Just in case hundreds of earnings reports weren’t enough to keep things hopping.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Just in case hundreds of earnings reports weren’t enough to keep things hopping.

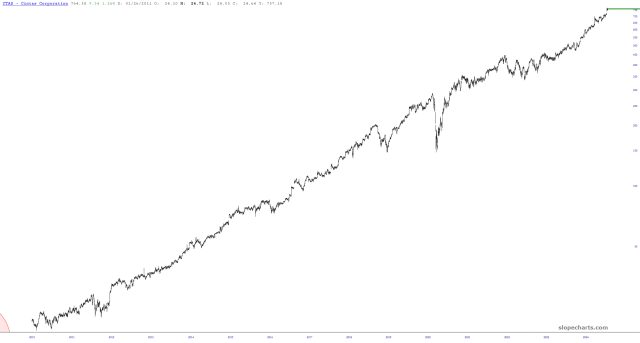

My hand to God, if you looked at this chart, you would have to assume the company has a patent on turning pig dung into gold bars. But, no………..they make uniforms. You know, like for nurses and police officers. Uniforms. Go figure.

This week has been a ball!