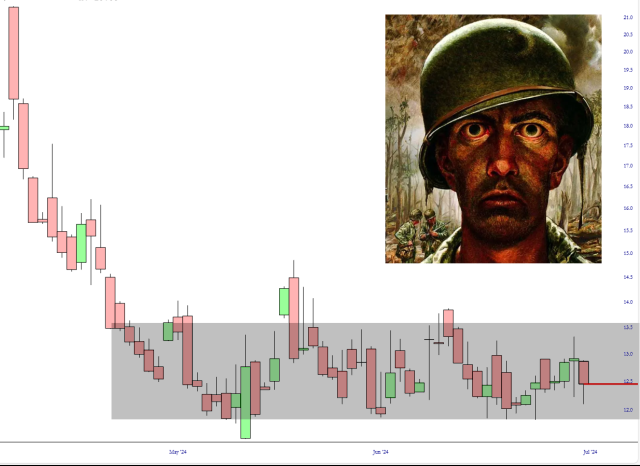

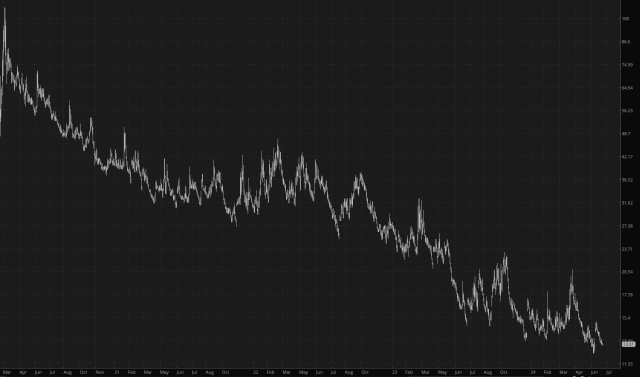

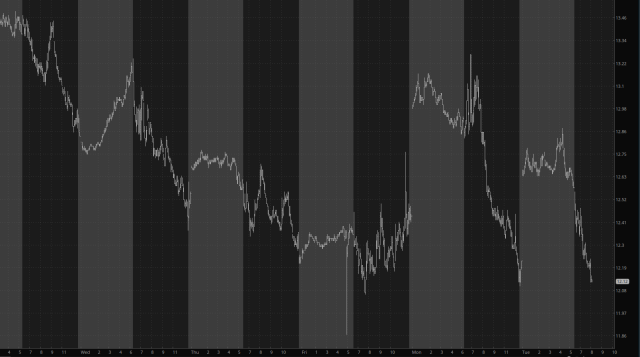

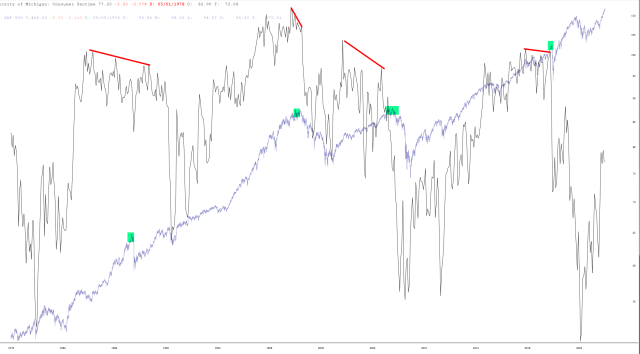

I have been running a nonstop dinner party for almost 20 years, and I can never shake the idea that i have to entertain my guests. This is one of those very rare times when I honestly have nothing to say, and if I could bring myself to do it, I’d just say buh-bye until something happened next week. This market is as boring as hell. Honestly. I can usually write something or another to fill this space, but my God, this market has entered into some kind of dull equilibrium with NO volatility and NO atmospheric changes. Ever.