Ok, right off the bat, this trade is not for most people. It is a high risk, high reward type of trade that my options scanner has picked up. There is supporting evidence by the options configuration, Bank Participation report and Commitment of Traders report, but the chart looks terrible (commodities are in a bear market after all – or are they still?). So at some point this summer, DBA may go ballistic, but it is a roll of the die when and by how much.

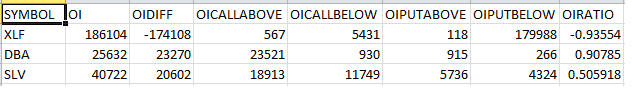

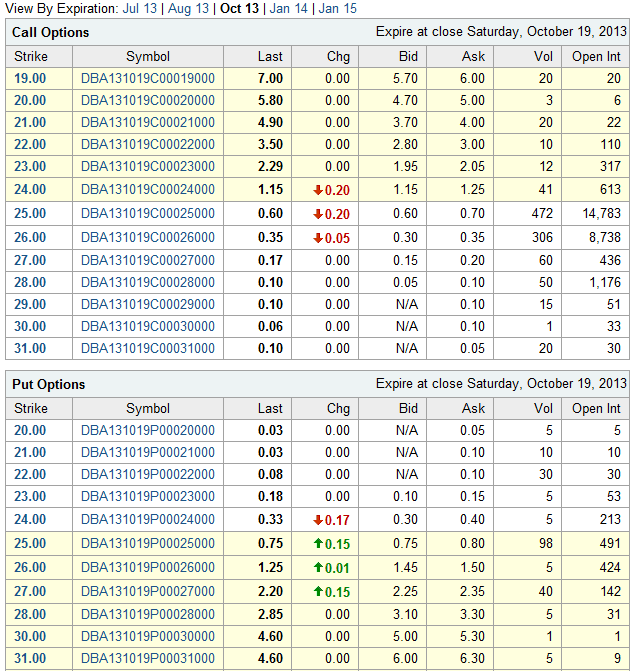

First, the options scan shows an incredible bias for DBA Calls in the October expiration. However, the open interest is not that large and if it weren’t for the Bank Participation and Commitment of Traders reports, I wouldn’t give this trade a second look. Note the DBA OIRATIO of 0.90785 with 23521 calls of the total 25632 open interest on the near strikes. (By the way, also notice the XLF short trade from last week still shows up in the October expiration also with an OIRATIO of -0.93554.)

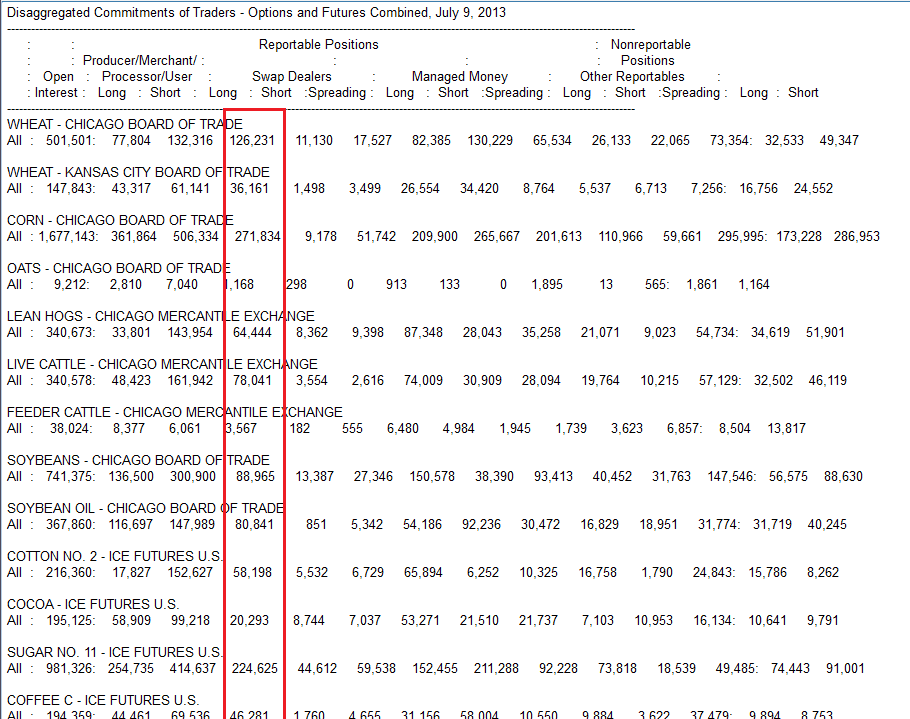

Now the Commitment of Traders report is definitely biased to the long side (see below), but remember the commercials have been taking the other side of the trade from the hedge funds during a bear market. However, at some point, they will have to pop the agriculture complex to clear their positions.

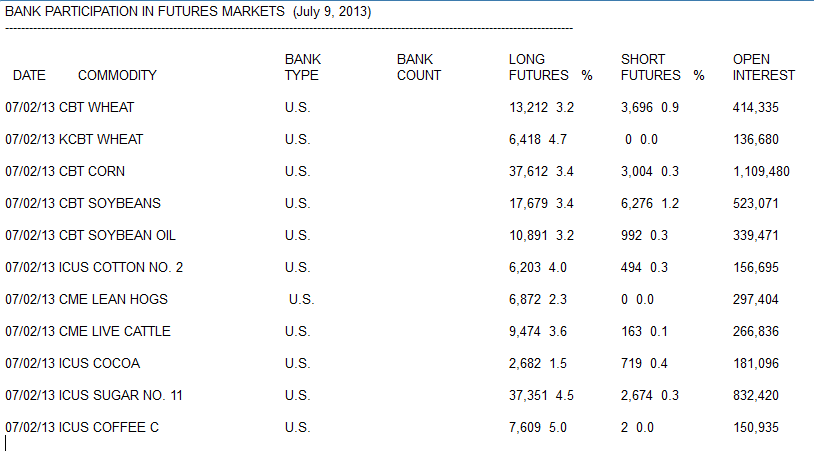

Much more interesting is the Bank Participation report. The banks take a position to generate a profit, not to act as a market maker. As you can see below, they are loaded with long agriculture positions.

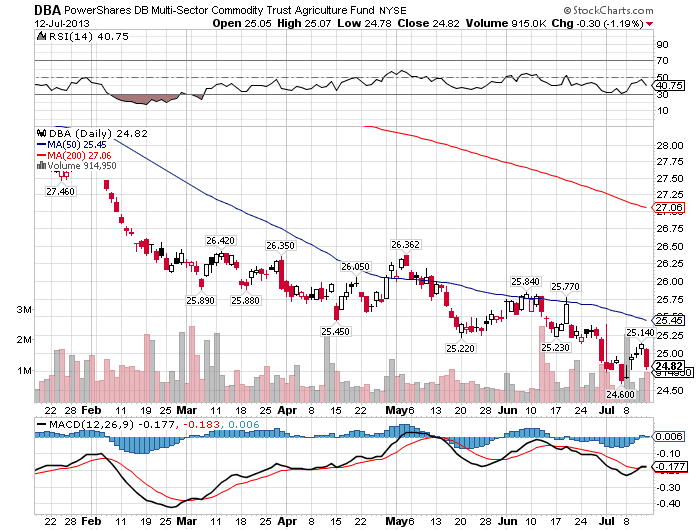

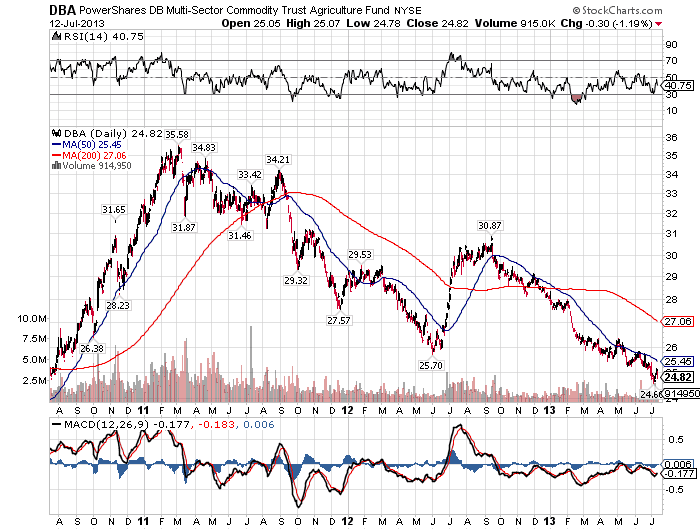

Ah, but what do we do about this DBA chart? Is it going to go oversold at 24.60 for a double bottom and a positive divergence on the MACD? I have my doubts.

Looking at the 3 year DBA chart, you will notice when DBA takes off, it is like a rocket. And with the takeoff window being June, July or August, we are down to just one month left for the takeoff. And as you see in the DBA options table below, a few points move yields a fantastic multiplier on the option.

So there you have it, a high risk, high reward trade on long DBA. As Bernanke said in his last press conference, we need a little inflation. Maybe August is the month of agriculture inflation.