Gold and Silver are kind of like Elon Musk and Kimball Musk. They’re related, but one of them gets almost all the attention. Let’s give Kimball, I mean silver, a bit of screen time.

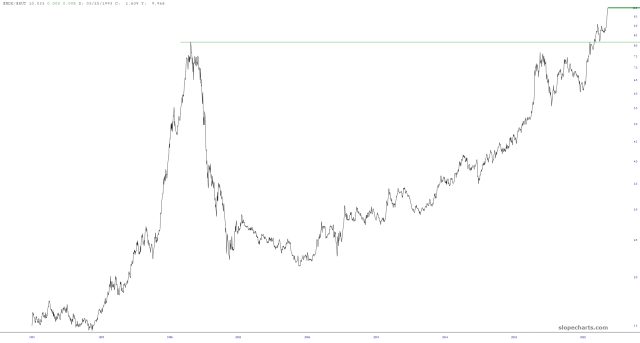

Here is the Dow Industrials divided by silver futures. Pretty toppy, wouldn’t you say? It this completes, it means lower stocks, higher silver, or both. I’m thinking “both.”