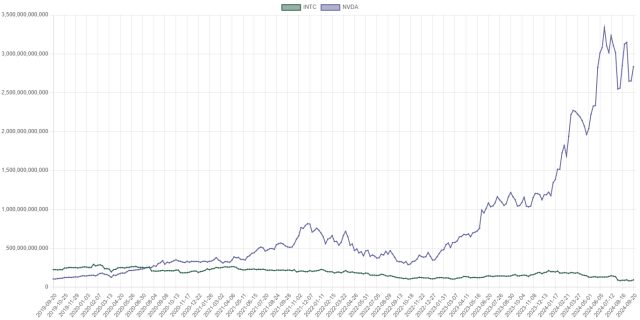

As a poignant example of how the new Market Cap charts work, below are the two semiconductor stocks Intel and Nvidia. Until a couple of years ago, there were roughly valued in the same range. Afterward, however, NVDA’s vastly superior strategy sent the stock into the ionosphere, where Intel is just rolling around in the mud. Truly stunning:

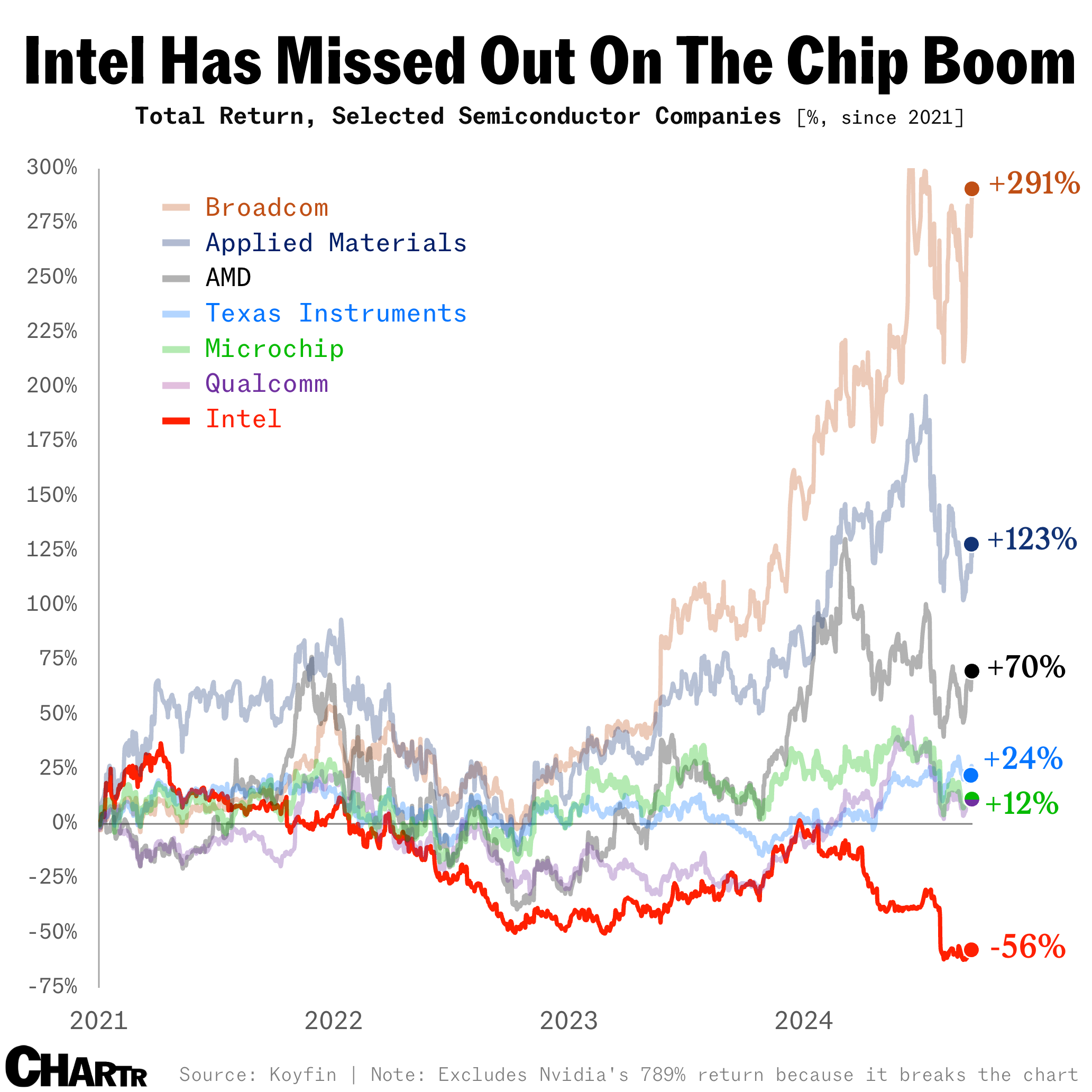

Business schools will be examining how Intel could have dropped the ball so terribly for decades to come.