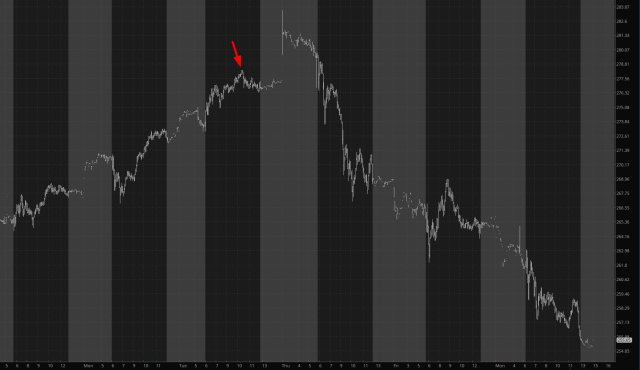

Let’s play everyone’s favorite game show – How Did Tim Screw Up the Trade? (Click here for realistic audience noises as we play). Below is a chart of SMH, on which I owned puts. See that red arrow? Yep, you guessed it. I was sick and tired of SMH going up all the time, so I ditched it. I was happy about this decision for about 10 minutes on Thursday morning, but after that, the SMH did nothing but fall.

Last I checked, after a mere three trading days, those puts were up 194.3%. And why didn’t I apply my 3 Minute Rule? Because I am an undisciplined Bozo, that’s why.

Still, all nine of my surviving bearish positions are profitable, so I may be a clown, but there are worse clowns than me. That market has definitely had its mojo removed, and my wild hunch, expressed very plainly in this premium post before the market opened on Thursday, was dead-nuts-on correct. If I had the testicular fortitude to follow my own counsel, I’d be swimming in profits right now.

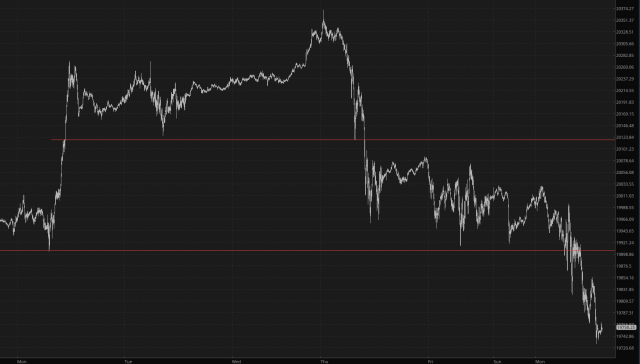

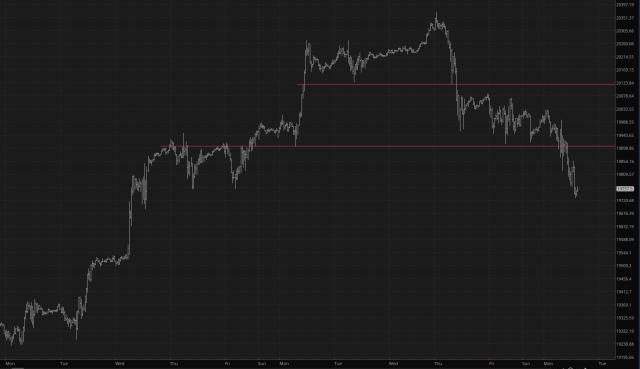

Looking at the /NQ (above) and /ES (below), it’s quite to see that there’s the prospect of a counter-trend rally in the hours ahead. That’s not a big deal, because I believe the control has been handed to the two or three bears left on the entire planet. Counter-trend is just that: COUNTER trend.

The /RTY (small caps) is a tougher read, since it is smack dab in the middle of the range we’ve been in since January 1st. I’m staying far away from this one right now.

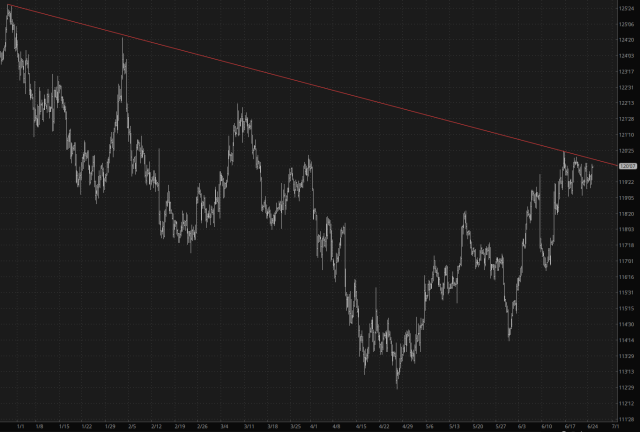

The last chart is the bonds, /ZB, which has been respectful of the resistance trendline for the entirety of 2024, although it would not take much to break it to the upside. The bounce in bonds since mid-April has been helpful to our bullish equity friends, so obviously this needs to weaken for the endlessly beleaguered bears to have any kind of hope