First of all, although I know some of you will protest, I have decided (once again) to eliminate myself from the Top Ten Virtual Traders list, because my equity amount (over $65 billion) has become just plain stupid. I thought for a while maybe I can get it to $100 billion or, who knows $1 trillion, just to be goofy, but, let’s face it, this isn’t helping anyone, and I’d rather focus on my REAL ACTUAL account. So, congratulations to Secundus, who is now in First Place!!

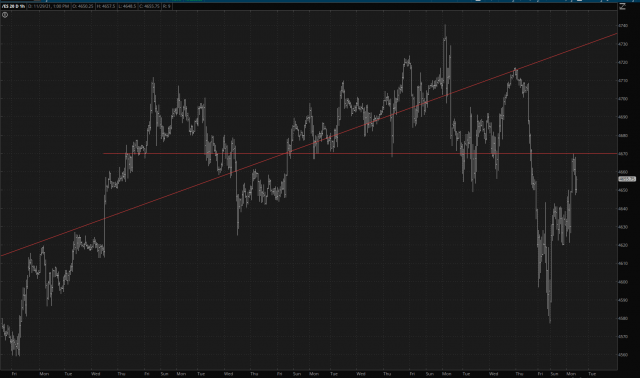

OK, let’s talk about the markets, and we’ll start with the S&P 500 futures (the ES):

So if the trading gods are reading this post, I’d be awfully grateful if you’d just start the weakness again, please, sir. I am delighted at how today, Monday, worked out – – after all, I had nothing but Put options in one portfolio, and in spite of a 70+ rise on the ES, I ended the day flat (!!!!!!!!!!!!!!!!!!!!). At this point, I am OUT of my bullish positions and am aggressively bearish again. And I do mean aggressively. I have no buying power left. None.

My biggest bullish positions was the small caps, by way of IWM December Calls, which I scurried out of minutes after the opening bell. A good thing, too, since the small caps were downright flimsy today.

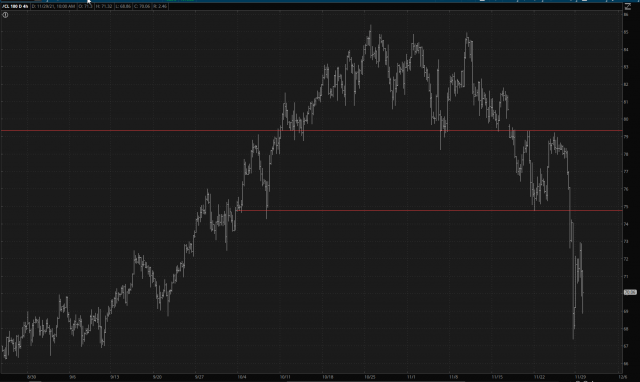

As for crude oil, I think this chart is simply terrific. I am actually way LESS positioned for energy than before, but I want to be very clear – – I think energy stocks are totally doomed. As doomed as doomed can be. For realz.

Oddly, I am finding great solace that the snapback rally is close to done for the gheyest of reasons, which is the world of crypto. I am watching this resistance level on the ETH coin closely. I believe it is a psychologically-important market for the animal spirits.

For you Gold and Platinum users, I encourage you to take a fresh look at my Bear Pen and x-Merrill watch lists, as they contain an up-to-date collection of bearish ideas and live positions as well as, of course, my mark-ups on each chart.