I try very hard to avoid starting with a bias and then charting, as there is a serious risk then that I would find evidence to support my expectations rather than form my expectations from the charts. I've been posting some potentially very bearish charts lately, but that's not because I look for bearish charts in particular, it's because they are almost everywhere I look on longer timescales. Will they play out? Hard to say, but what I do know is that when these have formed in large numbers in the past they have frequently played out afterwards, so that's worth bearing in mind.

There are many who believe that the markets cannot fall hard here because they are being indirectly supported by central banks on a large scale. Well, they are of course, but the only major industrialised nation that has run these sorts of policies before is Japan, where they have been running them so far for the 22 years of their on and off depression, and the Nikkei is currently at slightly over 20% of their 1990 peak (editor's note for clarification – in other words, they have lost 80%). What are the lessons to draw from Japan? Well at the least the lessons are that these policies can extend a crisis indefinitely, while depressing all asset prices and driving the state towards bankruptcy. That's not an encouraging example.

The other lesson is that when central bankers respond to a crisis by effectively taking over as the main drivers of an economy, the results can be grim. That shouldn't be a surprise to anyone really, as it would be overly charitable to describe central planning as having had mixed results in the USSR and China in the past, and central planning has no place in any theory of free market capitalism as far as I'm aware, as in capitalism it is the market that makes these key decisions. The developed world has moved away from that at the moment, and as and when governments run out of credibility and credit, it seems more than likely that it will be moving back again.

As for the oft-referred to long term comparisons between bond yields and stock market earnings that make the stock market look relatively 'undervalued' here, that is simply laughable. If that comparison held true then equities in Japan would have exceeded their 1990 highs long ago, but when one side of such a relationship is being artificially manipulated, you cannot reasonably expect the relationship to hold. The central thesis behind monetarism in the 1980s was a similar correlation between the money supply and inflation, but when governments attempted to use this through control of the money supply, the correlation vanished, as any reasonable person might have expected.

From an economist's perspective there is therefore no solid foundation here underpinning current equity valuations, so we need to be led by the charts. The charts are suggesting a high risk of a major decline, given a suitable trigger event, and one doesn't have to look hard at Europe to see what such a trigger event might be. That's just my two cents but from the perspective of a chartist considering the odds of possible outcomes faith is both cheap and worthless. There is some evidence for the power of positive thinking, there is however no evidence at all for good results from wishful thinking.

As I've been talking about Japan I'll lead with a Japanese chart today, and that's the chart of the EWJ iShares ETF monthly over the last 20 years. This looks rather different to the Nikkei, as in effect we are looking at the Nikkei in US Dollar terms, and the value of the US Dollar has varied widely over the period. This trends rather better than the Nikkei actually, and you'll note that EWJ is now testing the neckline of a perfectly formed H&S that indicates slightly below the 2009 low. Just sayin':

I posted a USD chart yesterday with the comment that on a break over 27yr declining resistance in the 93.5 area, there would be a double-bottom target in the 105 area. Some of you might be wondering whether I have anything to support that target on USD currency pairs and the answer is yes. There is a monster nine-year possible H&S that has now almost completed forming on EURUSD. The target would be at 0.74, somewhat below the lifetime Euro low against USD. Shorter term however I have the pattern neckline in the 1.20 area and declining channel support in the 1.19 area, and if we're going to see a decent bounce on EURUSD, that is the highest probability area to see that in my view

While I'm doing bigger picture charts I'll add in the 6yr weekly SPX chart to show where I think the key areas to watch are in the event that we see further declines on equities. The first level I've been looking at is the 1284 area, and there is a confluence of the lower bollinger band, the daily 200 SMA and the weekly 50 SMA there. That is strong support and the obvious place to see a bounce if bulls can hold it.

If that is lost with confidence then I have the next big support level in the 1180 area, which is the lower trendline test for the rising channel from the 2009 low that formed after the rising wedge from the 2009 low broke down last year. it's worth noting here that the 2012 high was a perfect retest of that wedge support trendline.

If that is lost with confidence then we have a potential double-top on SPX over 2011 & 2012, and will have lost all trendline support. However the valley low or neckline for that double-top is at the October 2011 low and the double-top would not be confirmed without a break with conviction below that level. Worth noting that 65% of potential double-tops never manage that according to Bulkowski. If we do see that break however the pattern target would be 727:

Returning to the shorter term charts SPX broke below bear flag support yesterday morning. There was an impressive bounce from not far below the break, and that looked promising until late afternoon weakness reversed the majority of the gains, with the rest and much more being given back overnight. As I mentioned yesterday, the bear flag target is in the 1210-20 area:

There is some very significant support above there though. I've mentioned the 1284 SPX area already of course, and you can see that on the daily chart with the lower bollinger band and the 200 DMA there:

Below that I also have decent declining trendline support on ES at 1264.50. That could well hold and if it does we might have a falling wedge forming on ES, though the upper trendline is unconfirmed as yet:

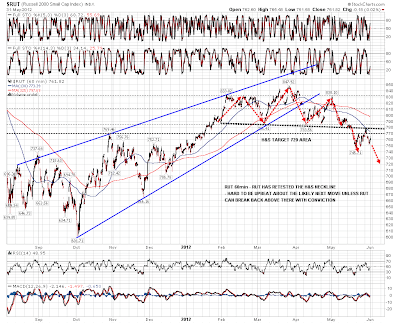

I posted the H&S on RUT yesterday saying that the next obvious move is to the H&S target at 720. That's still the case and I'll be watching that:

No break up from AAPL yesterday, and honestly, at this stage I'm not expecting one. My pal Cobra pointed out that the action from the low there looks like a rough rising wedge and a breakdown from that seems likely here:

When I started writing this post I was a bit concerned that readers might think that my assessment for the market today might be too bearish. Since then ES has dropped from 1294 to new lows and a test of 1280, so that's no longer a concern. I was talking yesterday to someone about the first trading days of the month yesterday and noted that these were generally bullish, with the occasional very strong decline. This is looking like a strong decline day so far.

The key level to watch on SPX today is at 1284. This doesn't need to hold intraday, but if we close the day and week below the 200 DMA there that will be a strongly bearish signal, though it might also suggest a short term low there within two or three days, which could well fit with EURUSD hitting support in the 1.19-1.20 area.