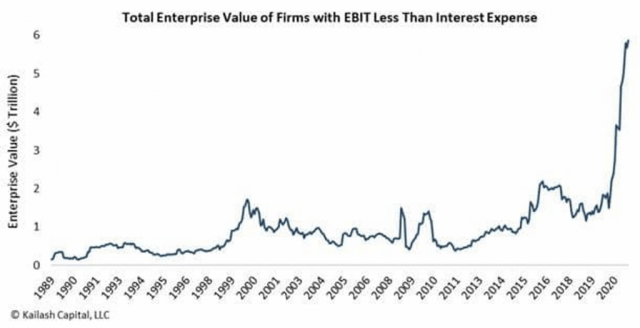

If you are not familiar with the term “zombie company”, it is an organization whose earnings before interest, depreciation, and taxes are insufficient to cover the interest payments alone. In a normal world, the word for such an organization would be “broke” or perhaps “bankrupt.” These days, however, with infinite free money to borrow, these dead companies remain eerily alive, and their collective value has exploded to over $6 trillion.