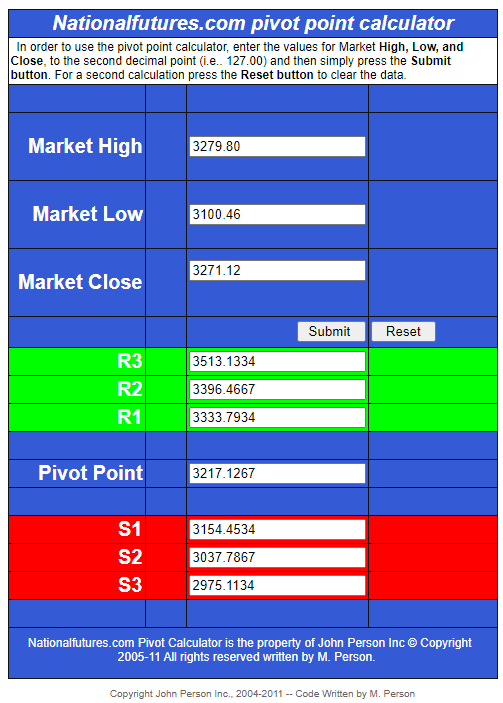

The pivot point support/resistant values/targets for the S&P 500 Index (SPX) for the entire month of August are based on the high/low/close of the July monthly candle, as shown on the following pivot point calculator.

The PP of each monthly candle is depicted as a blue cross on the chart of the SPX below.

You can see, at a glance, where the current price is relative to those…giving an indication as to its relative strength/weakness as the price moves above/below each one in the coming days/weeks/months.

The July candle closed on Friday, July 31. At that time, there was only one more PP to overcome…that of the January candle at 3259.31. As of Tuesday’s close of the new August candle, it’s well above all previous monthly PPs.

R1 sits at 3333.79…Tuesday closed just below at 3333.69…after hitting a high of 3381.70 (just under R2 at 3396.46).

The Balance of Power has been declining since May. It was hovering just above the zero level at the close of the July candle…signalling a potential weakness or lack of conviction in the buying in the ensuing months.

Near-term support sits, firstly, at January’s PP at 3259.31, then July’s PP at 3217.12. A drop and hold below that level may see price reach S1 at 3154.45, or lower.

A 10% correction from the recent high would see the SPX reach somewhere around 3,043.53…S2 sits at 3037.78, so that’s possible.

The SPX:VIX ratio dropped back below 150, after briefly breaking above and retesting the 200 MA, as shown on the following daily ratio chart.

The RSI is threatening to break its recent uptrend, but is still above 50. Both the MACD and PMO indicators are about to form bearish crossovers.

If the RSI breaks and holds below 50, and if the MACD and PMO form bearish crossovers, we may see price retest the 50 MA around 115, or lower to the next major support at 100…all as confirmation that the SPX may drop to its July PP, S1, or even correct by 10% down to S2.

However, if the SPX breaks back and holds above R1 (3333.79), it may retest or overshoot its all-time high of 3393.52. R2 sits at 3396.46.

Then, the next major resistance level (R3) is much higher (with only air in between) at 3513.13…so we’d be in for one heck of a bear surprise if that were reached!

I’d venture a guess that things are going to get “interesting” (volatile) this week…one way or the other!