Good morning, everyone. Hey, bring next week back! That was a lot more enjoyable.

Well, here’s the bad news. As of yesterday, even in the face of a huge rally, things were still a-ok. Patterns were intact. Gaps were at a distance. Charts, as I said, made “all the sense in the world.”

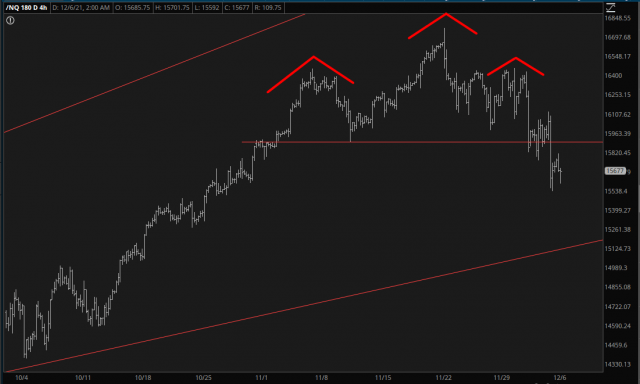

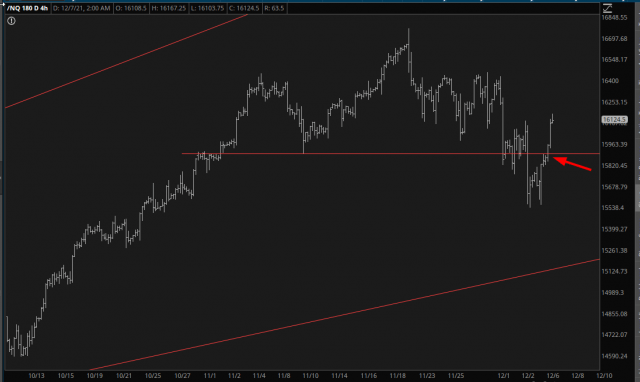

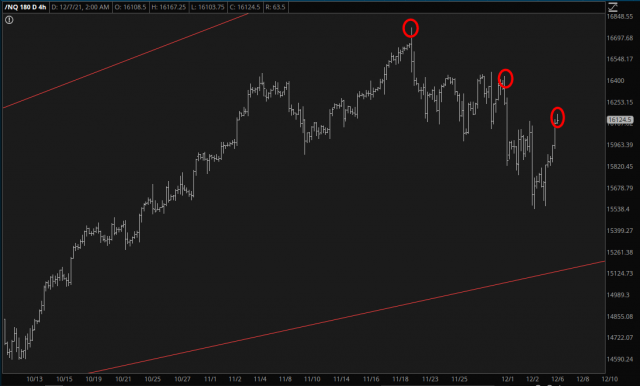

The continuation of this “Omicron is no big deal” rally (coupled, regrettably, with Gartman’s declaration on Monday morning that a bear market was at hand, which of course is the kiss of death) has partly wrecked the situation. The NQ, for instance, shown below is all its tidy glory, is messier now:

We can still retain the bearish argument, but it isn’t as squeaky-clean now. What remains intact is a series of lower highs and lower lows.

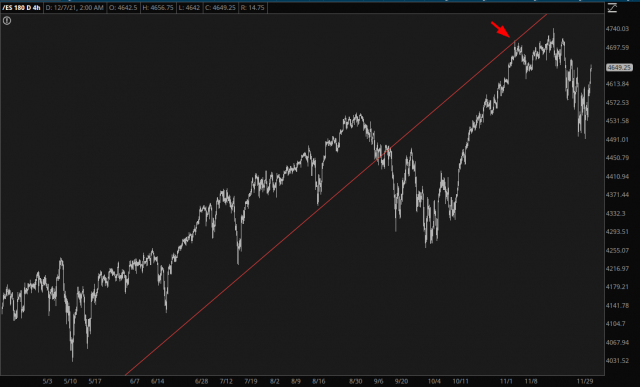

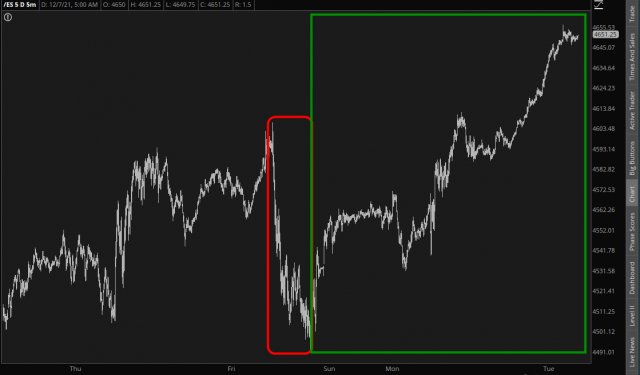

The ES likewise has spoiled its otherwise tidy topping pattern, although the larger trend-change is still absolutely intact.

The regrettable thing with the ES, though, is that the clarity and smoothness of the downtrend has been badly sullied.

One sharp way to look at this is to compare the (at the same) glorious sell-off on Friday with the one-two punch that followed with the new week, whose gain dwarfs Friday’s drop.

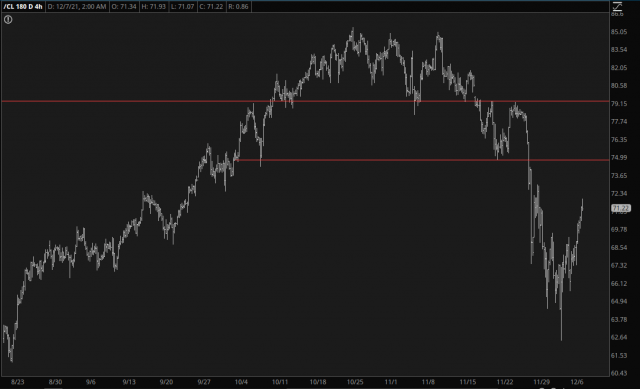

Let me emphasize, there’s still some nasty damage out there to the broader uptrend. As it has for been for weeks now, crude oil is going to be my guiding light, since I believe the prospect of exhaustion as it reaches its own rounded top could usher in more equity weakness.

Finally, if you’re looking for an interesting ETF short, I still think you could do a lot worse than EWW, the Mexico ETF. Let’s see if that neckline remains intact after the opening bell.