Big Fish and Little Fish

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

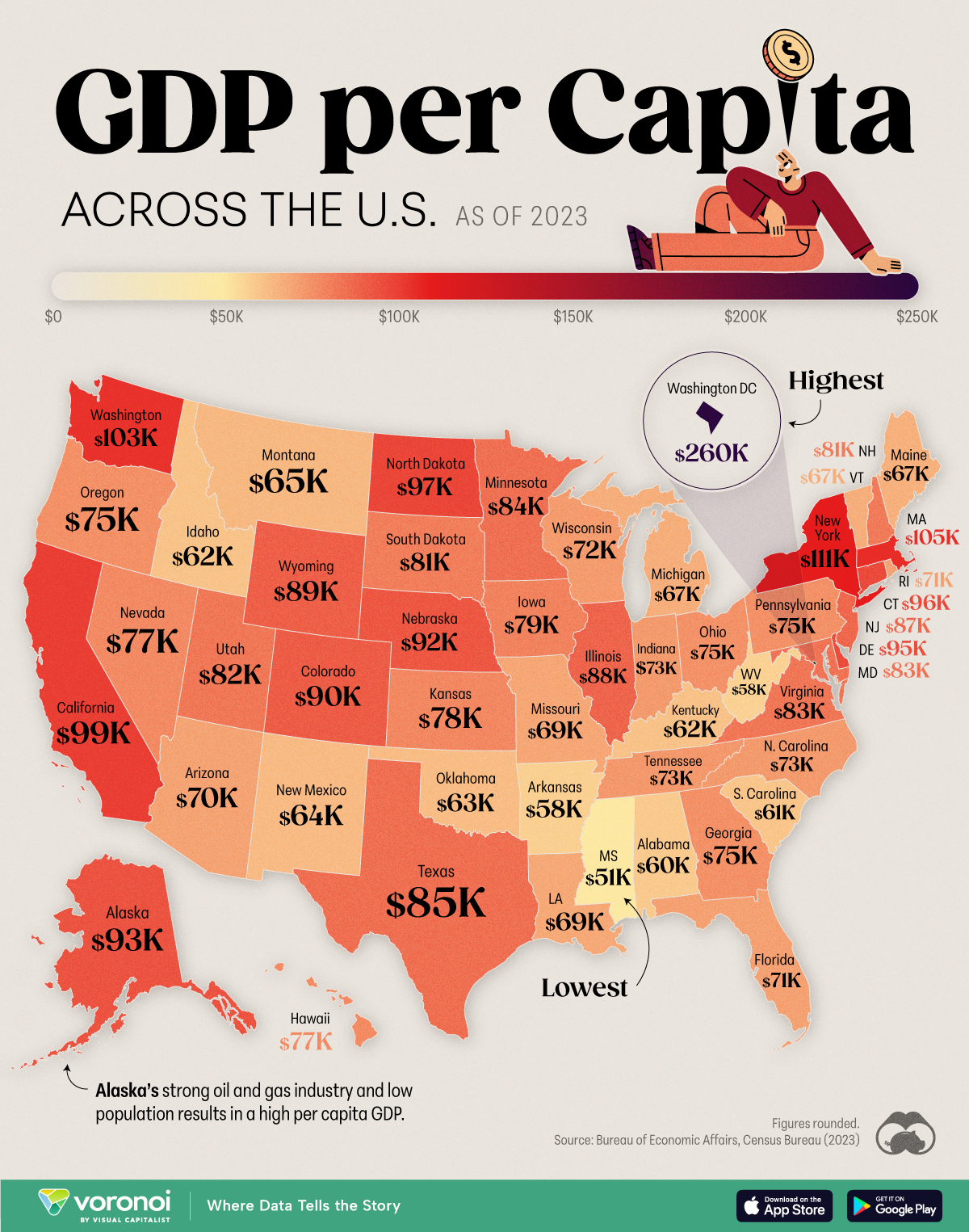

As in any listing, Mississippi is dead last. But the “State” with the highest productivity (by FAR) is none other than Washington, D.C.. HUH? What “product” in GDP are they making, precisely!?!?

This is, at last, the first interesting evening of earnings in this cycle, and Tesla (TSLA) is knocking the doors off, with a lift-off of about 7% based on strong earnings. This would completely seal the gap from October 10th.

Strap in for the most exciting week of the earnings season and the last one of 2024!