Fascinating Political Maps

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

This morning’s strength in equities should come as zero surprise. It makes total sense, and I welcome it, since I believe within the span of this week it’s simply going to open up another opportunity to get short at even better prices.

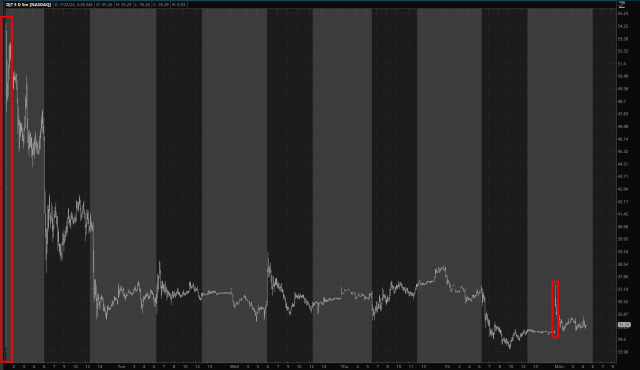

I will mention, in the meanwhile, how interesting the difference is in the behavior of symbol DJT this morning. Take a note of last Monday’s explosive leap contrasted with this morning’s much smaller leap, which has already been obliterated. In each question, symbol DJT is pondering the question: “What are the political implications of what just happened over the weekend?”

Note: I wrote this yesterday. Since then the price of Biden shares has dropped in half. I still think he remains the nominee though.

(more…)