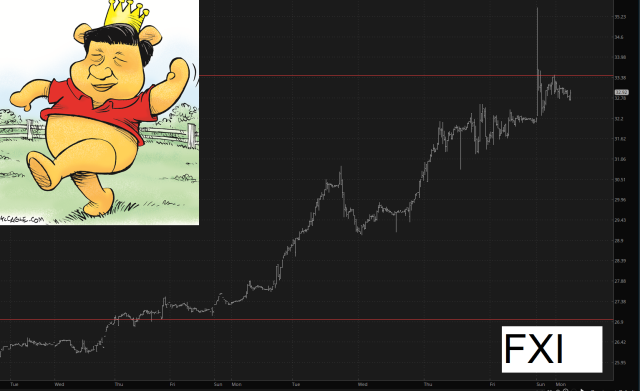

It’s fascinating to see how the trillions of dollars of “help” during Covid have reversed. I do not pretend to understand this stuff, but I offer it to brighter minds than mine. All I see before me is a near complete reversal of what was transpiring in 2020/2021. First there’s the Reverse Repo, which for the life of me I cannot get through my thick skull: